As a seasoned crypto investor with a background in economics, I find Jurrien Timmer’s analysis of Bitcoin and gold as stores of value intriguing. His perspective on fiscal dominance and the role of fiat money aggregates in determining their value is insightful.

As a researcher, I’d like to share my perspective on the ongoing debate between Bitcoin and gold as potential stores of value, focusing on their ability to hedge against inflation in various economic environments, based on Fidelity’s Director of Global Macro, Jurrien Timmer’s recent comments.

The Theory Of Money Supply And Asset Valuation

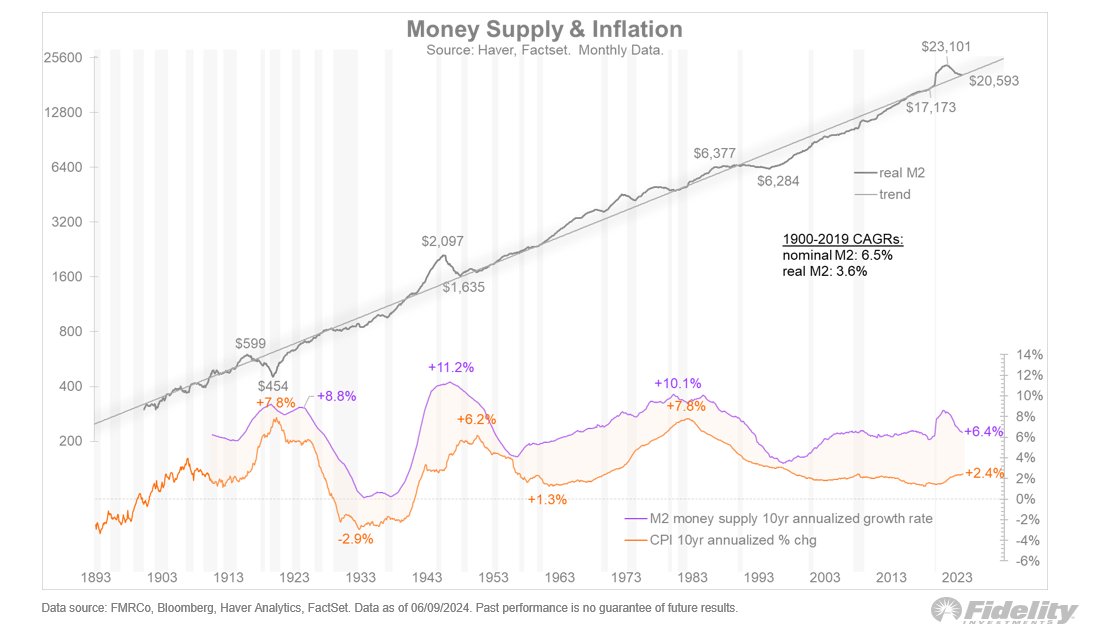

Timmer’s argument hinges on the idea of “fiscal dominance,” which refers to a government’s decision to increase its money supply, potentially leading to a decrease in the currency’s value and purchasing power. He points out that this situation could result in inflation, as evidenced by the historical correlation between the growth of M2 money supply and Consumer Price Index (CPI).

As a researcher exploring the relationship between Bitcoin (BTC) and gold as potential inflation-hedging assets, I acknowledge that these two investments are often cited for their resistance to inflation. However, I also share Timmer’s perspective that the conditions necessary for their full effectiveness have yet to fully materialize. Despite recent hawkishness from the Federal Reserve, we have not yet seen a consistently high and persistent inflation rate.

Bitcoin is often referred to as “digital gold,” “gold 2.0,” or “exponential gold” for a few reasons. Firstly, like gold, Bitcoin possesses several monetary qualities. However, it also functions as a new type of internet technology, as described by Timmer.

To secure a position alongside gold for Bitcoin, it’s necessary that the growth of fiat monetary aggregates significantly exceeds typical trends.

During the pandemic, the M2 money supply experienced a significant increase, as mentioned by Timmer. However, the Federal Reserve’s implementation of tighter monetary policies caused this surge to be short-lived. This finding implies that the functions of gold and Bitcoin as reliable stores of value may yet to be fully proven.

The price of Bitcoin has recently reached an all-time high of $69,523. This surge may be due to the recent Consumer Price Index (CPI) report showing signs of decreased inflation. Such a development could potentially reinforce Bitcoin’s role as a valuable asset and store of value.

The report had a favorable impact on gold’s value as well, leading to a 0.91% increase in its price within the last 24 hours, now standing at $2,336 per ounce.

Effects of Treasury Yield Correlations on Bitcoin

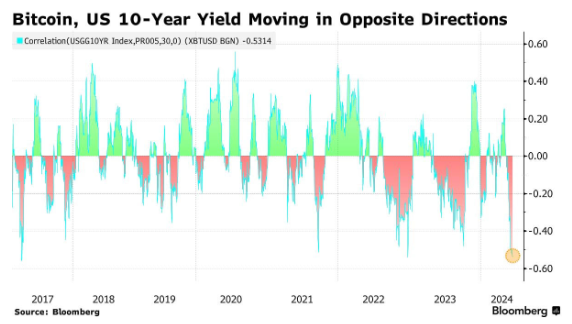

Recently, based on the most recent figures from Barchart, the price of Bitcoin (BTC) no longer appears to be linked with the 10-year U.S. Treasury (UST) bond yield as the correlation has plummeted to a record low over the past 14 years, reaching a negative value of -53.

As a crypto investor, I can explain it this way: The BTC split means that Bitcoin’s price movements are no longer directly linked to traditional financial markets like U.S. Treasury bond yields. In other words, the Bitcoin market is setting its own course, free from the influence of government securities yields. This separation is an important development for the crypto world.

As a researcher studying the digital currency landscape, I would put forth that Bitcoin’s connection to conventional financial systems may be becoming less rigid. This potential shift could mark the initial stages of Bitcoin’s emergence as a distinct asset class, setting it apart from traditional financial instruments.

As a researcher studying the relationship between Bitcoin and traditional financial metrics, I have observed an intriguing trend. Should Bitcoin continue to diverge from these conventional indicators, it would significantly bolster its argument as an effective non-traditional hedge against economic uncertainty.

As a crypto investor, I acknowledge that Bitcoin and gold have their own limitations when it comes to serving as stores of value. However, it’s essential to keep in mind that some economic conditions, such as the money supply and inflation, have yet to fully materialize and could significantly impact their value.

Featured image created with DALL-E, Chart from TradingView

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LBT PREDICTION. LBT cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

2024-06-13 04:11