As an experienced analyst with a background in on-chain data analysis, I find the recent decline in Bitcoin exchange inflows to be an intriguing development for the cryptocurrency market. Based on my interpretation of the data and trends, I believe this could be a bullish sign for Bitcoin’s price.

Recent on-chain data indicates a decrease in Bitcoin inflows into exchanges, which is a trend not seen in nearly a decade. This could be a positive sign for the cryptocurrency’s price.

Bitcoin Exchange Inflows Have Been On The Decline Recently

I’ve noticed in my analysis that according to CryptoQuant’s Axel Adler Jr, the deposits of Bitcoin into exchange wallets have been decreasing as per his recent post on X. The “exchange inflow” is a crucial on-chain metric that monitors the total quantity of Bitcoin investors transfer to wallets linked with centralized exchanges.

When the value of this metric is elevated, it signifies that a substantial number of coin transfers are occurring to these platforms at present. As a significant motivation for investors to store coins in exchanges is for selling intentions, such a pattern could be indicative of a bearish outlook for the asset.

In contrast, a low deposit rate at cryptocurrency exchanges signifies few new funds are coming in at the moment. The significance of this trend, considering the exchange outflow trend, could be bullish or neutral for the cryptocurrency’s pricing.

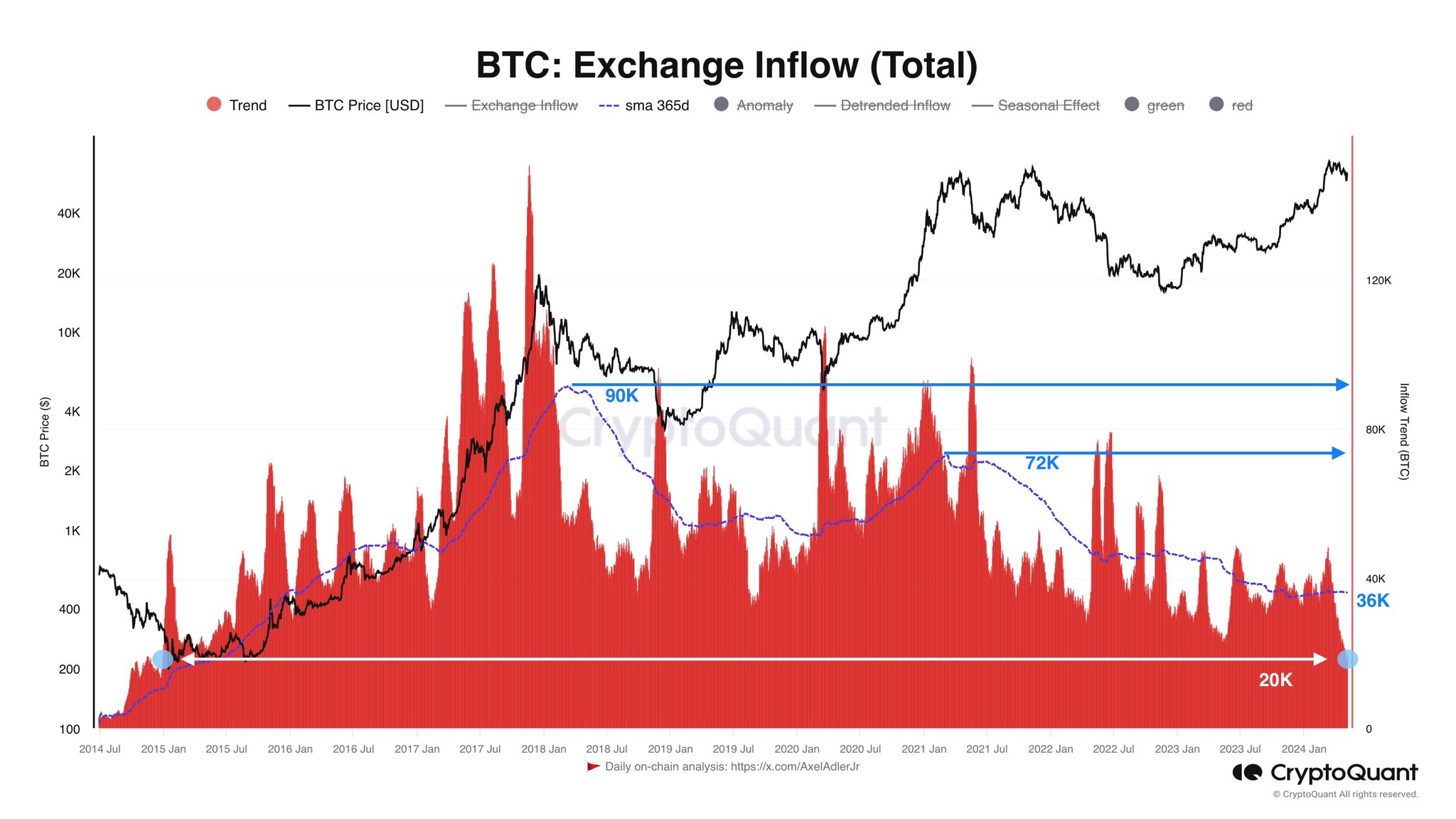

Now, here is a chart that shows the trend in the Bitcoin exchange inflow over the past decade:

From my analysis of the given graph, I’ve observed that the current inflow of Bitcoins into exchanges amounts to approximately 20,000 coins. This is the lowest figure since 2015 based on my research.

The analyst has included the 365-day moving average data for the indicator in the same chart as well. This line has been trending downward since February 2018 and has decreased significantly from a high of 90,000 BTC to its current level of 36,000 BTC.

A decrease in cryptocurrency inflows exchanged suggests that the desire to sell may be waning. Consequently, according to supply and demand principles, the price might experience an upward pressure from this trend.

As a researcher studying this long-term trend, I’ve considered an alternative perspective. The constancy of cryptocurrency exchanges in shaping the market may not be as solid as we initially thought. Their influence has not been consistent over the years.

As an analyst, I’d rephrase it as follows: During the 2017 market cycle, cryptocurrency exchanges played a significant role and attracted massive deposits due to their relevance. However, by the 2021 cycle, new investment avenues for Bitcoin emerged, possibly leading to the decrease in activity between these two periods.

Currently, Bitcoin is experiencing a period where ETFs traded on the spot market have secured authorization and are generating significant interest.

These ETFs have diminished the need for direct cryptocurrency exchange usage, indicating that the current market cycle might witness fewer deposit transactions compared to 2021.

BTC Price

Bitcoin surpassed $65,000 mark during the previous day, however, it has since retreated and is currently trading at around $63,100.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- EUR NZD PREDICTION

2024-05-07 09:27