Behold, the year of our Lord 2025, and lo! Bitcoin’s price glided along at $117,914 per coin, as if the very angels of the market had taken a siesta. Its market capitalization, a gilded throne, reached $2.34 trillion, while the 24-hour trading volume, a bustling bazaar, swelled to $43.60 billion. The intraday price, a fickle lover, flitted between $115,086 and $118,102, a dance of buyers and sellers at the gates of resistance, as if the market itself were debating whether to leap or linger.

Bitcoin

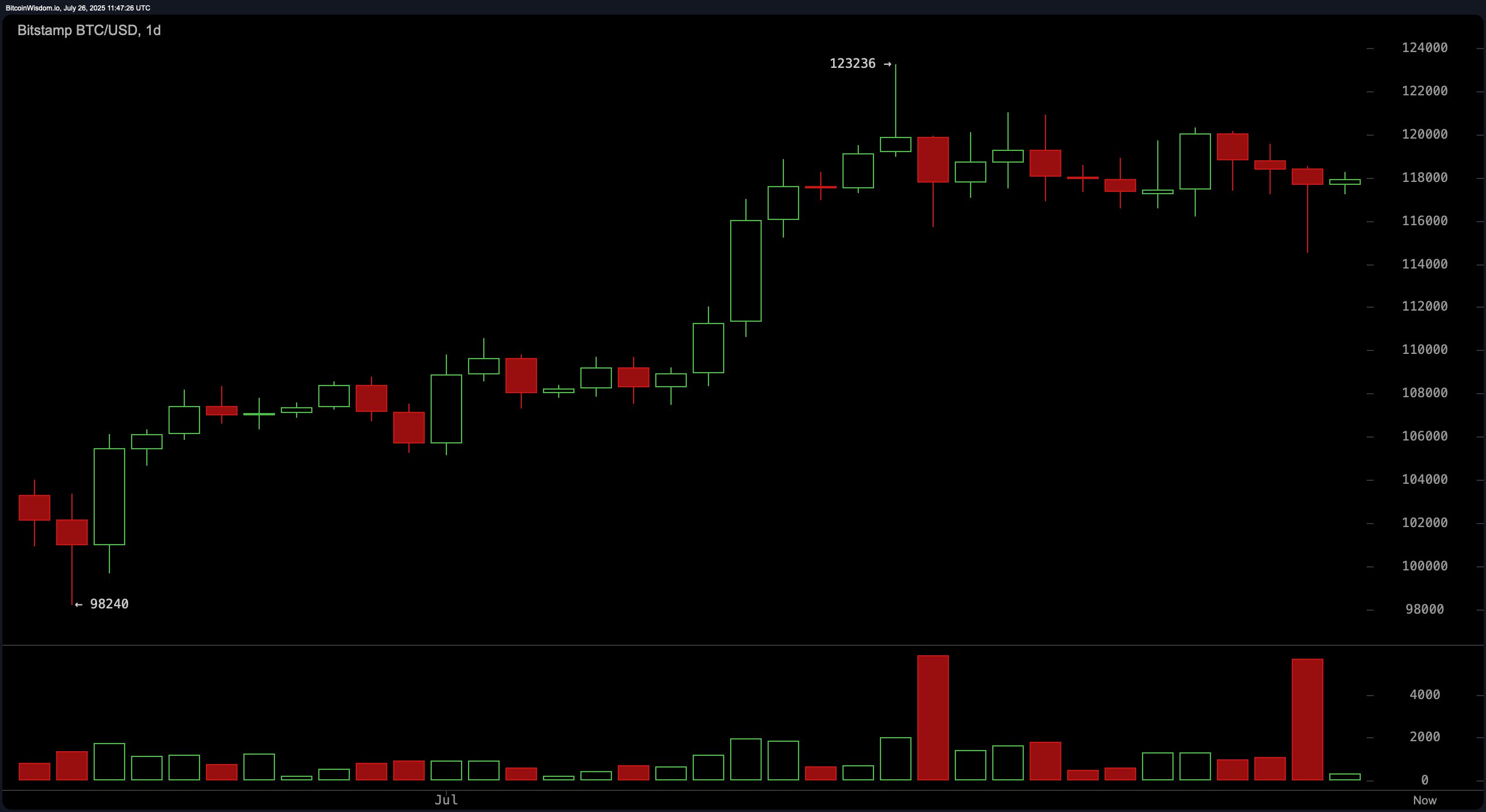

On the daily chart, bitcoin continues its grand procession, a broad uptrend now transformed into a cautious waltz after its recent crescendo near $123,200. This range-bound movement, akin to a nobleman pacing his estate, suggests profit-taking at the upper echelons, evidenced by a crimson volume candle, a harbinger of distribution by the institutional titans. Support, steadfast as a fortress, stands firm between $114,000 and $115,000, tested repeatedly. Traders, those intrepid adventurers, eye entries within this zone, targeting a move back toward resistance between $120,000 and $122,000, with risk managed below $113,500—though one might wonder if their courage is matched by their wallet’s depth. 🎯

