Ah, Bitcoin! The cryptocurrency that’s about as predictable as a cat on catnip. As we barrel into 2026, Bitcoin has decided to kick off the new year with a bang, boasting a rousing 7% gain over the last week. Currently strutting its stuff at about $93,600, it even managed to rise a cheeky 1% in just 24 hours. And let’s not forget the daily trading volume-an impressive $51.5 billion. That’s more money than I’ve seen in my lifetime, and I once won ten dollars on a scratch-off ticket!

In a rather dramatic turn of events on Tuesday morning, Bitcoin flirted with its highest price in almost two months, tantalizingly close to the $95,000 mark. Unlike those previous weekend escapades that ended in tears (or at least some serious buyer’s remorse), this rally actually managed to hold onto its gains through Monday. Miracles do happen, folks!

Price Moves Toward Key Resistance

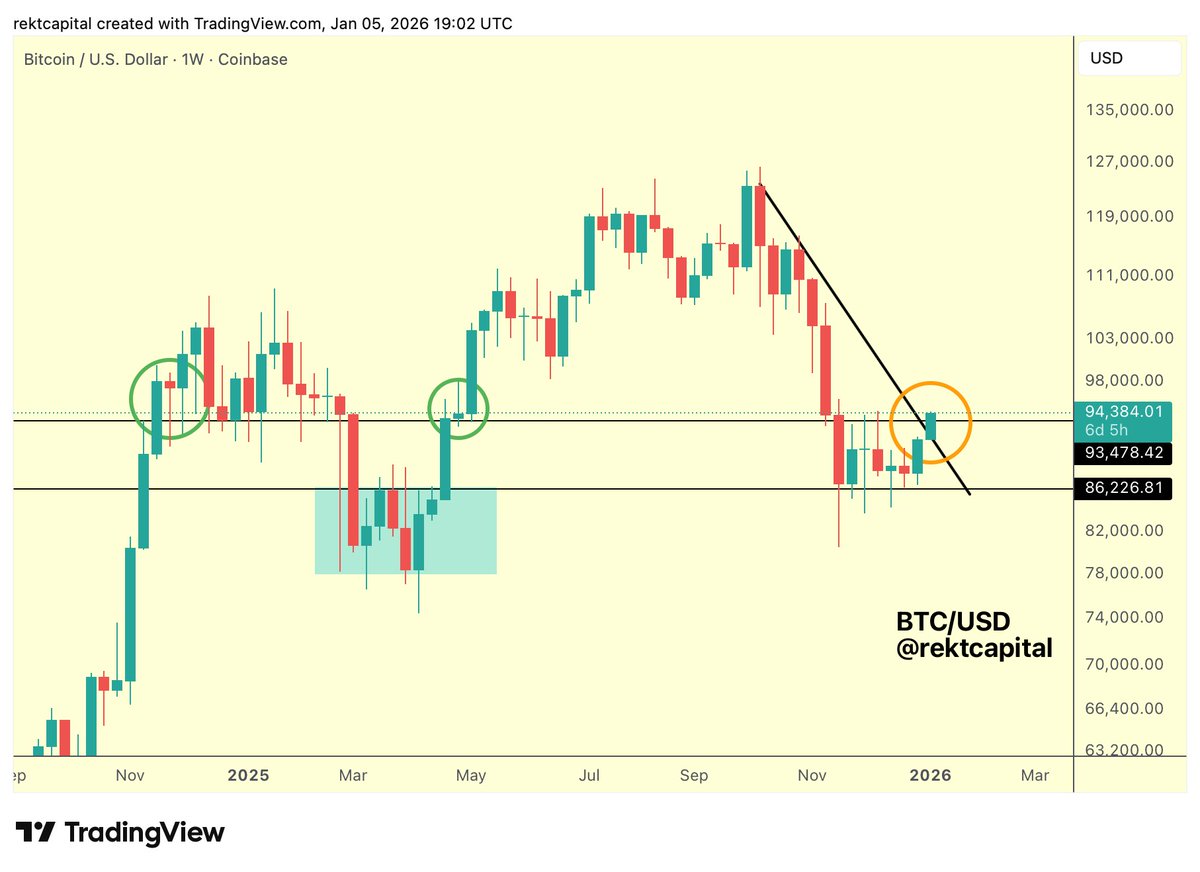

Bitcoin has bounced back from its lower weekly range of around $86,200, a level it’s clearly fond of, having treated it like an old friend at a reunion. With prices now testing the upper end of this range at about $93,500, analyst Rekt Capital has chimed in, declaring that a close above this level could signal a breakout. But let’s be honest-anything can happen in the wild west of crypto, especially when the weekly close is on the line.

In a twist worthy of a soap opera, Bitcoin has also managed to break above a downtrend line that’s been haunting it since October 2025. It’s like finally kicking that bad habit-good for you, Bitcoin! Many traders are crossing their fingers that it can hold above the $93,500 mark, which they believe could dramatically shift the mid-term outlook. No pressure!

“$93,500 needs to hold as support for mid-term bullish bias,” said Rekt Capital, like a modern-day oracle.

But wait! Before you get too excited and start planning your vacation to the Maldives, market analysts are cautiously peering over their glasses. Rekt Capital points out that Bitcoin closed its 12-month candle below $93,500. History suggests that similar levels have been notorious for sticking around for years. It’s like the bad penny that keeps turning up.

“If indeed Bitcoin has begun a bear market, price could overextend beyond $93,500 over the coming months… before continuing lower,” a rather grim prediction.

Meanwhile, Sykodelic, another analyst who sounds like he might have a side gig as a DJ, highlighted some strong buying activity that’s been pushing prices up. He mentioned a breakout in the On-Balance Volume indicator (fancy, isn’t it?) and noted that Coinbase is showing signs of a spot premium. But hold your horses, folks!

“We need to get above and hold $94.5K. If not, we may revisit $89K,” he warned, sounding like the voice of reason in a chaotic world.

Macro Trends May Be Shifting

Now let’s turn our attention to the macro trends, because why not throw in a little economics for fun? Analyst Lark Davis has spotted a technical crossover on the US Federal Reserve’s balance sheet-yes, that’s a thing! A monthly MACD golden cross has formed, which hasn’t happened since 2019. Back then, Bitcoin was off on a major rally. Coincidence? Perhaps not!

“Not official QE yet… but it sure looks like QE and smells like QE,” Davis mused, likely while sipping a latte in a hip café.

This crossover hints that the Fed’s balance sheet might be expanding again after months of playing hard to get. Such shifts in liquidity could certainly stir the pot for risk assets like Bitcoin as we groove into early 2026.

Support Levels and Market Outlook

Michaël van de Poppe has identified a key short-term level between $90,000 and $91,000 that absolutely must hold. This level aligns nicely with the 21-day moving average, which sounds fancy but is essentially just math in action. If Bitcoin stumbles and fails to hold, we could be headed back to test lower levels. Yikes!

“If that holds and a higher low forms, then we could be looking at $100K,” he commented, sounding like a hopeful game show contestant.

Data from Glassnode indicates that Bitcoin is trying to shake off a correction and is in what can only be described as a consolidation phase. While many indicators are turning positive (yay!), some analysts are whispering that this rally could be the last hurrah before a bigger tumble down. And here I thought roller coasters were only supposed to go up!

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- How to Unlock the Mines in Cookie Run: Kingdom

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Full Mewgenics Soundtrack (Complete Songs List)

2026-01-06 19:28