So here we are again-Bitcoin‘s rally is actually looking like it might not just be another flash in the pan. You know, the kind that goes up, and then-poof!-back down. But this time? According to CryptoQuant (who clearly have nothing better to do), it’s all because of the usual suspects: miners are holding more coins, traders are jumping back in, and, surprise, surprise, institutions are sneaking back into the market like they’re trying to avoid eye contact. Classic. 🤔

Miners Finally Stop Hoarding and Start Holding

Okay, so for months, miners have been acting like they’re clearing out their closets-selling coins left and right. But hold your horses, something’s changed. As of late, they’ve actually stopped dumping their Bitcoin. And get this-some are even *holding* on to their stash, which, for them, is basically a revolutionary act. 🙄

Miners Ease Selling, Buyers Re-Engage, and Institutions Rebuild Positions: A More Sustainable Bitcoin Rally Takes Shape

“If this alignment persists, it sets the stage for a constructive medium-term bias, one that could fuel a relief rally capable of squeezing out roughly $16 billion in short positions.”

– CryptoQuant.com (@cryptoquant_com) October 6, 2025

Apparently, with fewer coins on the market and demand creeping up, analysts are all of a sudden feeling optimistic. Funny how that works, right? Fewer coins + growing demand = “Hey, maybe this time it won’t crash.” 💰

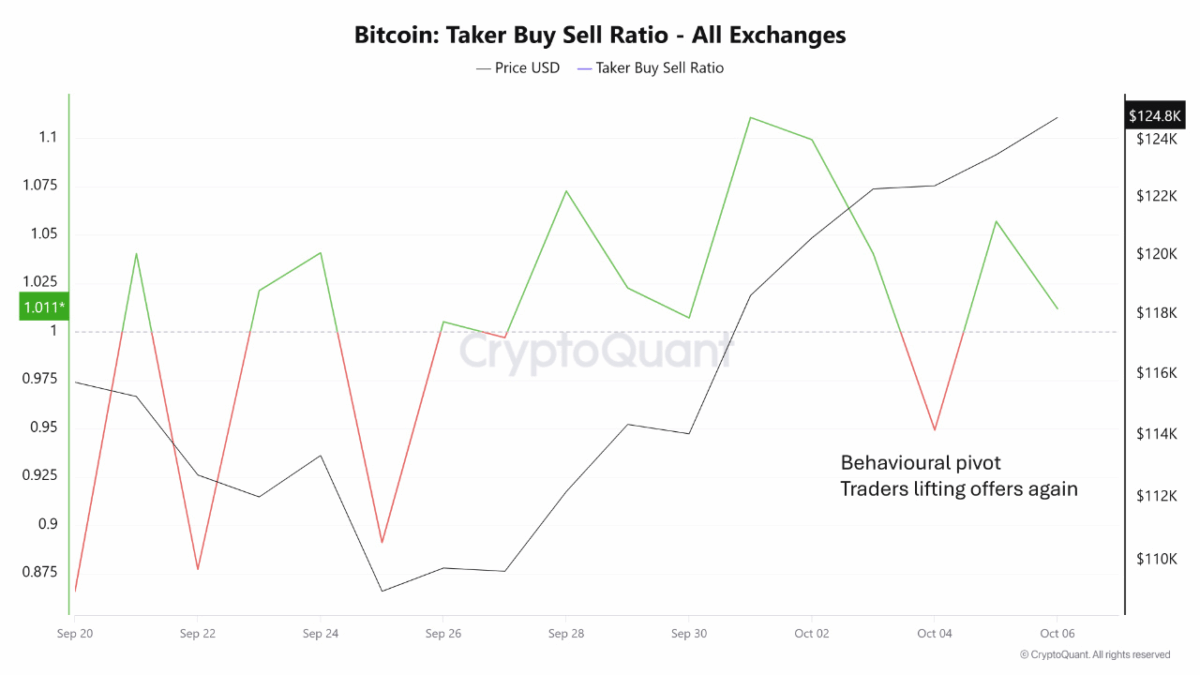

Traders are jumping back in, too. The Bitcoin taker buy-sell ratio (yes, that’s a thing) is back above 1, which is like a thumbs-up from the market. A ratio above 1 means buyers are in charge, and let me tell you, when buyers are in charge, prices tend to go up. Who knew? 🙄

Remember last month when it was below 1 and sellers were practically in charge of the whole show? Yeah, that’s all in the past. Now, traders are buying, not waiting for a cheaper price. Which-don’t get too excited-it’s usually a good sign. Might even push the price up in the short term. Maybe. 👀

Institutions Are Back, Too (Kind of)

Oh, and the big boys-institutions-are making a comeback. Slowly, but surely. Data from the Chicago Mercantile Exchange (CME) shows an increase in open interest (that’s fancy talk for active contracts). Basically, it means these guys think Bitcoin is going up in the near future. Shocker. 🙄

What’s even more fun? The institutions aren’t just protecting their precious holdings. Nope. They’re actually adding new positions. You know, like, real money entering the market. Not just the same old people moving their coins around. 🤑

CryptoQuant says if this trend holds, we might see a relief rally strong enough to wipe out $16 billion in short positions. That’s a lot of zeros. 🚀

So, overall, the outlook for Bitcoin is looking better than it has in a while. Miners are holding on, traders are buying, and institutions are-well-cautiously re-entering. So, maybe this rally will stick around longer than the last one. But, hey, no promises. 😏

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-10-07 11:43