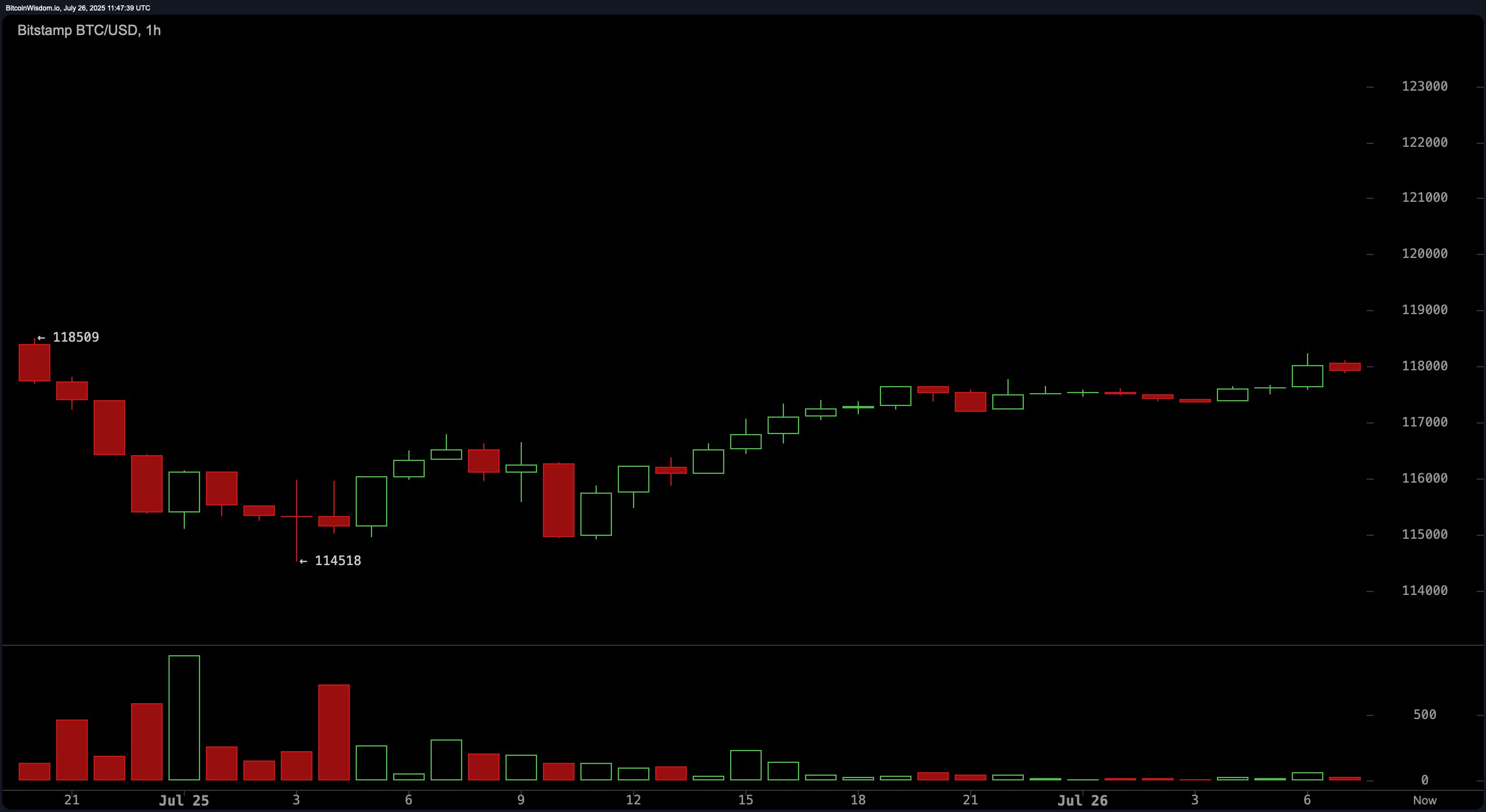

The 4-hour bitcoin chart, a tempest in a teacup, illustrates a recent recovery from a sharp decline that touched a low of $114,518. A tentative V-shaped recovery has formed, yet the lack of volume confirmation, like a whisper in a storm, hints at market hesitation. Currently, bitcoin tests the $118,000 level, an immediate resistance, as if the market itself is holding its breath. A close above $118,500 on volume could trigger a short-term breakout, while failure at this range may invite short-selling down to $116,000. The setup, a chess game of tactical positioning, waits for the next move. 🧠

In the 1-hour bitcoin chart, bitcoin marked a micro-bottom at $114,518, which initiated a strong rebound. However, the failure to breach the $118,509 lower high suggests near-term exhaustion, as if the market were sighing in relief. Volume has thinned during the current consolidation, pointing to indecision, a curious state for a creature as volatile as Bitcoin. Short-term traders, those nimble acrobats, are advised to scalp within the $117,800 to $118,200 zone, placing tight stops due to the narrow trading band. A clear break above or rejection from $118,200 will define the next minor trend, as if the market were a child with a toy that refuses to behave. 🤷♂️

From a momentum and trend-indicator standpoint, oscillators, those fickle courtiers, are largely neutral with a slight bearish tilt. The relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and Awesome oscillator all show neutral readings, like a man caught between two lovers. However, the momentum indicator, a sly fox, is flashing a bearish signal, and the moving average convergence divergence (MACD) level, a grumpy old man, is also in the negative range, which could hint at an underlying weakness not yet visible on price charts—a secret kept close by the market’s veil. 🕵️♀️

