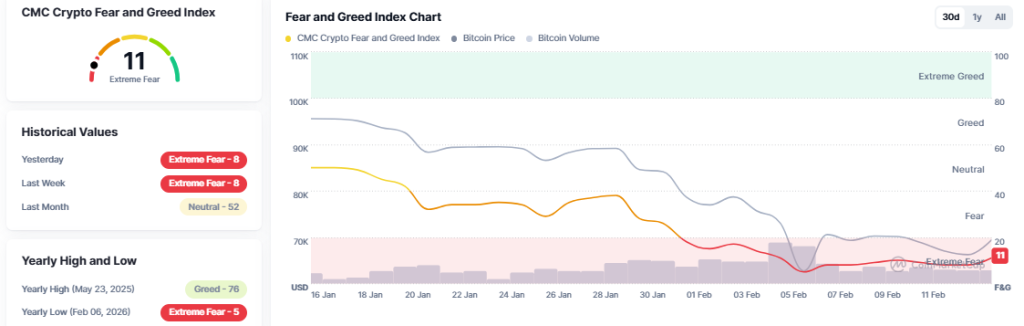

In the vast and tumultuous sea of financial speculation, the Bitcoin, that enigmatic creature of the digital realm, finds itself once more ensnared in the clutches of “Extreme Fear.” Ah, how history repeats itself, yet with a twist that would amuse even the most jaded observer of human folly. In bygone eras, such fear has heralded the advent of accumulation zones, where the astute gather their spoils. But the year 2026, with its peculiarities, defies simple comparison. The selloff, you see, is not the result of a singular calamity but a complex tapestry of institutional whims and macro-economic winds.

Let us journey back, dear reader, to the annals of Bitcoin’s past. In 2012, it plummeted to $7.10, a mere trifle. The Mt. Gox debacle saw it sink to $421.55. The 2017-2018 crash left it at $3,129.39, and the COVID panic brought it to $3,852.65. Even the FTX fiasco pushed it to $15,642.12. Each of these moments, marked by extreme fear, was accompanied by retail capitulation and institutional indifference. Yet, like a phoenix, Bitcoin rose again. But ah, the present is a different beast altogether.

Extreme Fear Then and Now

Fast forward to the 2026 crash, where a low of $60,001.01 on Coinbase has been etched in February, as fear grips the hearts of many. On the surface, it echoes the past. Yet, the market is no longer the domain of the retail trader alone. Institutions, ETFs, and macro-driven liquidity cycles now hold sway. Fear, once a reliable harbinger of recovery, may now be but a shadow of past truths.

The fear and greed index, once a trusty compass, may now mislead. In a market dominated by ETF sponsors and capital allocators, retail sentiment is but a whisper in the wind. Extreme fear, once a sign of impending recovery, might now merely reflect the damage already wrought, a grim reminder of liquidations past.

ETFs and Macro Pressure

Ah, the institutions, those titans of finance, with their penchant for scaling in at discounted levels. Their actions may render the fear index obsolete, a lagging indicator of their own liquidations rather than a signal of recovery. And let us not forget the macro-driven selloffs, those tempestuous forces that care not for sentiment but for the broader tightening of markets. Risk-off environments, my dear reader, can drown out even the most fervent signals of recovery.

Historically, the most profound accumulation phases began when even the most ardent dip-buyers fell silent. We approach such a phase now, but whether it has fully played out remains a question shrouded in uncertainty.

Whale Activity Adds Pressure

And then, there are the whales, those leviathans of the Bitcoin sea. A prominent whale, Garrett Jin, has deposited 5,000 BTC, worth a staggering $348.82 million, into Binance. Such inflows often presage distribution, adding a layer of supply-side uncertainty to an already fragile moment. Will he sell? Only time will tell, but the market trembles at the prospect.

Bitcoin just reclaimed $70,000 – but Garrett Jin(#BitcoinOG1011short) is selling again!

He just deposited another 5,000 $BTC($348.82M) into #Binance.

– Lookonchain (@lookonchain) February 14, 2026

What, then, does this portend for the Bitcoin price prediction narrative? Extreme fear, once a reliable timing tool, is now but a fleeting emotion in a market dominated by institutional flows and macro pressures. Until forced liquidations abate and spot demand absorbs supply without reliance on sentiment gauges, Bitcoin remains vulnerable to another leg lower beneath $60K. Yet, history whispers that such zones eventually become accumulation opportunities, a testament to the resilience of this digital marvel.

In the end, dear reader, we are left with a question: Is this time truly different, or are we merely witnessing another chapter in the grand saga of human greed and fear? Only time, that implacable judge, will reveal the truth.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Xbox Game Pass September Wave 1 Revealed

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2026-02-14 17:56