As an experienced analyst with over a decade of financial market observation under my belt, I have seen countless market fluctuations and learned to navigate them with caution and strategic thinking. The recent Bitcoin (BTC) liquidations, particularly the staggering 7,023% imbalance between long and short positions, is a stark reminder that the crypto market can be as unpredictable as a rollercoaster ride.

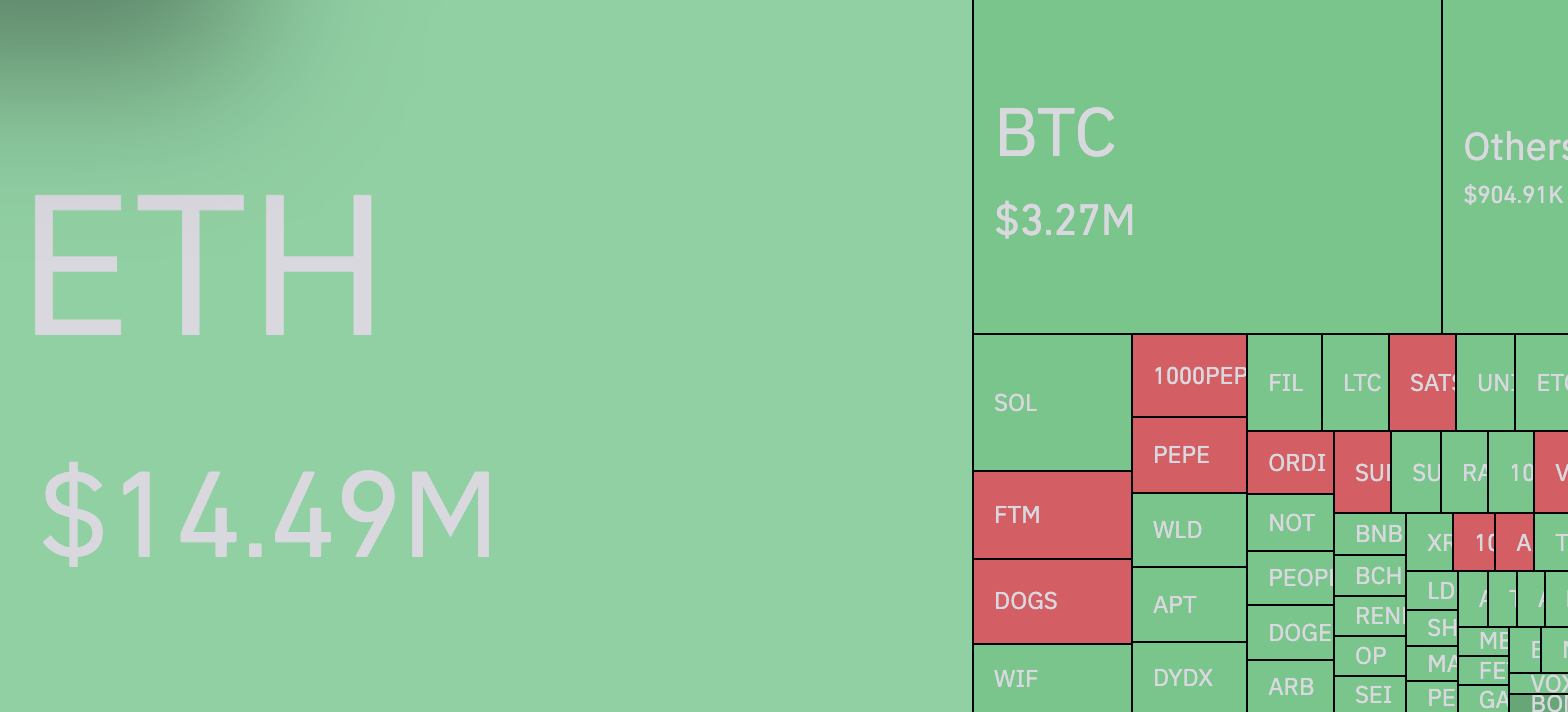

In recent times, the Bitcoin market has experienced a significant number of sell-offs (liquidations), with aggressive buyers taking the brunt of the impact. According to CoinGlass, around $3 million worth of long positions were liquidated in an hour alone, compared to only $51,000 in short liquidations. This massive disparity of 7,023% suggests a predominantly bearish market sentiment.

