- Bitcoin flirts with the critical $63K support level, risking a dramatic break in its four-year price saga.

- A tumble below $63K could send long-term holders into a tailspin, unleashing market chaos.

Ah, Bitcoin [BTC], that capricious creature of the digital realm, now finds itself at a crossroads. As it dances precariously near the $63K support level — a hallowed ground that has seen many a bottom — investors are glued to their screens, waiting for either a triumphant leap or a catastrophic plunge. 🎢

For years, Bitcoin has been the steadfast guardian of its price history, refusing to revisit the past four years. But lo! If the $63K support crumbles, that glorious streak may meet its untimely demise. 😱

A decisive drop below this threshold could rattle the cages of long-term holders, ushering in a tempest of volatility. With the year 2025 still unfolding like a poorly written novel, this moment could be pivotal in scripting Bitcoin’s next grand chapter.

Where Bitcoin could find its footing

Bitcoin has been hovering just above two critical levels — the active realized price at $70,730 and the true market mean price at $64,480. Talk about a tightrope act! 🎪

These levels have previously marked significant turning points: the May 2021 sell-off, the January 2022 bear market low, and the 2023–2024 accumulation zone. It’s like a soap opera, but with more numbers and fewer dramatic pauses.

The active realized price reflects the market’s behavior through absorbed profits and chain activity, while the true market mean price serves as a sturdy anchor tied to investor capital and active supply. Together, they form a high-probability bottom range that could stabilize BTC in the short term. Or not. Who knows? 🤷♂️

Bitcoin has never revisited four-year prices

Bitcoin has maintained a remarkably consistent pattern: it has never revisited price levels from four years prior. It’s like that friend who never shows up to the same party twice. 🎉

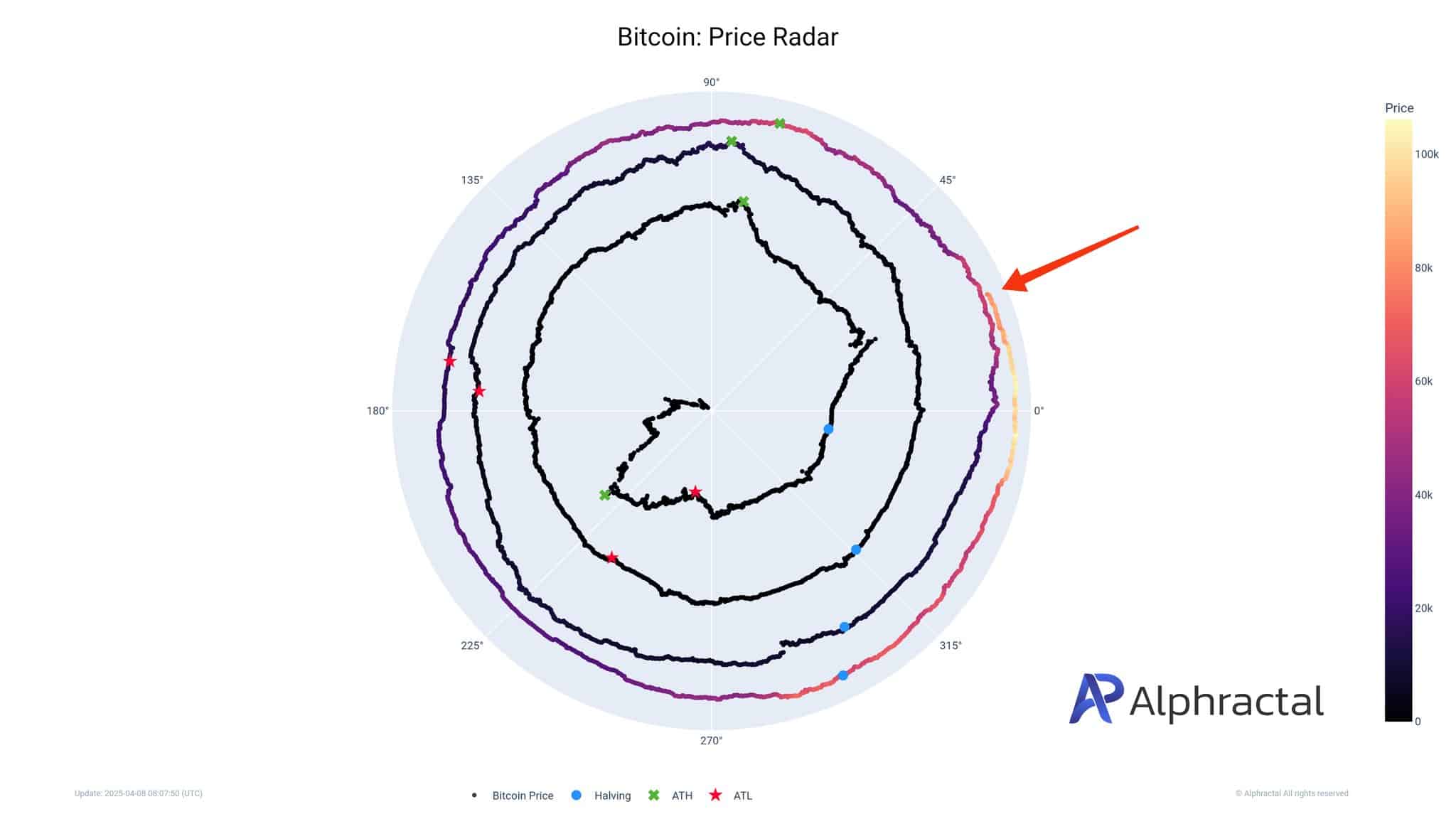

This rule, illustrated in the Bitcoin Price Radar chart above, forms the bedrock of Bitcoin’s cyclical nature and long-term allure. Each rotation on the radar represents four years, with halving events, all-time highs, and lows marked around the spiral. It’s a beautiful mess, really.

As BTC now approaches the $63K support level, it teeters on the brink of violating this long-standing principle. Will it break the mold? Or will it cling to its past like a nostalgic grandparent? 🧓

A breach would mark a historical first — shattering the psychological and structural rhythm that has shaped investor confidence and cycle expectations since Bitcoin’s inception. Talk about a plot twist!

Implications for LTHs

If Bitcoin dips below $63K, it would break a precedent that has held firm across every halving cycle — never revisiting prices from four years prior. It’s like breaking a family tradition, and we all know how that goes. 🍽️

For long-term holders, this isn’t merely a technical anomaly; it’s a psychological shock. Many have anchored their faith in Bitcoin’s historical consistency, using the four-year rule as a compass for timing and belief. But what happens when the compass goes haywire? 🧭

A breach could sow seeds of doubt, shake long-term conviction, and prompt a reassessment of cycle-based strategies. In a market driven as much by narrative as by fundamentals, violating this “rule” could unsettle sentiment and inject volatility into an already fragile macro environment. Buckle up, folks!

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 UFC 5 Perks Every Fighter Should Use

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- Invincible’s Strongest Female Characters

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- USD ILS PREDICTION

- How to Get 100% Chameleon in Oblivion Remastered

- Gold Rate Forecast

2025-04-09 21:18