As a researcher with a background in cryptocurrencies and market analysis, I find the current state of Bitcoin intriguing. Despite the broader market’s downturn and the selling pressure on Bitcoin itself, there are signs of underlying strength. Specifically, the increasing number of wholecoiners – addresses holding more than one BTC – is a significant development.

Bitcoins have gained significant attention lately, with the overall market experiencing downturns and several sectors, primarily meme coins, showing notable declines. Despite Bitcoin facing intense selling pressure, relevant on-chart data indicates resilience.

Over 1 Million Bitcoin Wholecoiners

As the price of Bitcoin experiences a tough time gaining momentum, the count of Bitcoin millionaires, represented by addresses containing over one Bitcoin, is on an upward trend and currently reaching new peaks. According to IntoTheBlock’s statistics, approximately 1 million distinct wallets now hold more than one Bitcoin.

This spike represents a significant achievement marking the increasing number of people striving to attain the “wholecoiner” title. Moreover, it signifies that a larger population is optimistic about the coin’s future and are actively acquiring it to join this exclusive group.

Currently, Bitcoin exhibits volatile price movements, but the broader outlook is optimistic based on market analysis. Numerous influential elements are impacting BTC‘s value, primarily economic instability. Experts keep a keen eye on relevant data emanating from the US.

As an analyst, I would interpret this situation as follows: The Federal Reserve’s unexpected decision to cut interest rates only once in 2023 instead of the anticipated multiple cuts is seen as negative news for Bitcoin (BTC). Economists had predicted that the central bank would adopt a more accommodative stance and lower interest rates repeatedly, following their previous aggressive rate hikes from 2022 to 2023. However, the recent change in their outlook implies that they may be less inclined to reduce rates as aggressively as initially anticipated. This shift could potentially weaken investors’ sentiment towards Bitcoin, which has historically benefited from a lower interest rate environment.

Over the past two weeks, I’ve noticed a downward trend in Bitcoin prices, with the US dollar gaining strength being a significant contributing factor. The situation has worsened due to Mt. Gox trustees’ unexpected change of plan to compensate victims in July instead of October as previously announced. Additionally, both the German and US governments have been selling off their Bitcoins, further pressuring the market.

BTC Remains Choppy, Over $265 Billion Must Be Injected For Prices To Break All-Time Highs

One analyst points out that if Bitcoin (BTC) keeps declining, unleveraged bulls may have to sell off their holdings as the price falls below the $60,000 threshold, forcing those with leverage to exit the market.

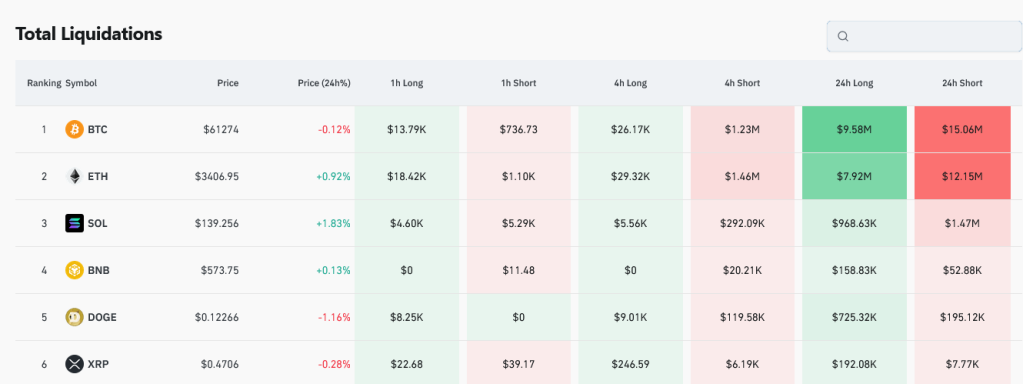

As a crypto investor keeping a close eye on market trends, I’ve noticed some significant liquidation events according to Coinglass’ data. In the last 24 hours, approximately $9.5 million worth of leveraged long positions have been forcibly closed, while over $15 million in short positions were liquidated as well.

As an analyst, I cannot predict with certainty whether the present sideways trend in Bitcoin’s price will persist in the near term. However, technically speaking, the price action is contained within a significant range, with resistance at approximately $74,000 and support around $56,000. Despite this range, the uptrend in Bitcoin’s price remains intact. To push the price above $74,000, it would take a substantial influx of over $265 billion into the cryptocurrency market.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- NAKA PREDICTION. NAKA cryptocurrency

2024-06-28 00:41