Despite neutral oscillator signals, moving averages (MAs), those steadfast pillars, remain decisively bullish. Both the exponential moving average (EMA) and simple moving average (SMA) across 20-day, 30-day, 50-day, 100-day, and 200-day intervals support a longer-term upward trajectory, as if the market were a river flowing toward the sea. The 10-period EMA has turned bullish, while the 10-period SMA lags slightly with a bearish signal, a curious divergence that points out the short-term choppiness amid a broader bullish trend. Collectively, these technical cues suggest that while bitcoin is consolidating below resistance, the underlying structure remains constructive for upside resumption if volume returns—a hope as fragile as a bubble in a champagne glass. 🥂

Bull Verdict:

If bitcoin sustains support above $114,000 and decisively breaks above $118,500 with accompanying volume, the broader trend favors a continuation toward the $120,000–$123,000 resistance zone. Strong alignment across longer-term exponential and simple moving averages supports a bullish outlook, suggesting accumulation is ongoing beneath key resistance—though one might question if the bulls are merely chasing shadows. 🦄

Bear Verdict:

Should bitcoin fail to reclaim $118,200 and break below the $114,000 support zone, a deeper correction may unfold, potentially targeting the $110,000 level. Bearish momentum signals from the momentum indicator and moving average convergence divergence (MACD) level suggest vulnerability to a downside shift if bulls lose their grip at current levels—a scenario as likely as a snowball’s chance in hell. ❄️

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-07-26 15:28