- Long-term holders have added a staggering 297K BTC in just nine days—confidence is in the air! 💪

- With this accumulation frenzy, Bitcoin might just leap past $88K, and who knows, maybe even touch the elusive $90K! 🚀

In the aftermath of the recent market crash, Bitcoin [BTC] has risen like a phoenix from the ashes, drawing investors back into its warm embrace. This resurgence has ignited a fervor of accumulation, as if the crypto gods themselves have decreed it so.

According to the wise sages at Glassnode, Bitcoin’s Accumulation Trend Score has soared to a year-to-date high. At the time of writing, it stands at a modest 0.43—an indicator of growing demand, or perhaps just a sign that everyone is feeling a bit more optimistic today.

A rising accumulation score suggests that wallets are re-entering the accumulation game on a grand scale. It’s like watching a herd of sheep return to the fold, but with a lot more zeros involved.

Despite a few hiccups in price, the big players have cautiously resumed their stacking rituals, with long-term holders (LTHs) leading the charge. In just nine days, they’ve added a whopping 297,000 BTC to their coffers—talk about confidence! 🤑

To further bolster this trend, the LTH Binary Spent has plummeted to 0.3 in the past week, indicating that fewer long-term holders are parting with their precious Bitcoin—a bullish signal if there ever was one!

As LTHs tighten their grip, other market participants are following suit. Unspent outputs have steadily grown through 2025, now hitting 3.03 million. It’s a drop from 5.2 million in 2024, but hey, who’s counting? The current levels still suggest that BTC holders are feeling bullish and expect better days ahead.

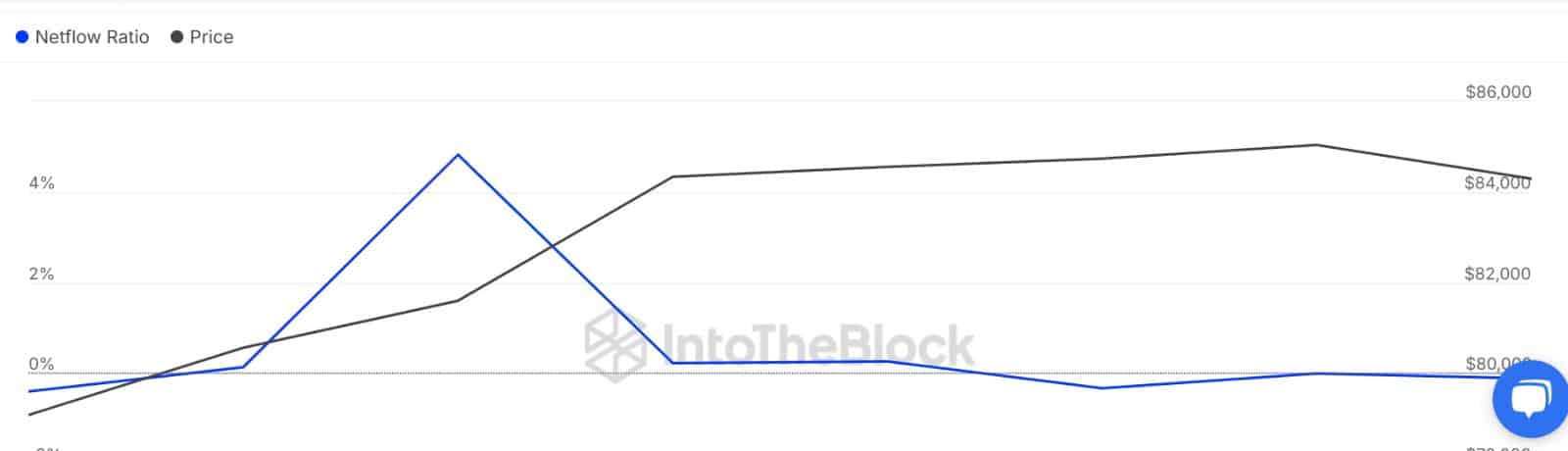

And let’s not forget the whales! Their activity has only reinforced the ongoing accumulation narrative. For three consecutive days, the Exchange Flow from large holders has remained negative, indicating that more BTC is being withdrawn than deposited. It’s like watching a game of musical chairs, but with a lot more money at stake.

What does it mean for BTC?

With long-term holders (LTHs) and large investors accumulating, Bitcoin’s market stability appears as solid as a rock—at least for now. Big players are betting on improved performance, and this optimistic sentiment often drives prices higher. Who doesn’t love a good bull run? 🐂

If this accumulation trend continues, Bitcoin could very well see a reversal in fortunes, propelled by organic demand. An upward move from here could lead to a breakout from consolidation, with BTC surpassing $86,700. If the momentum holds, we might just see Bitcoin reclaim $88K and make a run for the psychological $90K level. Fingers crossed! 🤞

However, if short-term holders (STHs) decide to cash in on their recent gains, Bitcoin might take a nosedive, potentially dropping to $82,696. It’s a wild ride, and monitoring accumulation trends and investor activity will be crucial in determining BTC’s next direction.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Get 100% Chameleon in Oblivion Remastered

- USD ILS PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Invincible’s Strongest Female Characters

- Gold Rate Forecast

2025-04-17 15:06