Bitcoins held by large investors, or “whales,” have not been sold off during the latest market downturn based on transaction data recorded on the blockchain.

Bitcoin Whales Have Participated In Net Accumulation Since March 1st

According to a recent post by on-chain analysis firm Santiment, large Bitcoin investors have remained unfazed by the recent drop in price.

Here, we focus on the “Bitcoin Holding Distribution,” providing insights into the current quantity of Bitcoin being stored by different wallet categories within the market.

Addresses are categorized into wallet groups based on the quantity of bitcoins they hold. For example, the group holding between 1 and 10 bitcoins includes all addresses or investors with a balance of at least one but not more than ten bitcoins.

In the ongoing conversation, there are three groups that matter: those holding between 100-1,000 BTC, 1,000-10,000 BTC, and 10,000-100,000 BTC. The initial group can be referred to as the “large investors” or “significant holders.”

Sharks represent an essential segment of the Bitcoin market, even if they don’t wield the same level of influence as the large-scale investors, referred to as “whales,” who own 1,000 to 10,000 Bitcoins. The discrepancy in their holdings sizes is the primary reason for this difference in impact.

The final group, consisting of 10,000 to 100,000 BTC holders, comprises some of the largest players in the Bitcoin market. These entities surpass even the size of typical “whales.” At times, they are colloquially referred to as “mega whales.”

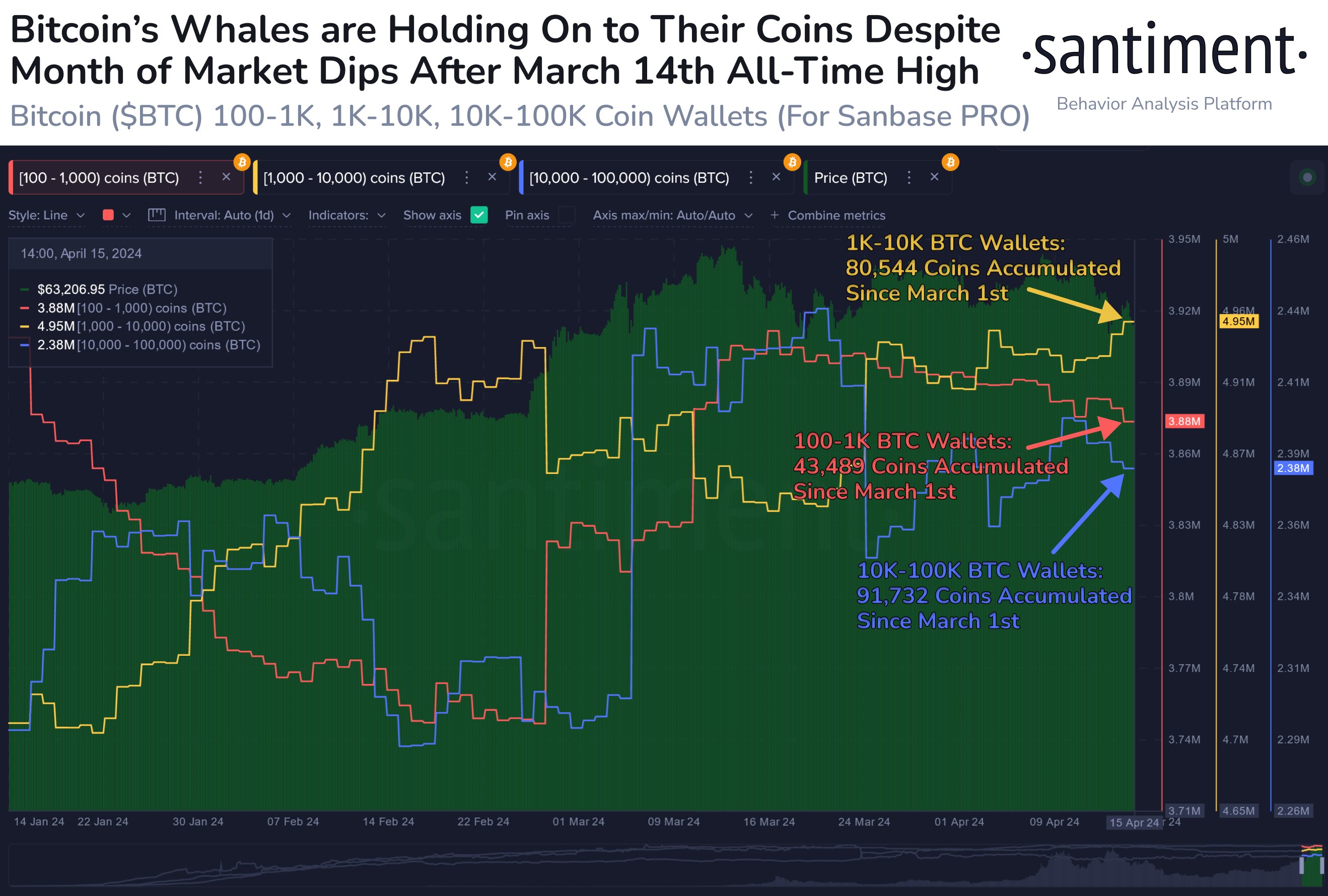

Here’s a chart illustrating the recent development in Bitcoin’s Supply Distribution:

Based on the graph shown above, the number of Bitcoin holders with substantial amounts of the cryptocurrency has risen significantly since March. This increase indicates that these holders have likely been purchasing more Bitcoin, leading to a net accumulation.

In more detail, during this timeframe, sharks have purchased approximately 43,489 Bitcoins (valued at around $2.72 billion based on current exchange rates), while whales have acquired about 80,544 Bitcoins ($5.04 billion), and mega whales have obtained around 91,732 Bitcoins ($5.75 billion).

In the chart, you can see that while the buying patterns were not identical among these groups, the mega whales initiated significant and forceful purchases at the beginning of last month. This aggressive accumulation likely contributed to the price surge towards a new record high (ATH).

The whales sold into this ATH and only bought once the drawdown had finished following this peak, while the sharks consistently bought as the rally towards the ATH took place and then stopped purchasing further.

Based on this trend, it seems plausible that the huge surge in price for ATH was driven by large-scale buying from big investors, or “whales.” After the initial dip in price, these major investors sold some of their holdings. However, they have continued to keep their investments since then.

In the same window, both sharks and whales in the market have experienced lateral adjustments to their Bitcoin holdings. This observation holds true even as downward price trends persist for Bitcoin.

BTC Price

Currently, Bitcoin is hovering near $62,600 in value, representing a decrease of over 11% within the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

2024-04-16 19:11