Dear Reader, let us turn our attention to the recent affair involving the esteemed Bitcoin aristocracy. Following a most remarkable ascent to a record high above £123,000 (forgive me, I do believe the modern term is “$”), the grand ball has turned into a scene of profit-taking. Miners, those industrious souls who toil in the digital mines, along with the long-dormant whales, have taken the lead in this dance, as per the observations of CryptoQuant.

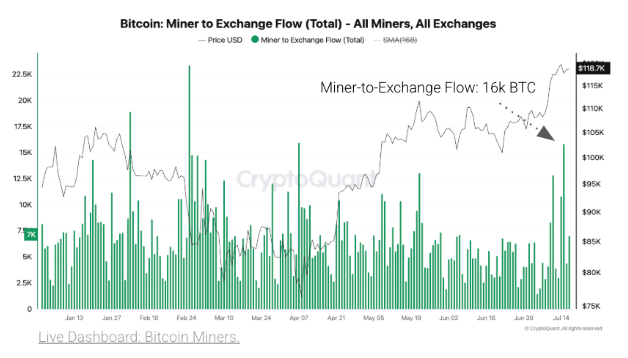

On the 15th of July, the miners, with their hearts set on exchanges, transferred a staggering 16,000 BTC, marking the largest offloading since the 7th of April, when they moved 17,000 BTC.

Miners’ Grand Sell-Off: A Scene of Opulence and Panic

The consequence of such activity was a decline in miner reserves, plummeting from 68,000 BTC to 65,000 BTC—a one-month low. CryptoQuant remarked, “All the Bitcoin was transferred into exchanges, reinforcing the view that miners sold as Bitcoin reached the most recent all-time high.”

However, the selling pressure was not confined to the miners alone. Other cohorts, sensing the scent of profit near market highs, joined the fray.

CryptoQuant reported a surge in total exchange inflows to 81,000 BTC on that fateful day, a stark contrast from the mere 19,000 BTC a few days prior. This surge was largely attributed to the whales, whose exchange transfers escalated from 13,000 BTC to 58,000 BTC.

A Satoshi-era whale, an address that had lain dormant since Bitcoin’s infancy, made a stirring appearance, transferring 40,000 BTC to exchanges. This wallet, once holding over 80,000 BTC, now seems to have taken a fancy to liquidity.

Blockchain analytics firm Lookonchain speculated that this transfer was a likely sell-off, suggesting that long-term holders might be capitalizing on the moment to secure their gains.

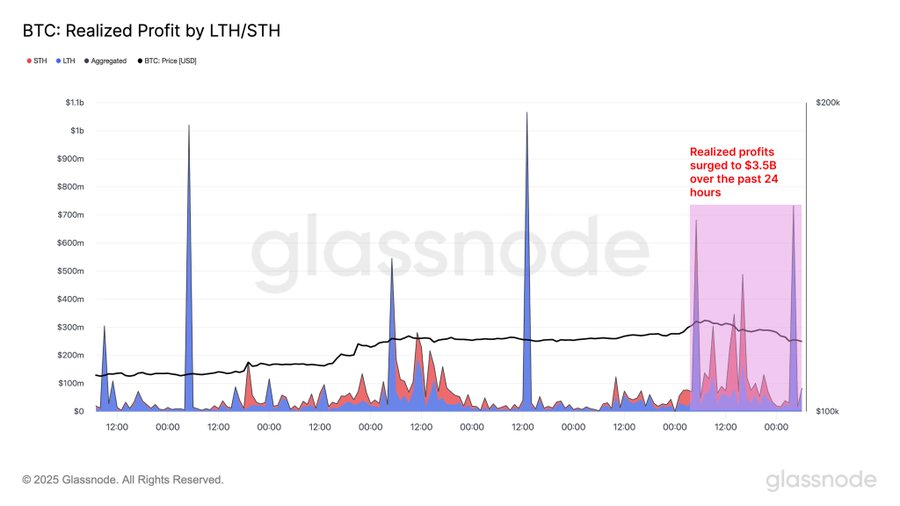

Indeed, the day’s heavy selling culminated in one of the largest profit-taking events of 2025. According to Glassnode, realized profits soared to $3.5 billion, with long-term holders claiming 56% of the spoils, amounting to $1.96 billion. Short-term holders, not to be outdone, realized $1.54 billion in gains.

Realized profit, an on-chain metric that tracks the value of coins sold at a higher price than their last recorded transaction, provided a fascinating glimpse into investor behavior during volatile times.

Following these hectic trading actions, Bitcoin’s price has cooled to approximately $118,229, according to BeInCrypto data. Yet, the optimists among us persist in their hopeful musings regarding Bitcoin’s future price prospects. They point to the recent pro-crypto legislation in the US as a driving force behind sentiment. Moreover, the burgeoning interest from institutions worldwide hints at further upside potential.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-07-19 14:31