Ah, the month of August-a time when the sun shines, the days grow lazy, and Bitcoin traders begin to mutter dark and mysterious phrases about “curses.” Yes, dear reader, these seasoned cryptocurrency aficionados are convinced that August, that enigmatic little month, has taken a personal dislike to Bitcoin, and have dubbed it the “August Curse.” This delightful little superstition has been a regular companion since 2017, leading many a hopeful trader to weep bitterly into their digital wallets.

This year, the ominous shadow of the curse has already crept across the land, as the once glorious Bitcoin rally finds itself slipping under the weight of hefty whale liquidations, dizzying ETF outflows, and macroeconomic worries. At this very moment, our beloved Bitcoin is playfully dancing around the precarious $111,000 support zone, like a cat on a hot tin roof.

Cerberus and the Shaky Start to August (2025 Edition)

The chatter on trading forums could rival the most fascinating of seances, where characters debate the nature of the infamous “August Curse”. Those who subscribe to the theory are clutching their pearls as whale selling and ETF dalliances confirm their worst fears. Others, however, are wearing their rose-tinted glasses, convinced that greater liquidity and a strong institutional base may just put a new spin on this age-old tale.

The first week of August, however, has provided a rather humorless punchline, as Bitcoin, after closing July with a triumphant flourish, suddenly figures it would be amusing to drop below $115,000. As we enter August 6, our digital friend hovers teasingly above $111,000-a level that is proving to be as vital as a good cup of tea on a rainy afternoon.

Meanwhile, Ethereum, bless its little heart, has nudged back to a rather *merely* respectable $3670, following July’s exuberance. And for those adventurous souls dabbling in altcoins like Solana, they’ve been greeted with a brutal reality check, as SOL plummets by a whopping 9% within the first week-goodness gracious! 🤦♂️

Even historical data is chiming in to support the mysterious ‘August Curse’. Just last year, Bitcoin went on a rather unfortunate jaunt from a lofty $65,587.9 at the month’s start to a dismal dip of $49,486.9 by August 5, showcasing a true 8.7% nosedive. The month stumbled along with an average price of $59,913.4, flaunting a dramatic variance of more than $16,000-now that’s a theatrical performance!

The ever-eccentric Robert Kiyosaki, of “Rich Dad Poor Dad” fame, has also joined the chorus, suggesting the ‘Curse’ may well lead us to a chilling drop down to $90K. Who needs horror films when you have this saga unfolding? 😱

Despite the gloomy pall hanging over the market, there are whispers of optimism-as on-chain and technical signals hint that buyers might just be stepping in, making the days ahead a veritable test of market sentiments. Will they rise to the occasion or merely serve as entertainment for the bears? 🎭

ETF Outflows: The Gritty Tale of Profit-Taking

Ah, the U.S. spot Bitcoin ETFs have recently performed a rather alarming vanishing act, executing the largest single-day redemption in history on August 1, with a staggering $812 million disappearing into the ether, as reported by SoSoValue. What a crafty trick! The week concluded with a net outflow of $643 million, abruptly halting a generous streak of $10 billion in cumulative inflows.’

And then there’s BlackRock’s iShares Bitcoin Trust (IBIT), which has had its own brush with misfortune, apparently losing $292 million in August. Alongside them, our friends from Fidelity’s FBTC also faced the dreaded outflows, all too willing to take profits after the July festivities. So far, withdrawals for BTC ETFs have now exceeded $1.14 billion-what a fabulous mess!

The Dormant Dragon Awakens!

An intriguing twist to our tale reveals that not all selling pressure is the work of wide-eyed novices. The Exchange Whale Ratio remains stubbornly elevated at over 0.70-indicating that our hefty friends are dominating the exchange deposits like they own the place. Quite cheeky, if you ask me!

In what can only be described as the dramatic entrance to a Shakespearian play, a long-dormant Satoshi Era Bitcoin wallet has suddenly stirred from its slumber, confidently transferring over $1.18 billion worth of Bitcoin to major exchanges like Binance and Bitstamp. One can only wonder what roused it from its peaceful slumber! 🦸♂️

Exchange inflows have jogged up since early July, with Binance overseeing a daily influx of Bitcoin that has gone from a casual 5300 to a more energetic 7000 BTC. Meanwhile, the rise in Coin Dormancy-measuring how long coins have been held-is almost ominous, suggesting that long-term holders might just be ready to sell. Clutch the pearls, indeed!

