Welcome, dear reader, to the dawn of a new financial era—where fortunes are made and lost faster than you can say “market cap.” Today’s cryptic whispers and bold claims serve as your morning wake-up call, so sip your coffee with a dash of skepticism.

Allow me to guide you through the tangled web of digital gold, where Bitcoin’s ascension has left Google and Amazon gasping for air—delivered as a delightful slap in the face to the old guard.

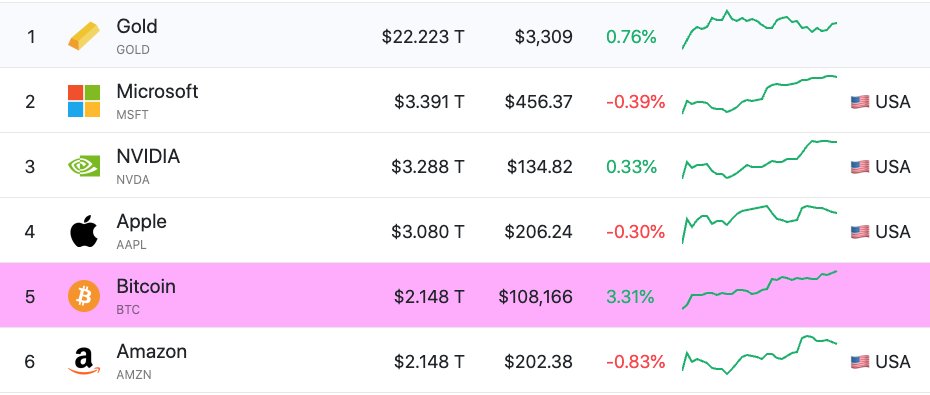

Crypto News of the Day: Bitcoin Overtakes Amazon and Google After All-Time High

It appears that Bitcoin, that rebellious marvel, has surpassed Google in market cap—no longer the quirky outsider, but now the sixth largest asset on Earth. Its market cap stands proudly at $2.16 trillion, increasing 14% since April 23. One wonders whether we should bow or simply applaud this spectacle.

And so, Bitcoin, in its infinite charm, sidesteps Google and strides closer to Amazon—much like a thief in the night, stealing the crown from the giants. The Twitterati (or should I say, the modern oracle) speculate that Bitcoin might soon dethrone Amazon altogether, with only a mere 2.7% separating the two titans.

Others boldly declare that Bitcoin is destined to challenge gold itself, for it has achieved in a mere twelve years what took Google twenty-one—truly, history in the making, or perhaps just financial chaos dressed up in blockchain feathers.

“Bitcoin flips Google and now dances as the 6th largest asset on the planet, surpassing Alphabet with a market cap over $2 trillion. It trails only Gold, Microsoft, Nvidia, Apple, and Amazon. A number? No—an epoch,” wrote Dariusz Kowalczyk, a man who clearly has a crystal ball.

The excitement is palpable—some whisper that Bitcoin may soon topple Amazon, with only a whisper of difference in their market caps. Others, perhaps more poetic, believe Bitcoin shall eclipse even the gleaming gold reserves, rewriting the rules of wealth.

And why not? Bitcoin hit the $1 trillion mark faster than any other asset—proof that perhaps, just perhaps, we are witnessing a revolution cloaked in digital cipher.

Time taken to reach $1 Trillion:

Bitcoin: 12 years

Facebook: 17 years

Tesla: 18 years

Google: 21 years

Amazon: 24 years

Apple: 42 years

Microsoft: 44 years

— Documenting ₿itcoin (@DocumentingBTC), May 12, 2025

Meanwhile, in the land of the rising sun, inflation’s fierce grip has Bitcoin emerging as the knight in shining armor—though some might say it’s just a shiny object for gamblers and dreamers alike.

In another twist of poetic irony, Bitcoin’s role as a hedge against the treacherous US Treasury and traditional finance becomes ever more apparent—as if decentralization itself were a grand middle finger to the antiquated old guard.

“Bitcoin is a hedge against both TradFi and US Treasury risks…It’s a decentralized ledger, darling, not a government IOU,” quipped Geoff Kendrick of Standard Chartered, perhaps with a wink.

Robert Kiyosaki Says No One Wants US Bonds

Enter Robert Kiyosaki, the oracle of your couch, who dismisses US bonds as the financial equivalent of a party where nobody showed up. On May 20, the Fed’s attempt to sell bonds was met with silence, so they bought their own fake currency—how darlingly absurd.

“Imagine throwing a party and no one comes—that was the US bond auction. So, the Fed bought $50 billion of its own paper—talk about financial finger painting,” quipped Kiyosaki.

Columbia’s Charles Calomiris had warned us last year about the very distrust that now plagues US debt—a distrust that fuels inflation and worries investors like a toddler on a sugar high.

Yet, amid the chaos, Kiyosaki forecasts a dazzling future: gold at $25,000, silver at $70, Bitcoin at an eye-watering half a million to a million dollars—one wonders, with what magic wand does he conjure such forecasts?

“Good news! Gold at $25K, Silver at $70, Bitcoin at $500K to $1M,” he proclaims—perhaps from a crystal ball, perhaps from wishful thinking.

This symphony of nearly apocalyptic optimism underscores the urgent need for sound money—be it shiny yellow or digital gold—as the old system limps towards its own demise.

Chart of the Day

Byte-Sized Alpha

Some witty subheadline, if needed

Crypto Equities Pre-Market Overview

| Company | At the Close of May 20 | Pre-Market Overview |

| Strategy (MSTR) | $416.92 | $417.21 (+0.07%) |

| Coinbase Global (COIN) | $261.38 | $262.35 (+0.37%) |

| Galaxy Digital Holdings (GLXY.TO) | $30.52 | $29.58 (-3.08%) |

| MARA Holdings (MARA) | $16.19 | $16.09 (-0.62%) |

| Riot Platforms (RIOT) | $8.93 | $8.87 (-0.68%) |

| Core Scientific (CORZ) | $10.92 | $10.86 (-0.55%) |

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- USD ILS PREDICTION

- REPO’s Cart Cannon: Prepare for Mayhem!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Invincible’s Strongest Female Characters

2025-05-21 19:16