In the autumn of 2025, the sun rose over the city, and with it, the price of Bitcoin began its ascent-slow, deliberate, like a man walking through a swamp, unsure if he’s sinking or simply wading. The market, ever the enigma, whispered of bullish momentum, though its words were as clear as a foggy morning.

Bitcoin Chart Outlook and Price Prediction 📈

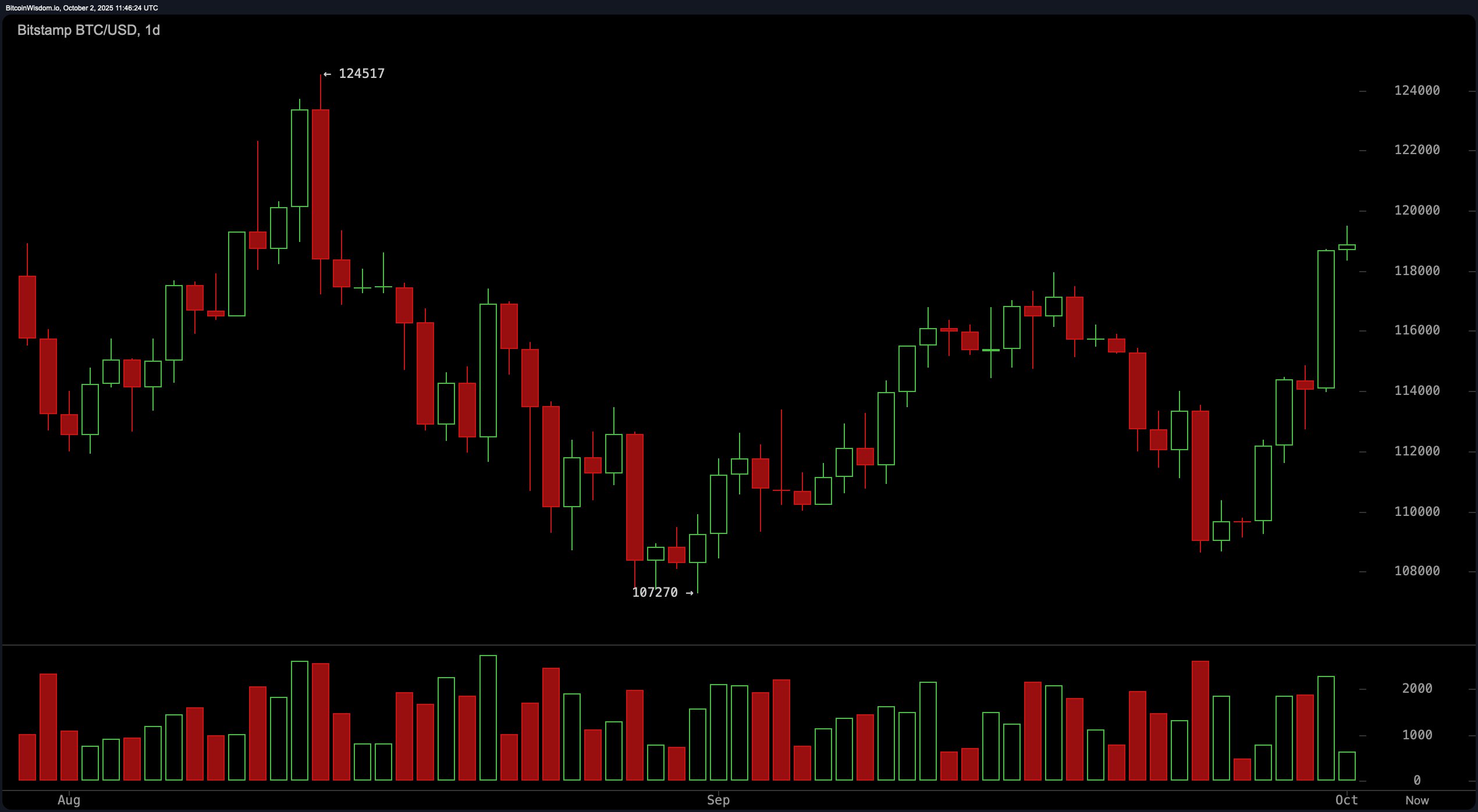

The daily chart, that old trickster, broke above the $114,000-$116,000 zone, a feat as surprising as a cat learning to whistle. A green candle, fat and proud, danced across the screen, while volume swelled like a drunk at a party-loud, but perhaps not entirely reliable. One might wonder if the institutions had finally decided to stop hiding behind their desks and join the party.

The market’s ability to reclaim $118,000 after September’s gloom was a triumph, though one might question if it was a genuine victory or merely a temporary truce. A pullback to $116,500-$117,500 could be a chance to buy low, or a trap for the unwary. Resistance at $124,000-$125,000 looms like a grumpy uncle at a family gathering-unwelcome, but impossible to ignore.

The 4-hour chart, ever the optimist, presented a rounded bottom-a classic reversal, though one might argue it resembles a fidget spinner more than a chart. After bottoming at $108,652, Bitcoin climbed with the determination of a man chasing a dream. The breakout above $113,000, confirmed by volume, felt like a sigh of relief… or a warning.

