- Bitcoin’s glorious rise, gone in a flash, thanks to a geopolitical soap opera!

- Will the macro risks keep stomping on Bitcoin like an angry bull on a rampage?

On June 16th, Bitcoin [BTC] shot up to a ridiculous $108,944, making all the naysayers look silly for a moment. A wild short squeeze wiped out a whopping $45.7 million in short positions. This wasn’t a small dance; it was an earthquake in the crypto world!

For three days, Bitcoin had been compressed like a soda can under pressure around $105k. Traders were bracing for another crash, like early June’s disaster where BTC fell to $100,424.

But what’s this? A plot twist! Instead of crumbling, BTC surged higher. Is this a sign of a local bottom, or will this geopolitical circus bring it all crashing down before we can even blink?

Trump’s “emergency” move ruins Bitcoin’s good mood

Bitcoin almost triggered another massive liquidity grab around $109,700, where traders had stacked $50 million in shorts. But guess what? BTC said “not today” and stalled before the sweep.

Then, in a beautiful plot twist, BTC reversed sharply, plummeting by 3.2% to a low of $105,412. In the chaos, three major long positions worth about $25 million each got wiped off the map. Yikes.

What killed the vibe? A classic macro fakeout.

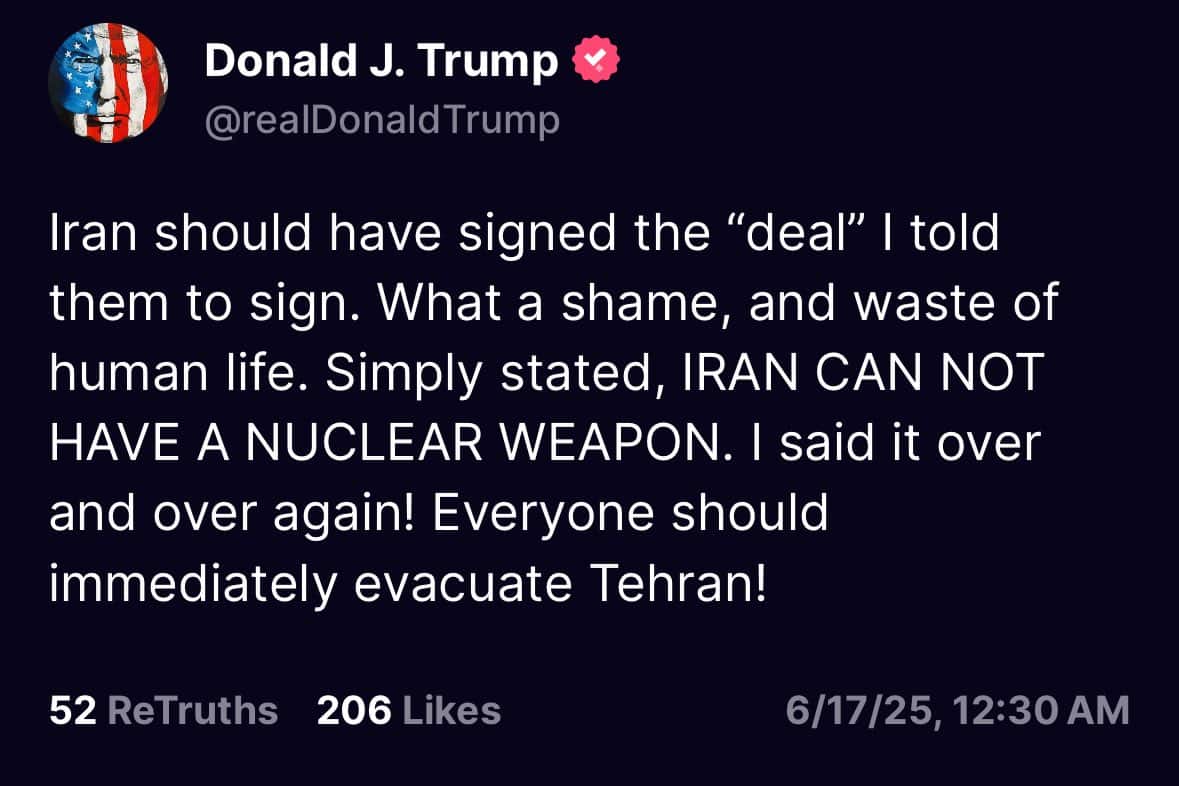

Apparently, the rally had been fueled by rumors that Trump had brokered a peace deal between Israel and Iran. Sounds too good to be true, right? Well, it was. Trump shot those reports down faster than a meme in a Reddit thread and hit the panic button instead.

And boom! Enter the classic bull trap. Latecomer traders jumped in, hoping for a miracle, only to be left with their portfolios burning. Open Interest dropped by 1.47%, signaling an ocean of liquidations while a tsunami of 23,900 BTC flooded the exchanges. A 231% spike in a single day? Somebody get this man a cape.

But hey, it feels like we’re just seeing the cracks in the bigger macro situation. Bitcoin’s still stuck in “wait and see” mode—caught in the chaotic clash between news and hesitation.

G7 chaos thickens the plot

Markets shifted into “risk-off” mode faster than you can say “political drama.” It all started with Trump ordering an evacuation in Tehran. Just a casual Tuesday, right? But then, hold onto your hats—he abruptly cut his G7 trip short.

But wait, there’s more! Fox News reported that Trump told the National Security Council to stand by in the emergency situation room. Oh, sweet irony—just as Bitcoin was looking to be the hero, the world stage threw it into turmoil.

This only fueled the growing rumors of a U.S. military intervention. Naturally, Bitcoin did what it does best: sat below $105k, struggling like a man with a broken GPS, unable to find its bottom.

Meanwhile, Bitcoin’s Funding Rates are still heavily leaning toward long positions. And with that, the stage is set for another spectacular fall.

At this rate, a return to $100k is looking more likely than a Kardashian appearance on a serious political debate. Better hold onto your hats, folks, the crypto rollercoaster isn’t over yet.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-06-17 22:25