Hark! Attend, gentle sirs and madams, for I shall relay tidings of a most peculiar digital coin – Bitcoin, they call it! – whose value doth dance with a capriciousness that would make a harlequin blush. ‘Tis said, and not without some truth, that this Bitcoin hath lately enjoyed a most spirited ascent, climbing to a princely sum of 110,000 crowns after commencing the week at a more modest 107,000. A veritable fortune, I say!

Yet, alas, ’tis a fickle fortune! For though it strives to reach the dizzying heights of its former glory, it finds itself perpetually thwarted, beset by sellers of a most stubborn disposition. Some whisper that this grand bull run, as they term it, hath already breathed its last. Oh, the lamentations!

But fear not, for there are those – learned analysts from a cabal known as The Bull Theory – who possess a keener eye than most. They claim to have discerned a shift in the very fabric of Bitcoin’s cycles, suggesting that this bullish trend may endure, yea, even unto the second quarter of the year 2026! A bold prediction, to be sure!

Of Cycles and Such

These wise scholars explain that Bitcoin hath, for many a year, followed a predictable pattern: a ‘Halving’ (a most mysterious event, indeed!), a rally of twelve to eighteen months, a dramatic flourish, and then, a period of gloom. But lo, recent observations suggest a change! The rhythm, it seems, is slowing.

They posit that this Bitcoin now follows a five-year cycle, rather than the traditional four, and that its zenith shall not be reached until the spring of 2026. This, they attribute to the sluggishness of the global economy. Governments, it seems, are eternally delaying payment of their debts, business moves with the speed of a snail, and the flow of fortunes through the markets is now a mere trickle!

Furthermore, they claim that when these central banks cease their tightening (a curious phrase, methinks), it takes a full six to twelve months for any effect to be felt. The pronouncements of Master Jerome Powell, head of the Federal Reserve, shall not bear fruit until well into 2026, not immediately, as some might expect! 🎭

And hark! Even beyond the realm of the Americans, the Middle Kingdom – China – doth pump forth money at a rate twice that of the United States! And history doth teach us that when China’s coffers overflow, Bitcoin’s value swiftly follows… extending the cycle into the first half of 2026. And the Japanese also stir, with new economic remedies.

The Discreet Accumulation

But there’s more! This surge is not fueled by the mad enthusiasm of the common folk, but by the measured acquisitions of institutions-grave and serious men of commerce! They hoard Bitcoin in their treasuries, unlike the fleeting fancies of the retail rabble.

Indeed, interest in these coins amongst the populace, as gauged by those curious devices called ‘Google Trends’, remains remarkably low. No spectacle, no mania, ’tis all very subdued. 🧐

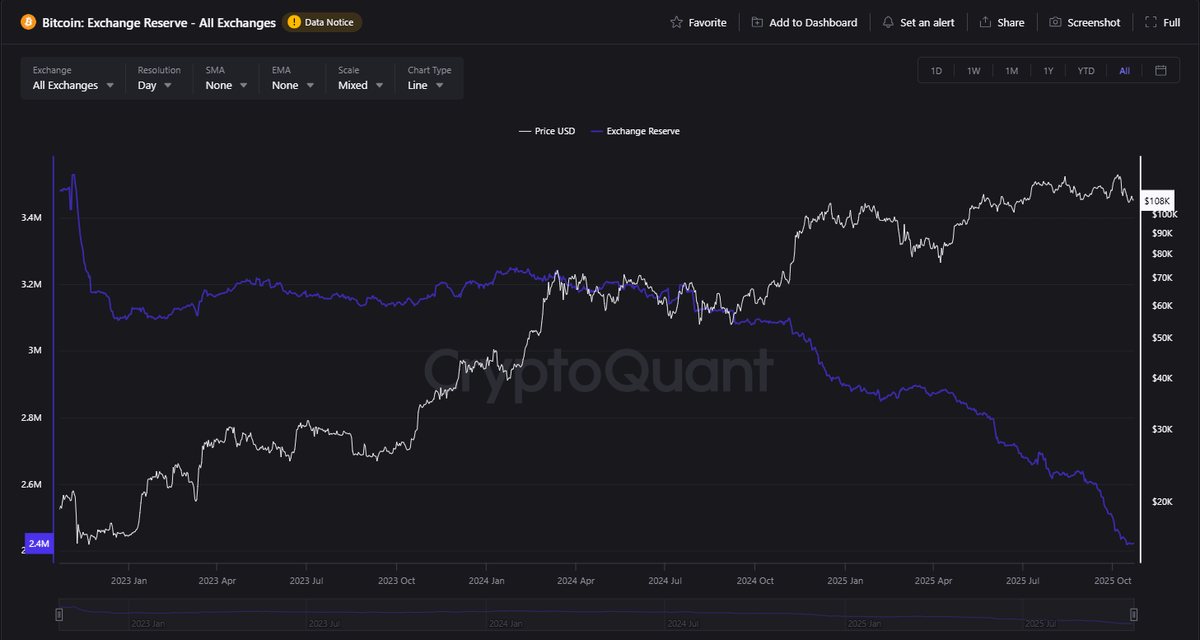

The evidence, they say, lies ‘on the chain’ – a mystical realm of data – where it is revealed that institutions continue to stock up, while the exchanges hold little and the miners sell even less since the Halving. A most peculiar state of affairs!

Thus, these analysts conclude that the established cycles, while still relevant, are now being molded by the sluggishness of the world economy, the deliberate pace of the institutions, and the drawn-out rhythm of the times. Therefore, the apex of this boom may arrive not in 2025, as many believe, but in the spring of 2026. A most curious prospect, wouldn’t you agree? 💸

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

2025-10-24 10:01