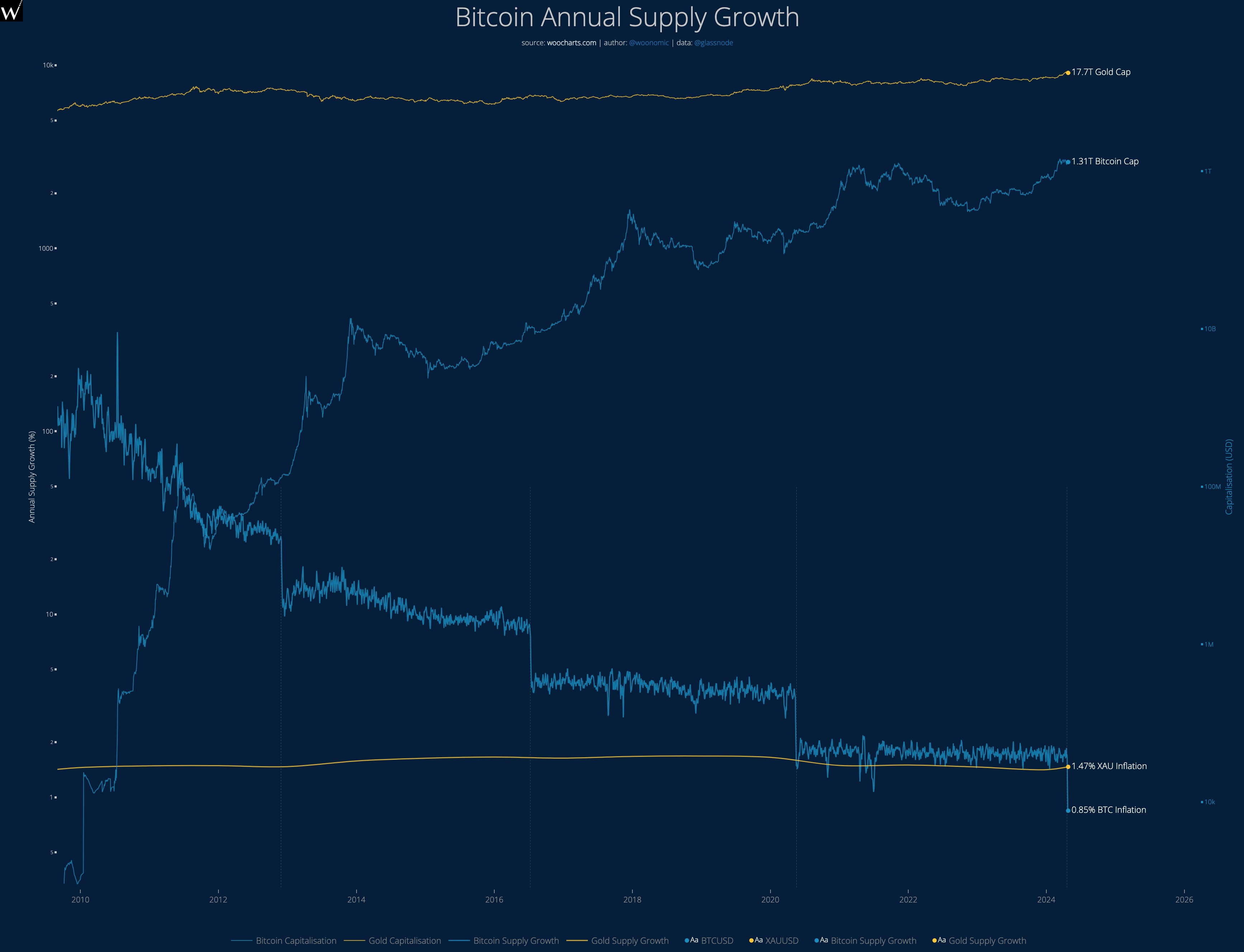

Bitcoin expert Willy Woo started a discussion among cryptocurrency enthusiasts about the possibility of Bitcoin exceeding gold’s market value of $17.7 trillion. Through thoughtful comments, Woo explored the intricacies of Bitcoin’s stock-to-flow ratio, its inflationary path, and the growing institutional acceptance of the digital currency.

According to Woo’s argument, the S2F model is a crucial part. This model measures an asset’s scarcity by looking at its current supply versus how much it produces each year. Now, with Bitcoin having a lower inflation rate than gold, some experts believe that this digital currency could potentially surpass gold as a popular store-of-value asset.

Woo cautioned against setting high hopes, predicting it could take between 5 to 10 years for Bitcoin‘s market cap to match its S2F valuation. He explained this time gap by referring to several reasons: The incorporation of Bitcoin into institutional investments is a gradual process; Regulatory frameworks are being developed; and Secure custody solutions need to be established.

People’s money

Although Woo expressed caution about the timeline for experiencing the benefits of the S2F model for Bitcoin, he emphasized that individual investors who hold and manage their own Bitcoins could potentially gain these advantages sooner. He implied a difference in adoption paces between institutions and retail investors, with the latter possibly adopting Bitcoin’s value proposition more quickly.

With Bitcoin’s market value having the potential to hit an astounding $17 trillion, it raises intriguing questions regarding how this development could impact cryptocurrency prices in the meantime.

Might the gap between Bitcoin’s estimated worth and its current market value cause heightened instability or spur excessive buying and selling? Furthermore, how could events like regulatory changes and broader economic conditions impact its path in comparison to gold?

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- EUR ILS PREDICTION

- OOKI PREDICTION. OOKI cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

- NOTE PREDICTION. NOTE cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

2024-04-24 17:30