As a seasoned crypto investor with a few years of experience under my belt, I’ve witnessed the ebb and flow of the digital asset market through various narratives and events. The approval of Bitcoin spot ETFs in the US and the halving event were two significant milestones that left indelible marks on the crypto landscape in 2024.

Moving towards 2024, Bitcoin spot ETFs and the upcoming halving were the most prominent stories in the cryptocurrency world. The Securities and Exchange Commission (SEC) granted approval for the first BTC spot investments in the US market, leading to a surge in Bitcoin’s price to a record-breaking peak.

While the anticipated price surge following the halving event has not fully materialized for Bitcoin, the cryptocurrency has experienced a modest uptick in value over the past few days. This growth partially offsets the price stagnation witnessed during the previous month.

Whales Have Added 250,000 BTC Since ETF Approval: IntoTheBlock

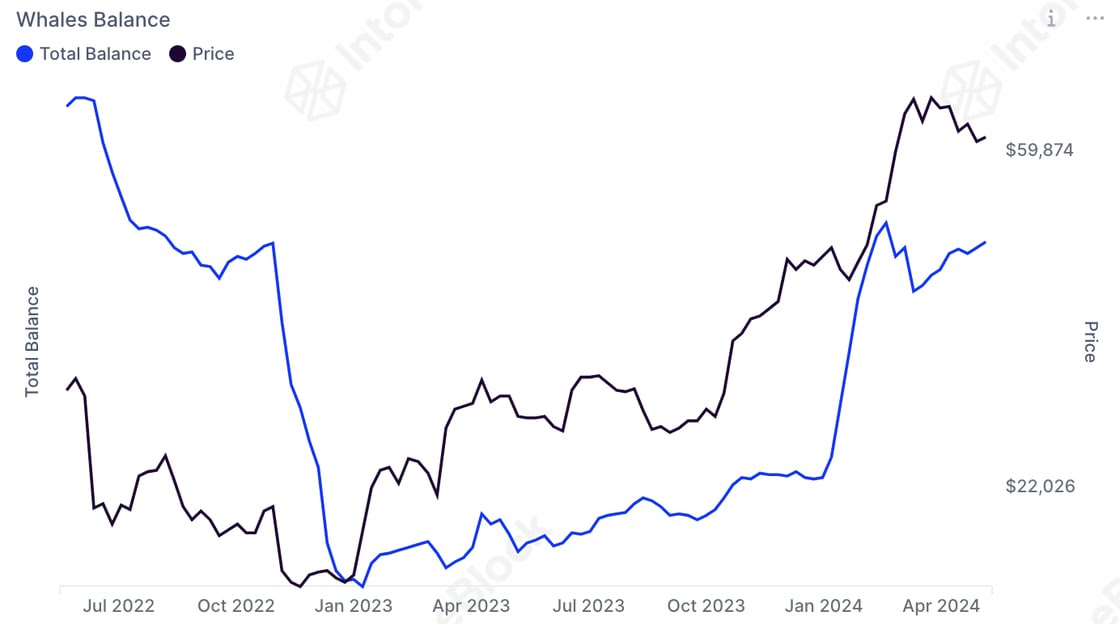

As a blockchain analyst, I’ve come across an intriguing finding from IntoTheBlock’s latest post on the X platform. They’ve uncovered that a specific group of large-scale Bitcoin holders have been actively amassing more Bitcoins in the past few months. This insight is derived from the Whales Balance metric, which monitors the total Bitcoin supply held by wallets containing over 1,000 BTC.

Based on IntoTheBlock’s statistics, approximately 250,000 more Bitcoins have been added to the stash of this specific group of whales since the introduction of US-listed spot Bitcoin Exchange Traded Funds (ETFs). This fresh accumulation has brought the quantity of Bitcoin held by whales possessing over 1,000 coins closer to its pre-FTX exchange crash level.

The collapse of FTX under Sam Bankman-Fried’s leadership resulted in significant distrust among cryptocurrency investors. Consequently, numerous large investors and holders chose to exit the market and sell their assets. This mass exodus could potentially signal the end of the market turbulence brought about by FTX’s downfall.

As an analyst, I’ve noticed a significant upward trend in Bitcoin holdings, indicating that large institutions have grown increasingly confident and eager for the premier cryptocurrency. This heightened interest came after the SEC gave its approval for spot Bitcoin ETFs. For institutional investors, these regulated investment products provide a more accessible and controlled way to gain exposure to Bitcoin, making it an attractive option even for traditional financial players.

As a market analyst, I can assert that crypto whales hold significant power in the digital currency space. Their actions, particularly the buying or selling of large amounts of Bitcoin (BTC), can substantially impact asset prices. Consequently, when whales amass BTC, this behavior is often interpreted as a positive indicator for the coin’s price trend. Essentially, their accumulation acts as a bullish signal and expresses optimism regarding Bitcoin’s future direction.

Bitcoin Price At A Glance

The price of Bitcoin has eased a bit after reaching new highs, rising from $61,000 to over $67,000 to finish the week. Currently, Bitcoin is priced at approximately $67,170 with no substantial shift in value observed in the last day. However, on a weekly basis, Bitcoin has experienced a remarkable increase of 10%.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-19 17:06