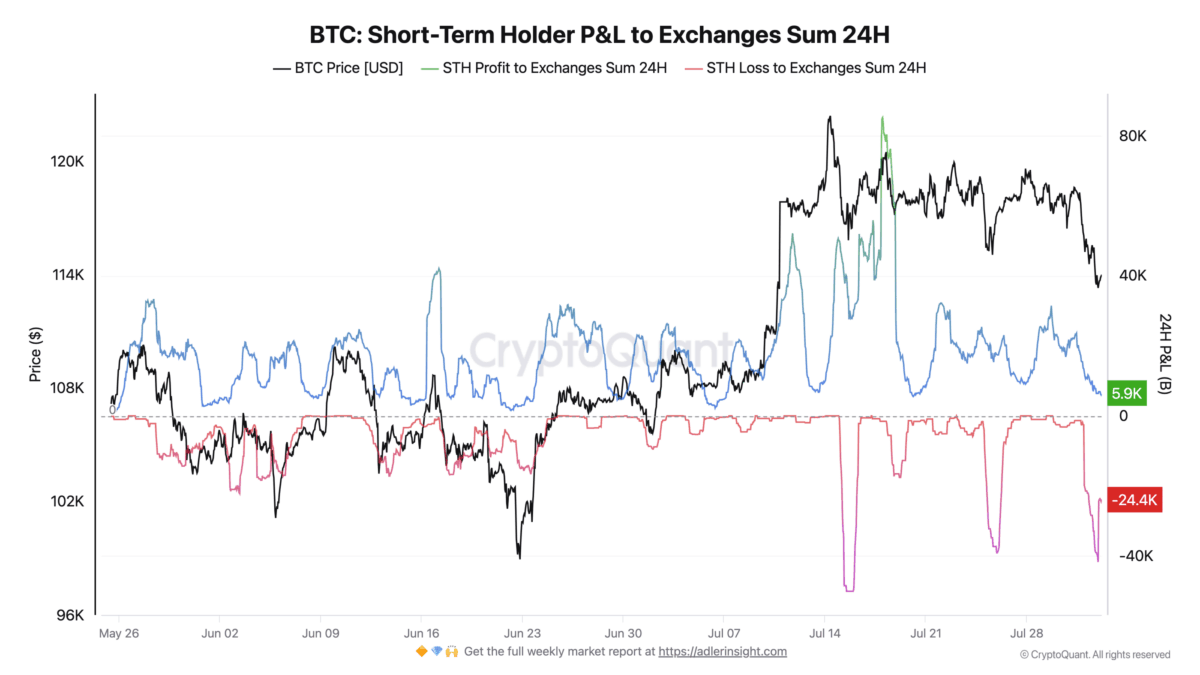

On August 1, a decidedly dramatic 16,417 BTC flowed into exchanges, coinciding with a delightful display of short-term holders capitulating by selling 40,000 BTC at a loss. And lo and behold, the Short-Term Holders SOPR (Spent Output Profit Ratio) has dipped below 1, leading to certain rumors of disgruntled investors not quite seeing the returns they had hoped for. Cheerio! 😬

Despite the merry-go-round of sell-offs, structural conditions seem to be supporting a longer-term uptrend. Bitcoin’s closing price for July was the highest on record. It would appear this recent dip is more akin to a hiccup than a full-blown collapse. Regulatory clarity is advancing, stablecoin integration is picking up pace, and institutional tokenization initiatives are finding their footing. Like a phoenix rising from its ashes-or in this case, Bitcoin rising from its bear market grave.