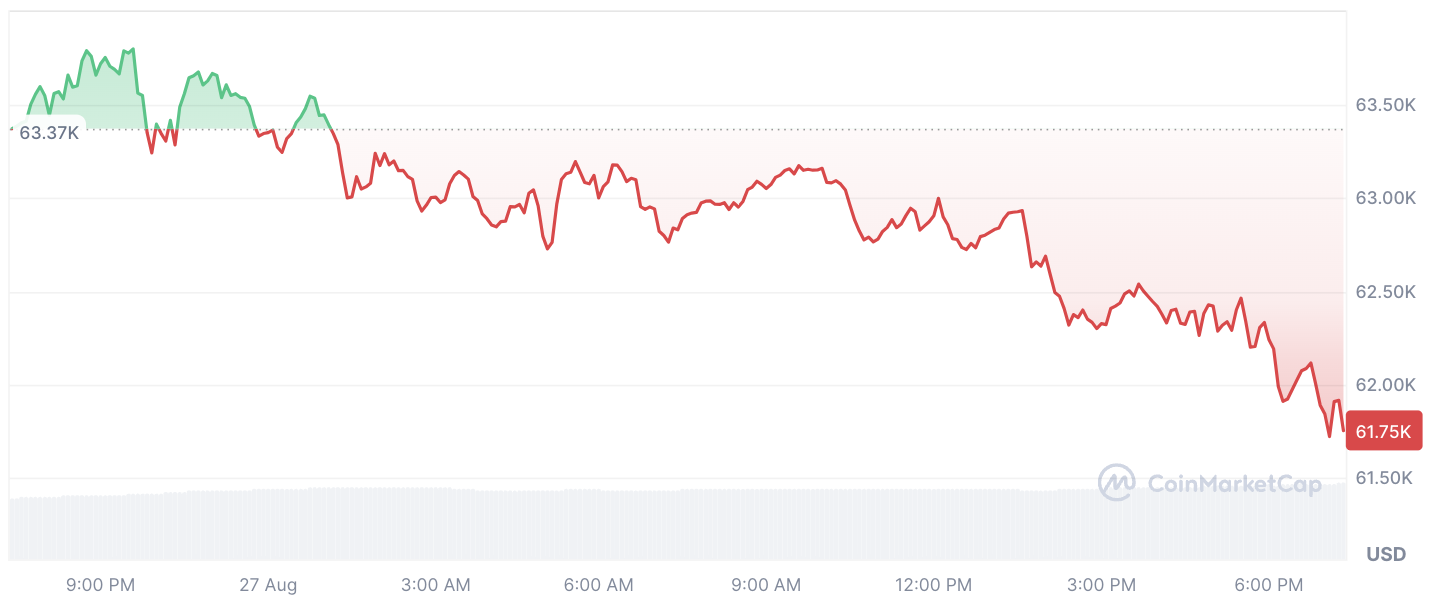

Over the specified timeframe, I observed a 0.6% decrease in the value of Bitcoin, which seems to have fueled a wave of liquidations. This decline follows a more substantial 3.7% drop at the start of the week, making things tougher for those who are optimistic about its price rise.

In many instances, individuals who entered too late or failed to properly handle risks found themselves facing substantial losses. This latest round of sell-offs has raised questions about whether the market is merely undergoing a standard adjustment, or if it signals the demise of Bitcoin’s recent upward trend.

Without a doubt, Bitcoin continues to hold significance among investors and traders, even amidst recent market fluctuations. The financial sector remains keenly interested in this digital currency, suggesting that its volatility is here to stay.

For individuals ready to join in, there’s both potential advantages and drawbacks. While some might feel hesitant due to the latest sell-offs, others could view this scenario as an opportunity to purchase Bitcoin at a possibly reduced rate.

Keep in mind that investing with leverage involves substantial risks, so it’s crucial to consider your risk appetite prior to engaging in these kinds of trades.

Read More

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ADA PREDICTION. ADA cryptocurrency

- EUR AUD PREDICTION

- GBP USD PREDICTION

- THL PREDICTION. THL cryptocurrency

2024-08-27 18:51