As a seasoned crypto investor with a keen interest in on-chain data, I find the recent trend of Bitcoin whales accumulating at the price lows to be an encouraging sign. The decline in the Bitcoin Exchange Reserve, as highlighted by the analysis from Ali Martinez, is an indicator that large holders have been taking their coins off exchanges and self-custodizing them.

Bitcoin whales could be clandestinely amassing coins at the current dip in prices, according to on-chain analysis, while significant amounts have been withdrawn from exchanges.

Bitcoin Exchange Reserve Has Observed A Decline Recently

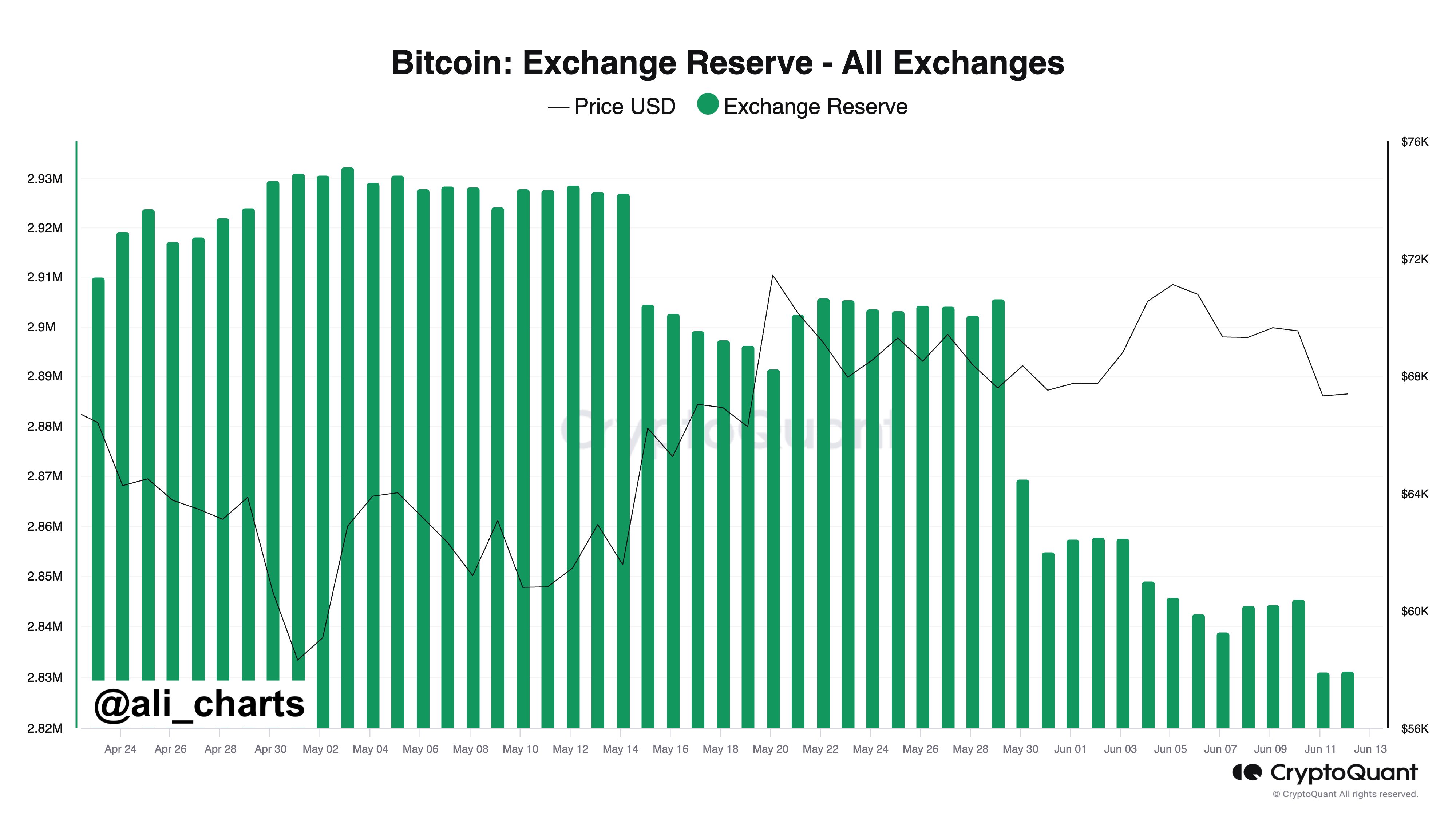

I’ve noticed an intriguing observation made by crypto analyst Ali Martinez regarding the recent trend on exchange X. He brought up that there have been substantial withdrawals from these platforms over the past few days. A metric worth considering in this context is the “Exchange Reserve.” This measure indicates the total quantity of Bitcoin held in the wallets of all centralized exchanges at present.

When the level of this metric increases, it signifies that these platforms are currently taking in more deposits than they’re withdrawing. Given that investors often transfer their coins to exchanges to sell, such a pattern could potentially indicate bearishness for the asset’s price.

Alternatively, the decrease in the indicator signals that more tokens are being withdrawn from these entities by users at present. This action might indicate a bullish trend for cryptocurrencies as holders may choose to store their coins long-term by taking them out of central custody.

Now, here is a chart that shows the trend in the Bitcoin Exchange Reserve over the past few months:

I’ve analyzed the data presented in the graph and found that the Bitcoin Exchange Reserves have seen a significant decrease recently. Approximately 14,140 Bitcoins, equivalent to around $954 million at current exchange rates, have been withdrawn from these exchanges over the past 48 hours.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin has experienced lower trading prices in recent times after a significant decline. These reductions in balance may suggest that some investors have taken advantage of these seemingly attractive prices to increase their holdings, potentially setting the stage for future price growth.

Considering the substantial size of the players involved, it’s only logical that the whale entities have likely intervened in this situation. The presence of such large-scale investors purchasing coins at these prices and moving them into personal wallets is an encouraging indicator for the value of the asset.

The cryptocurrency appears to have gained value from its previous accumulation, with its price bouncing back above $69,000 once more.

Based on the graph, it is apparent that the recent exchange outflows aren’t a completely novel occurrence in the market. In fact, the Exchange Reserve has been gradually declining over the last month.

In the Bitcoin market, there’s been a notable trend of people eagerly withdrawing coins from various platforms lately.

BTC Price

Despite Bitcoin’s price surge above $69,000 after significant whale transactions, the coin remains confined to the extended price range it has been oscillating between for quite some time.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-06-12 20:11