As a seasoned analyst who has navigated through numerous Bitcoin market cycles, I find myself cautiously optimistic about the current state of the market. The recent volatility, fueled by geopolitical tensions and monetary policy decisions, is reminiscent of the wild west days of cryptocurrency trading. Yet, despite this tumultuous environment, key data from CryptoQuant suggests that confident holders hold a substantial portion of the Bitcoin supply – a trend that I’ve seen in previous market rallies.

Following several tumultuous weeks marked by instability and doubt, Bitcoin now finds itself at a critical juncture. The recent reduction in interest rates by the Federal Reserve, combined with the intensifying tension between Iran and Israel, has resulted in unpredictable price swings, making it challenging for traders to navigate an atmosphere fraught with apprehension.

In this chaotic situation, information from CryptoQuant shows that a significant chunk of Bitcoin is being held by those who are bullish on its future. This pattern implies a robust faith in Bitcoin’s lasting worth, potentially leading to favorable developments for BTC over the next few months.

As investors keep a close eye on economic trends and global political happenings, there’s a general optimism that the strong stance of long-term investors could fuel a market surge. The prospects of a comeback look encouraging if Bitcoin manages to maintain itself above crucial support points.

Currently, traders and investors are trying to decipher signs that suggest whether Bitcoin is about to regain its upward trend or if more adjustments are imminent. Given the market’s delicate state, the upcoming weeks will play a significant role in predicting Bitcoin’s direction as it moves through this period of instability.

Bitcoin Supply Conditions Signal An Upcoming Rally

As a researcher, I am observing that Bitcoin has reached a pivotal point, maintaining its position above the psychologically significant threshold of $60,000 after a slight retreat of approximately 10% from recent peaks around $66,000.

As a seasoned trader with over a decade of experience navigating financial markets, I have seen my fair share of market volatility. However, this recent dip has caught my attention, and it seems to be causing some unease among traders. But after carefully analyzing market dynamics and on-chain data, I remain confident that this downturn is simply a healthy market reaction to the aggressive surge that followed the Federal Reserve’s decision to cut interest rates. My years in the industry have taught me that such corrections are often temporary and provide opportunities for savvy investors to buy low and hold strong. In short, while it may be nerve-wracking to see my investments dip, I am optimistic about the long-term prospects of this market.

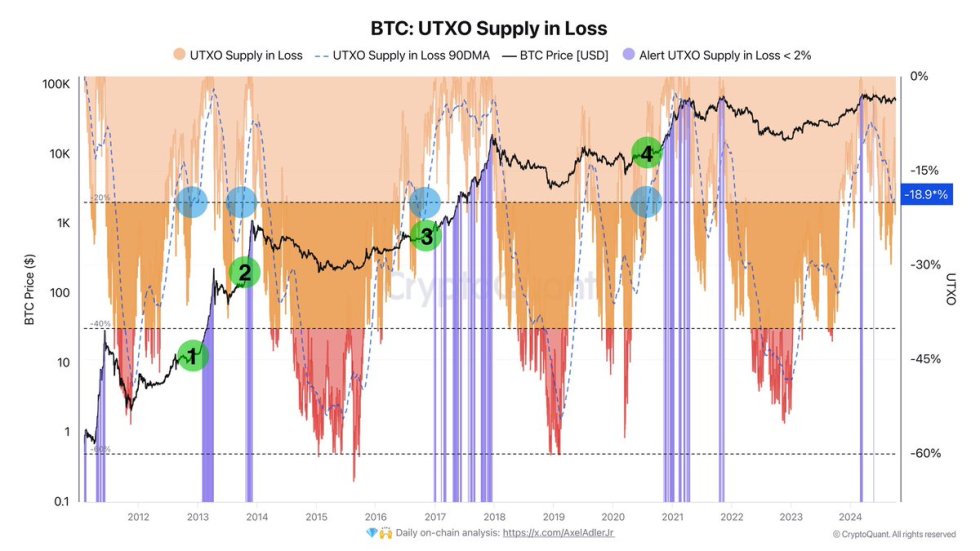

Axel Adler, a well-respected analyst and investor, recently showcased a chart from CryptoQuant. This chart indicated that about 20% of Bitcoin’s Unspent Transaction Output (UTXO) supply is currently held by individuals experiencing losses. This statistic underscores the belief of many long-term investors, as they seem to be confidently holding onto their Bitcoin. On the other hand, the rest of the Bitcoin supply belongs to those who are facing losses, emphasizing the emotional component in market psychology.

Historically, Bitcoin has tended to experience price surges under similar circumstances, implying that its current pessimistic outlook and media coverage might be misleading, since underlying data points towards a possible uptrend in the near future.

With the market currently absorbing recent events, traders are keenly observing for signs of upward momentum. If Bitcoin manages to hold its value above $60,000 and draws interest from buyers, it could potentially lead to a recovery approaching old highs. This situation presents an engaging prospect for investors, emphasizing the importance of keeping track of price movements in the near future.

BTC Testing Demand Levels

Currently, Bitcoin is being traded at approximately $62,100. This value surpasses the 4-hour 200 exponential moving average (EMA) of around $61,852, suggesting it’s holding strong. This stability suggests that the buyers are trying to keep the price trend going, yet they’re finding it tough to push past the vital $64,000 threshold at this time.

Breaking through this resistance level and subsequently reaching $66,000 is crucial to reinvigorate the bullish outlook. Overpowering these hurdles might indicate a larger upward trend and boost trader confidence.

If Bitcoin cannot maintain its position above the 4-hour 200 Exponential Moving Average, the market might see a reversal towards demand zones around $59,000. This dip could worry investors and potentially lead to heightened selling, particularly if pessimistic feelings spread.

Over the next few days, traders will keep a close eye on some important price points. Maintaining a position above the four-hour 200 Exponential Moving Average (EMA) is essential to preserve the bullish trend, but falling below could lead to a significant correction. The price movements of Bitcoin are currently precarious, with both positive and negative outcomes possible.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- XDC PREDICTION. XDC cryptocurrency

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- APU PREDICTION. APU cryptocurrency

- POL PREDICTION. POL cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- JST PREDICTION. JST cryptocurrency

2024-10-10 08:12