On Saturday morning, bitcoin’s price drowns in the lukewarm bath of $68,090-$69,162, its $1.36 trillion market cap a gilded cage. The $97.38 billion 24-hour volume? A fleeting sigh of panic, now replaced by the existential dread of indecision.

Bitcoin Chart Outlook

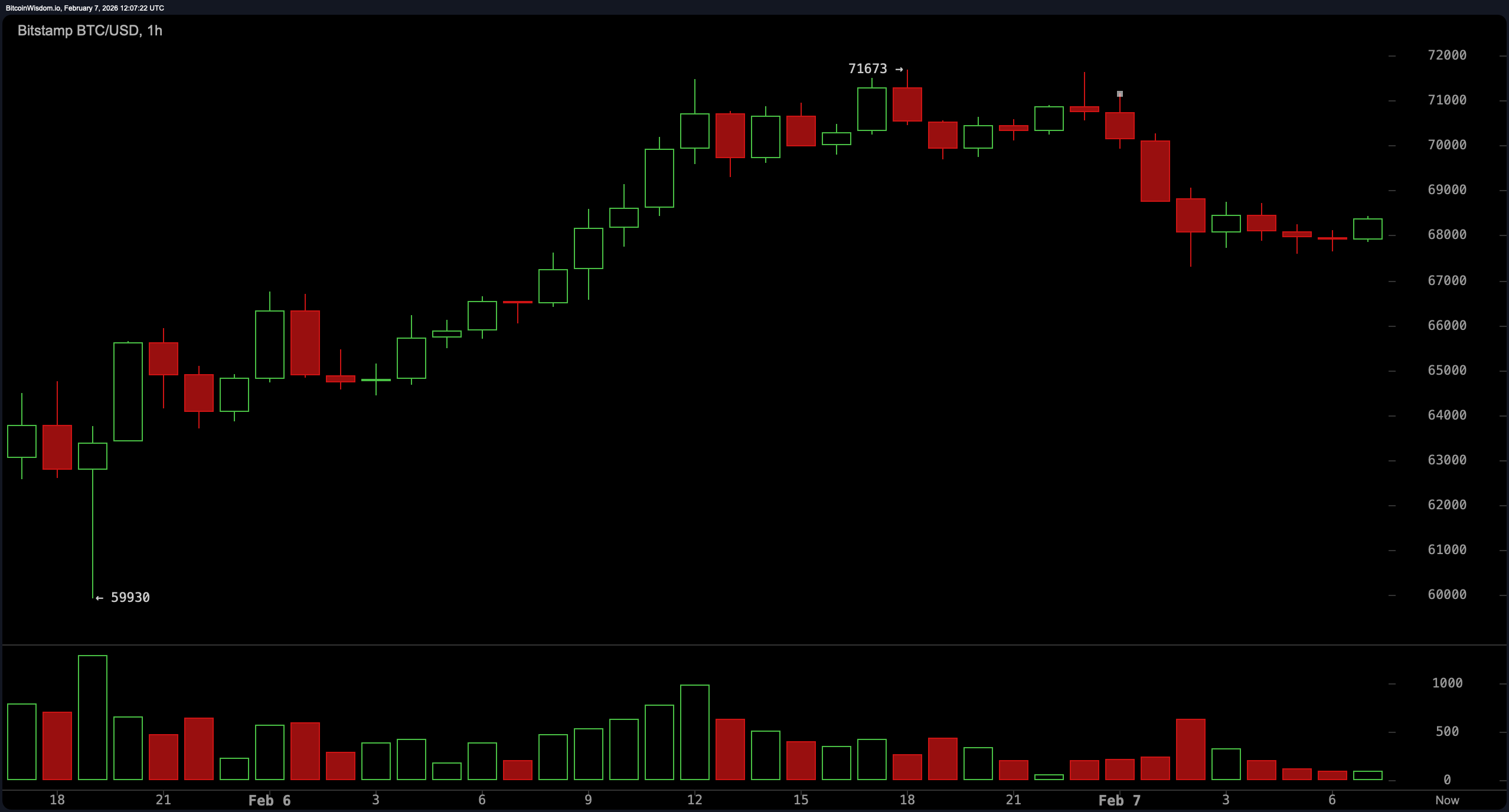

The daily chart paints a parable of hubris and collapse. After the failed ascent to $97,900-a peak as ephemeral as a mirage-the market plummeted to $59,930, a wick of despair. The rebound? A reflexive twitch, not a resurrection. Volume surges like a last gasp, then fades into the void. Such is the rhythm of panic and pretense, a dance where no one believes the encore.

The four-hour chart, a microcosm of futility, reveals a V-shaped recovery that peaked at $71,000-only to crumble like a house of cards. Support forms near $66,000, a psychological anchor for the weak. Resistance? A cruel joke between $70,500 and $71,700. This is not a market-it’s a pacing cell, its prisoners waiting for the next arbitrary order.

The one-hour chart? A theater of absurdity. Price oscillates like a pendulum trapped in a loop, its “conviction” a farce. The $68,000-$69,000 range is not equilibrium-it’s the market’s way of saying, “We’ll decide later.” Volume is a ghost story told in whispers. Traders watch, sip lukewarm tea, and hope the next tick isn’t a punchline.

Oscillators and moving averages conspire in unison. RSI at 31: a man clutching the edge of a cliff, debating whether to let go. Stochastic at 21: the last candle in a crypt. MACD negative: the universe’s polite way of saying, “You’re irrelevant.” The ADX at 44? A grim nod to the inevitability of collapse. Bitcoin’s resilience is a joke; the charts are the punchline.

Every moving average looms like a tyrant, a stacked ceiling of past failures. Bitcoin’s “resilience” is a peasant’s defiance against a pharaoh. The charts don’t lie-they just smile slyly as you drown.

Bull Verdict:

Stabilization above $66,000-$68,000? A Hail Mary pass to the gods of momentum. The one-hour chart’s compressed volatility is a ticking time bomb, waiting for a spark. A breakthrough at $71,000 would be less a victory and more a “let’s pretend this isn’t a setup for disaster.”

Bear Verdict:

The daily downtrend is a death sentence. Moving averages and negative momentum readings are the executioner’s noose. Until Bitcoin reclaims $75,000, this is not a market-it’s a waiting room for the guillotine. Support at $66,000? A last meal.

FAQ ❓

- What is bitcoin’s price today?

Bitcoin flounders between $68,090 and $69,162, a 24-hour range of $66,131 to $71,604. Volatility? A cruel joke played by the gods of chaos. - Is bitcoin bullish or bearish right now?

Technically bearish, a truth as obvious as the sun rising in the east. Moving averages loom like storm clouds, and momentum indicators weep into their teacups. - What levels matter most for bitcoin price action?

Support near $66,000: a lifeline for the desperate. Resistance at $71,000-$75,000: a wall of bricks built by skeptics. - What is driving bitcoin market sentiment today?

Volume, weak indicators, and consolidation after the $59,930 capitulation. Sentiment? A collective shrug from a society that forgot how to believe.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

2026-02-07 16:48