A Most Curious Decline in Bitcoin‘s Transactions! 🧐

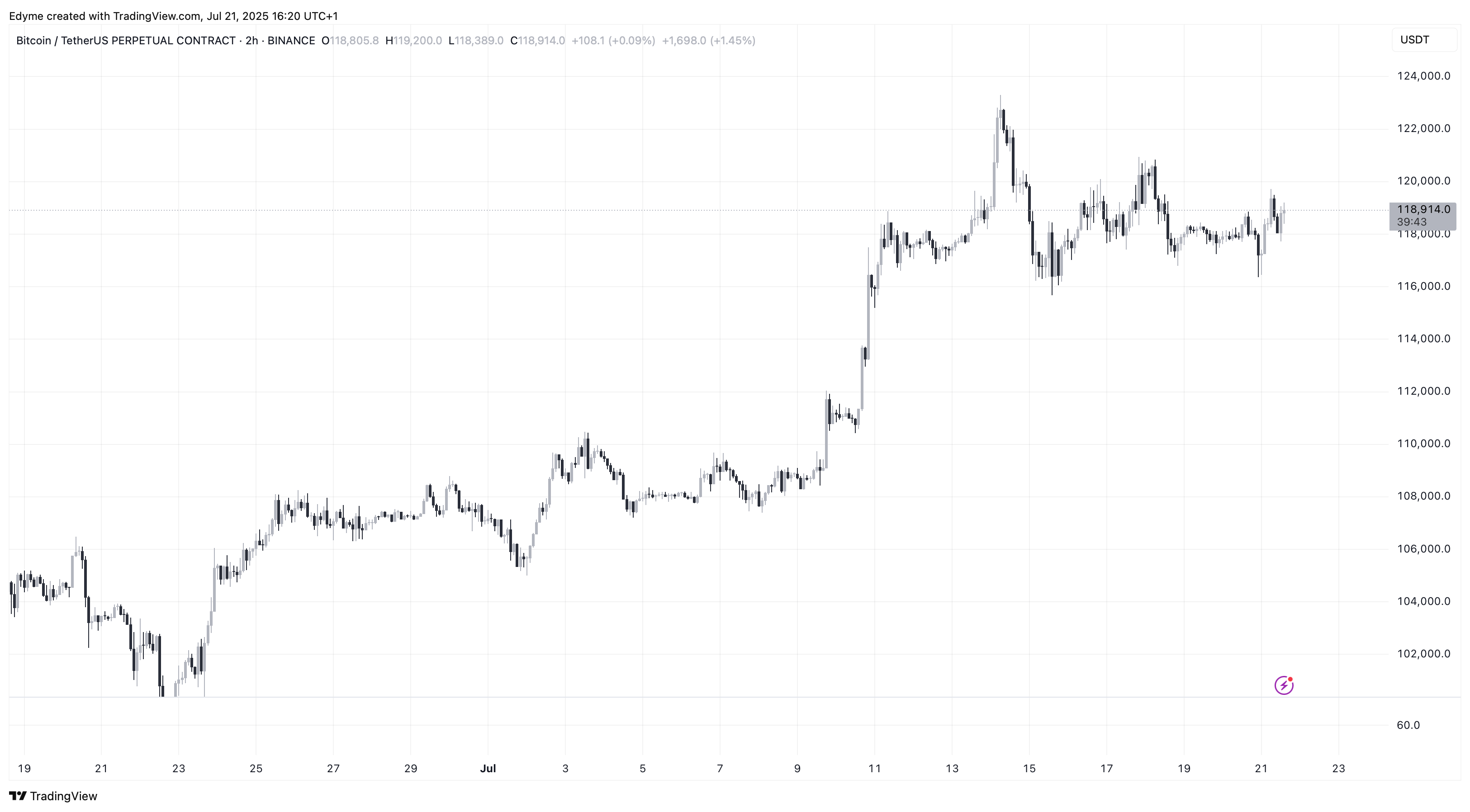

Hark, gentle readers! The price of Bitcoin, that digital bauble so fashionable amongst merchants and financiers, has suffered a slight, though perhaps not entirely unwelcome, cooling. It presently lingers just beneath the astonishing sum of one hundred nineteen thousand dollars—a trifle down, by three percent, in these past seven days. 💸

But observe! This lull follows a period of ascendance most vigorous, fueled by the eager pursuits of both grand institutions and those of lesser purse. ‘Tis possible, methinks, that this pause serves merely as a moment of re-adjustment, a weighing of accounts, before these players resume their frenetic gamblings.

And as the price doth settle, astute observers of the blockchain—those learned scholars of on-chain activity—have detected tremors beneath the surface. A most peculiar decline, I say! The count of Unspent Transaction Outputs, or UTXOs as they are termed, diminishes steadily. 📉 Is this a mere coincidence, or doth it signify something more profound?

A Gathering of the Whales! 🐳

Avocado, a most discerning contributor to the CryptoQuant, doth suggest that this reduction is no mere happenstance. Rather, it speaks of a strategic rearrangement, orchestrated by those formidable titans of finance, the whales and institutions! Since the winter of December of the year twenty-four, these esteemed gentlemen—and ladies!—have been consolidating their holdings, merging numerous UTXOs into fewer, more manageable addresses. A most efficient practice, to be sure!

“The approval of these exchange-traded funds,” quoth Avocado, “hath spurred a rush of assets into secure vaults, whisked away from the bustling marketplaces.” A preference for long-term custody, you see! A commendable prudence, though perhaps lacking a touch of the joyous excitement of a swift trade. 😉

This movement doth suggest a long-term outlook, a patience not often observed in these fleeting markets. They eschew the fleeting whims of speculation, preferring stability and a slow, deliberate accumulation. A contrast to the bustling activity of the retail crowd!

The Quiet of the Common Folk & Future Fancies

While these great players consolidate, the common investor—the retail participant—remains, shall we say, muted. Unlike previous episodes of feverish activity, where the masses stampeded into the market, driving UTXO growth, this ascent lacks that lively grassroots fervor. 😴

The creation of new UTXOs remains…well, rather flat. A most unsettling stagnation, some might declare! Yet, Avocado doth foresee a turning of the tide. Should a sudden, dramatic surge in price occur—a spark to ignite the passions—the retail hordes might yet awaken and resume their contributions.

Such a reawakening would be reflected in a flurry of activity: new UTXOs blooming like wildflowers, a rush to the exchanges, and—alas—a bout of unpredictable volatility! But until that day arrives, the market appears to be guided by the steady hand of strategic accumulation.

Despite this momentary lull, the underlying foundations remain sturdy. Funds flow into exchanges at a moderate pace, the wise long-term holders continue to amass their treasures, and the institutions maintain their unwavering commitment. 🏛️

Therefore, let us not despair! This consolidative phase is not a harbinger of ruin, but rather a period of quiet strength. And should the retail investors return, their enthusiasm renewed, Bitcoin may yet ascend to even greater heights, propelled by both solid demand and the fickle winds of speculation. 🚀

Read More

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

- EUR USD PREDICTION

- Best Finishers In WWE 2K25

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Unlock & Upgrade Hobbies in Heartopia

- Uncover Every Pokemon GO Stunning Styles Task and Reward Before Time Runs Out!

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- How to Increase Corrosion Resistance in StarRupture

2025-07-22 05:48