As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market volatility and unpredictable events. Bitcoin’s “Uptober” has indeed had a rocky start this year, but it is essential to remember that historical trends do not always guarantee future results.

In simple terms, Bitcoin (BTC) has had a challenging beginning to the traditionally prosperous month of October, influenced by mounting geopolitical conflicts in the Middle East. However, optimistic investors continue to hold out hope for a reversal of fortune towards the end of the month.

Bitcoin’s “Uptober” Off To A Patchy Start

In simpler terms, the cryptocurrency with the highest value according to market reports had a volatile start to its strongest performing month in terms of growth since 2013. The graph below shows that October is traditionally Bitcoin’s best-performing month, offering an average return of approximately 21.2%.

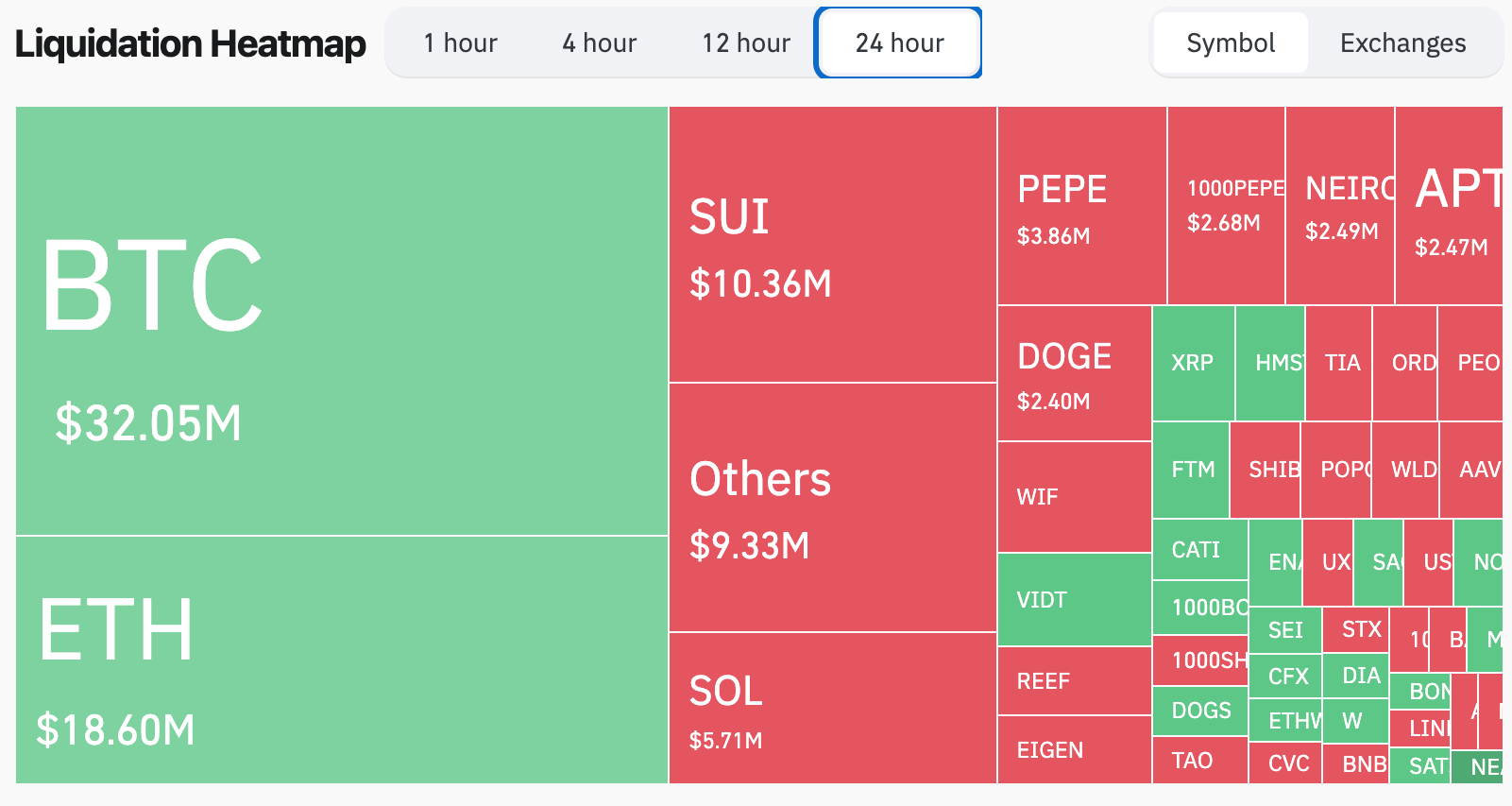

Yesterday, Bitcoin (BTC) dipped temporarily below the significant $60,000 mark before regaining to $61,179 at the time of reporting. This price fluctuation resulted in approximately $32 million in BTC liquidations, with Ether (ETH) seeing slightly over $18 million in liquidations during this rollercoaster ride.

In the last week, Bitcoin has fallen by about 6.9%. However, significant declines have been seen in major altcoins as well. Ethereum (ETH) has dipped by 11.2%, Solana (SOL) has dropped by around 10.9%, and BNB has experienced a decrease of 9.9%.

Based on information from CoinGlass, it’s common for Bitcoin’s value to grow more significantly towards the end of October. As the graph shows, the start of October has tended to be a less advantageous time for Bitcoin price increases in the past.

As a researcher, I’ve observed some interesting trends in Bitcoin’s performance across different October dates. Specifically, October 1 has shown a positive trend only once since 2013, while the following day, October 2, has displayed gains five times out of eleven occasions. Conversely, later dates such as October 28 have delivered positive returns nine times out of eleven instances, followed closely by October 20 with eight positive days out of eleven.

It’s important to mention that even Bitcoin’s historically least favorable month, September, ended up showing a 7.29% increase this year, marking its strongest performance since 2013.

Multiple Factors Weighing On Bitcoin Price Action

In April 2024, Bitcoin experienced its fourth reduction in the number of new coins being issued (halving), and later in September, the U.S. Federal Reserve reduced its interest rates (interest rate cuts). These two events are generally seen as positive indicators for the potential increase in the price of Bitcoin.

Despite these encouraging advancements, the increasing tensions on the global political stage and the uncertainties associated with the upcoming closely fought U.S. presidential election in November 2024 have cast a shadow over them.

As a crypto investor myself, I’ve taken note of the optimistic predictions by some analysts regarding Bitcoin’s recovery towards the end of this year. For instance, an analyst from Standard Chartered views the recent dip below $60,000 as an excellent opportunity to buy more Bitcoins.

10x Research’s Markus Thielen anticipates “very likely” or “highly probable” cryptocurrency market growth by Q4 2024. His prediction is based on two main factors: a decrease in Bitcoin’s influence over the market and an increase in Ethereum transaction fees.

Conversely, Arthur Hayes, one of BitMEX’s co-founders, believes that decreases in interest rates could trigger a temporary market drop. Currently, Bitcoin is trading at $61,179, marking a 2.2% increase over the past 24 hours.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD CLP PREDICTION

- USD COP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- Kaspa Price Analysis: Navigating The Roadmap To $0.2

2024-10-05 19:42