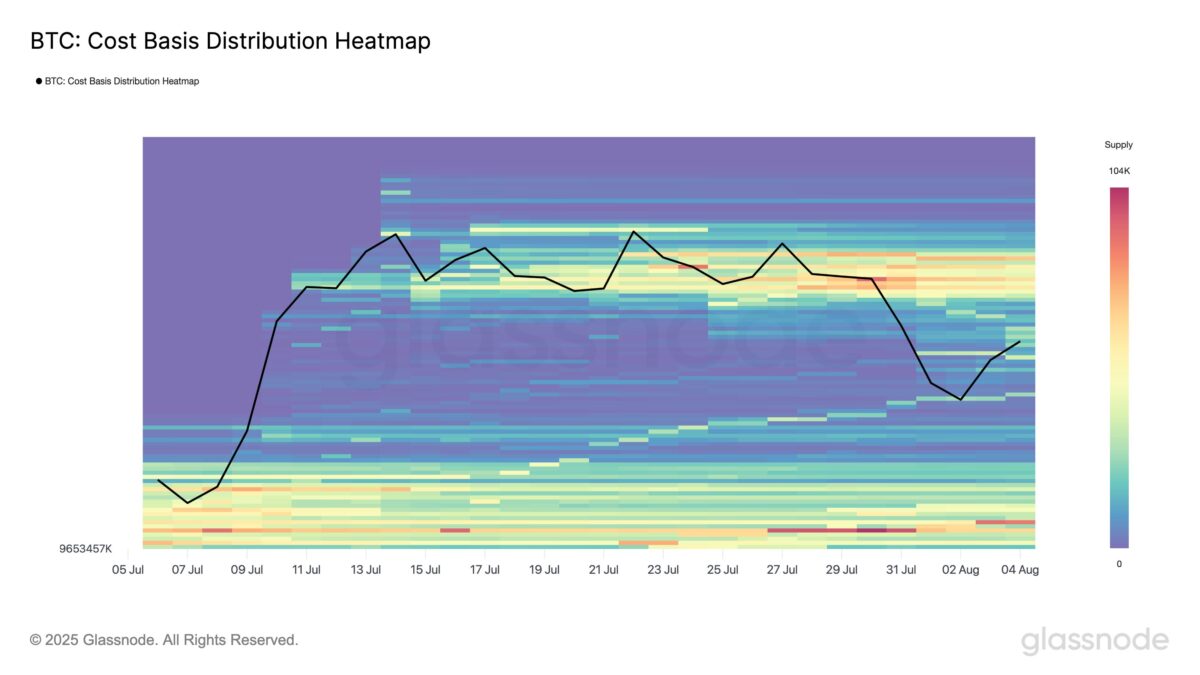

On-chain cost basis data suggests that seasoned buyers are stepping in, filling the airgap between $109K and $116K during price drops. It’s as if they are marking out their territory with cheerful little staircases. 🏰

Most intriguing is the apparent lack of distribution from the $118K-$120K range, indicating that holders in this picturesque zone are opting to brave the storm rather than sell at a loss. Meanwhile, traders in derivatives are preparing for a little jaunt above the prior all-time high, eyeing August 29 call flies at $118K/$124K/$126K.

Our wise friends at QCP have noted, “Spot levels near $112K warrant a cautious gaze, especially amidst relentless macro uncertainty. However, flickers of stabilization, such as renewed spot ETF inflows, declining implied vols, and a narrowing of skew, would send delightful signals that institutional sentiment may be making a comeback!”

The Technical Picture: Retests and the 50-Day MA

This past weekend, Bitcoin managed an almost theatrical retest of the previous highs, maintaining its position above the all-important 50-day moving average-a vital lifeline for medium-term trend support. Nic Pukrin, the astute CEO of Coinbuerue, declared that the setup is looking positively splendid! This resilience, bolstered by eager dip-buyers, hints that demand remains vibrant, much like a summer garden.

Bitcoin had a near-perfect retest of the previous highs on the weekend.

We also managed to hold above the 50-day MA.

Looking good here ✅

– Nic (@nicrypto) August 5, 2025

However, well-known analyst Ali Martinez warns that $111,000 is the true line in the sand-cross it, and we may find ourselves on a slippery slope towards the $90,000 demand zone. Oh, the drama! 😳

$111,000 is a critical support level for Bitcoin $BTC. If it breaks, the next key demand zone sits around $90,000, according to the Pricing Bands.

– Ali (@ali_charts) August 5, 2025

He’s also noticed a rather alarming correlation-each time the weekly RSI drops below the 14 SMA, BTC has previously corrected by 20% to 30%. If history is to repeat itself, we might be bidding adieu to our recent highs and saying a not-so-happy hello to the $95,000 mark.

What’s Next in This Grand Adventure?

Now, let us gaze into the crystal ball and explore the key metrics to watch for any hints of a potential sentiment reversal:

- A rebound from net ETF outflows to net inflows

- Plummeting implied volatility levels

- A narrowing options skew showing neutrality

- The all-important $111K holding as steadfast as an old oak tree

If these delightful metrics improve in conjunction with continued dip-buying, our sell-off may very well transition into a delightful buy-the-dip adventure rather than a desperate decline. 🛒

Why Does It Matter, You Ask?

The so-called August Curse is more than just a trader’s whimsical superstition. It serves as a stress test for Bitcoin’s capacity to hold its momentum against the seasonal ebb and flow of market pressures. This year’s challenge is particularly potent, given we’re witnessing a rare convergence: record ETF redemption, aggressive whale selling, and macroeconomic turbulence arriving at the same time-what a riot!

Whether Bitcoin can maintain its grip on the $111K level or not will likely determine the course for the remainder of the month. Should it falter, we might be looking at a scenario where institutional profit-taking and whale selling set the stage for a dramatic descent towards the $90K range. Conversely, if dip buyers rally and mount a gallant defense, we could very well be on a thrill ride into uncharted territories!

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

2025-08-06 20:00