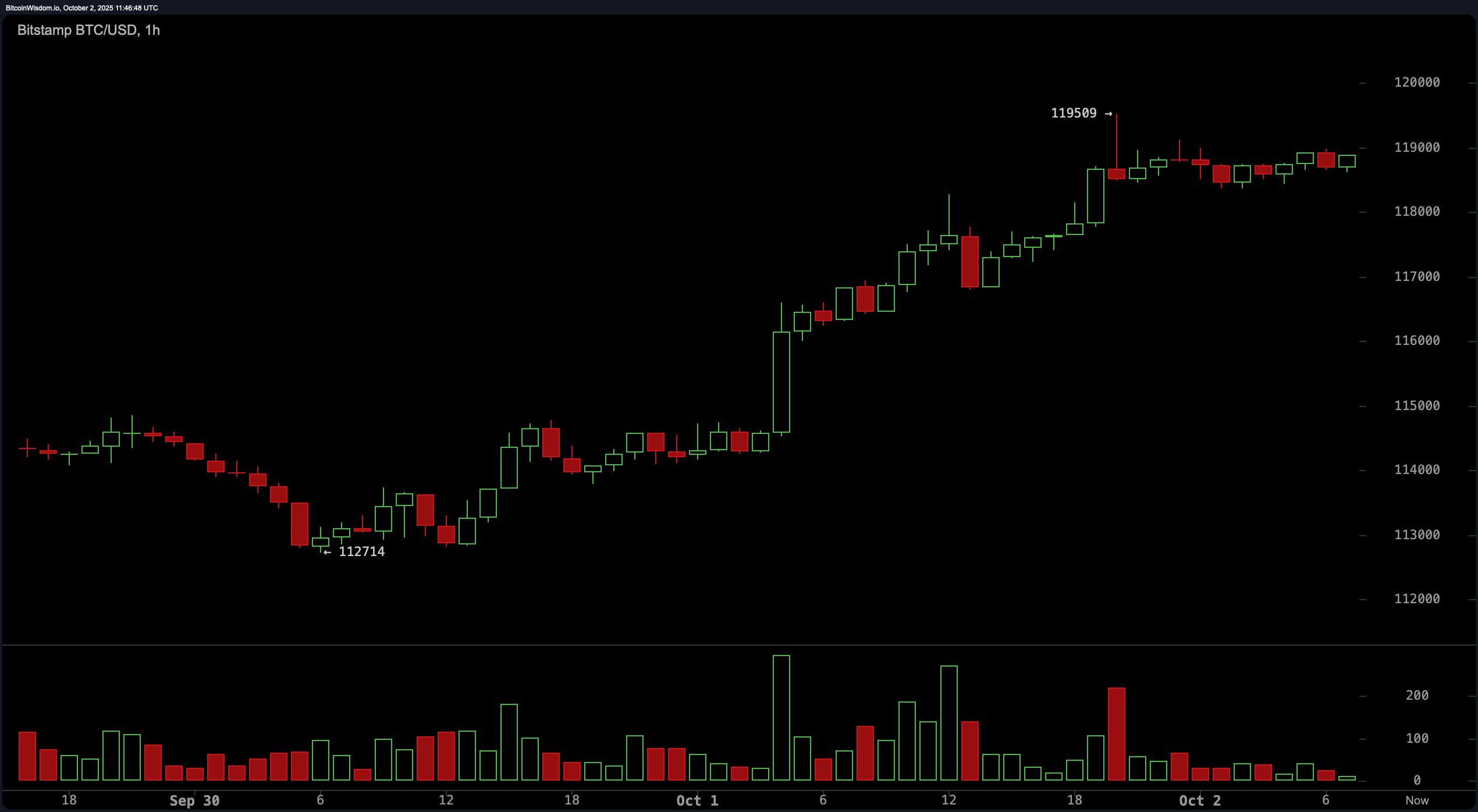

The 1-hour chart, that frenetic child, broke from $112,700 with the energy of a caffeinated squirrel. It reached $119,509, a height as fleeting as a sunset. The rally, though vigorous, left the market slightly breathless, hinting at a need for a nap. A pullback to $117,000-$117,500 might be the perfect time to catch one’s breath-or jump back in.

The oscillators, those fickle friends, offered a mixed bag. RSI at 63, Stochastic at 84-neutral, yet hopeful. The CCI at 137 and ADX at 20 suggested a market teetering between calm and chaos. Momentum indicators, however, were the life of the party: Awesome oscillator at 1,534, momentum at 6,080, MACD at 530-each a cheerleader for the bulls. Yet, one might ask, is this a parade or a procession to the unknown?

Moving averages, those steadfast guides, all pointed upward. The EMA (200) at $106,683 and SMA (200) at $105,122 were distant memories, now buried beneath the current price. A testament to the market’s resilience-or its delusions of grandeur.

Bull Verdict:

With Bitcoin above key resistance and moving averages in its corner, the bulls are like a dog with a bone-relentless, if a bit misguided. The test of $124,000-$125,000 looms, a challenge as daunting as a mountain. Yet, the market, ever the optimist, may yet climb.

Bear Verdict:

But beware, dear reader-the 1-hour chart’s overbought state is a warning sign. A retest of $117,000-$117,500 could see the rally stall, and the bears, those quiet predators, may strike. A fall to $114,000 would be a cruel joke, a reminder that even the brightest stars fade.

Read More

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Build Muscle in Half Sword

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- Violence District Killer and Survivor Tier List

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

- Sega Declares $200 Million Write-Off

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- All Pistols in Battlefield 6

2025-10-02 16:18