In a world where institutional investors have more enthusiasm for cryptocurrencies than a schoolboy for his first cigarette, Bitcoin (BTC) has once again found itself basking in the glow of a robust surge. As BTC inches tantalizingly close to the $120,000 mark, the market is abuzz with whispers of a grand breakout and what it might portend for the digital currency’s future. 🌟

Market Overview: Bitcoin’s Technical Analysis Reads Like a Romantic Novel

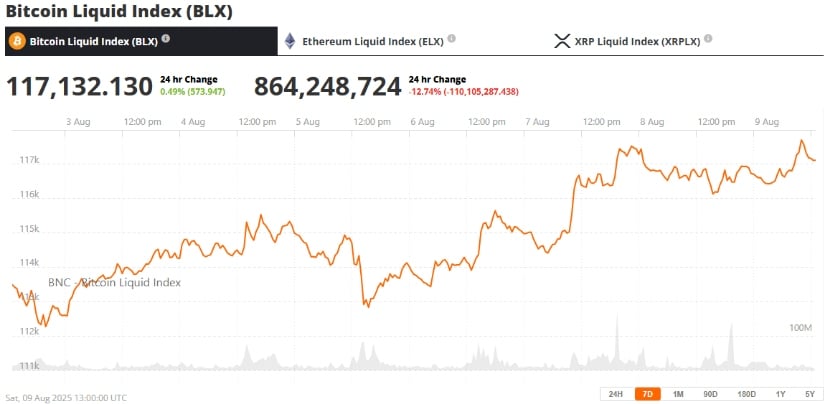

Today, Bitcoin’s price chart reads like a love letter to bulls, with key technical indicators painting a picture of unwavering optimism. The daily chart shows BTC flirting with the upper boundary of a bullish flag pattern, a formation that suggests the start of a new romantic chapter-or, in financial terms, a significant upward move. The 50-day Simple Moving Average (SMA) at around $113,400 acts as a sturdy floor, while a bounce off the 0.382 Fibonacci retracement level near $113,678 adds a touch of poetic justice to the story.

The Relative Strength Index (RSI) is currently lounging in the mid-50s, a comfortable position that suggests there’s still room for the romance to deepen without the risk of becoming overly sentimental. Meanwhile, the Moving Average Convergence Divergence (MACD) is on the brink of a bullish crossover, a technical signal that could turn even the most skeptical bear into a believer. A decisive close above $117,335 could open the door to a return to the previous high near $123,250, with the ultimate goal of reaching the dizzying heights of $127,000 if the love affair continues unabated.

For traders, the $116,500-$117,300 range offers a tempting opportunity to join the party, with stop losses advised below the $113,400 support zone, just in case the romance takes an unexpected turn.

Trend & News Factors: Institutional Demand and the 2025 Halving-A Match Made in Crypto Heaven

The current market cycle, marked by a growing influx of institutional participation, is a far cry from the wild, untamed days of yore when corrections of 70-80% were par for the course. In this new era, the latest correction peaked at a mere 26%, a sign that the market may be maturing into a more stable and less volatile adult. 🕵️♂️

One of the key drivers of this newfound stability is the increasing approval and adoption of Bitcoin Exchange-Traded Funds (ETFs), which have made it easier for traditional investors to dip their toes into the crypto waters. Spot Bitcoin ETFs in the U.S. now hold a staggering $150 billion in assets, bringing them tantalizingly close to the $198 billion held in gold instruments. It’s a testament to the growing acceptance of Bitcoin as a legitimate investment vehicle.

And then there’s the 2025 Bitcoin halving, a biennial event that promises to tighten the supply of new coins and reinforce Bitcoin’s status as a scarce and valuable asset. Historically, halving events have been followed by significant price rallies, a trend that many experts believe will repeat itself this time around.

Adding to the bullish sentiment are recent regulatory changes, such as the U.S. executive order allowing cryptocurrency investments in 401(k) retirement plans. This move could unlock trillions of dollars in institutional and retail capital, further fueling the fire of Bitcoin’s ascent.

Expert Insights: Bitcoin as the New Gold-A Hedge Against Inflation and Fiscal Folly

//bravenewcoin.com/wp-content/uploads/2025/08/Bnc-Aug-10-981.jpg”/>

The expansion of the global money supply, which recently hit a record $55.5 trillion across major central banks, underscores the need for a reliable store of value. Bitcoin, with its limited supply and improving transaction capabilities thanks to innovations like the Lightning Network, is increasingly seen as a practical solution to the challenges posed by traditional financial systems.

For many investors, Bitcoin is no longer just a speculative asset but a cornerstone of their portfolios, particularly as traditional markets grapple with mounting fiscal debt and monetary easing. It’s a sign of the times, and a harbinger of things to come.

Looking Ahead: A Bullish Outlook with a Dash of Caution

Bitcoin’s recent breakthrough above $117,000 is a clear indication of strong bullish momentum, supported by robust technical indicators and favorable macroeconomic conditions. The path to $120,000 and beyond seems increasingly likely, driven by the adoption of ETFs, the dynamics of the 2025 halving, and a steady stream of institutional inflows.

However, as any seasoned investor knows, the road to riches is rarely smooth. Bitcoin’s inherent volatility means that short-term corrections are always a possibility, and maintaining a disciplined approach to risk management and diversification is essential.

As Bitcoin continues to evolve from a speculative asset into a long-term inflation hedge, its future looks bright-and perhaps a bit more predictable-than ever before. 🚀

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- How to Unlock & Upgrade Hobbies in Heartopia

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Who Is the Information Broker in The Sims 4?

2025-08-09 23:19