Bitcoin, that capricious darling of the digital age, has been wallowing in the dreary limbo between $117,261 and $120,000 for the past fortnight—a state of affairs as predictable as a Wildean plot twist. Its dalliance with a new all-time high (ATH) remains as elusive as a well-mannered rake’s promises at a garden party.

Yet, beneath this veneer of monetary ennui, the murmurs of an audacious shift are growing louder. August may very well be the scene where Bitcoin, in a flourish of dramatic irony, defies its own storied past.

Investors Sending Mixed Signals

The current sell-side risk ratio for Bitcoin stands at a modest 0.24—a figure that, while marking a 6-month high, still coyly shies away from the neutral threshold of 0.4 and hovers near the low-value realization threshold of 0.1. In essence, the market is taking a genteel pause, as if investors have temporarily exchanged their frenzied sell-offs for a quiet tête-à-tête over tea.

Historically, such periods of low sell-side risk have heralded market bottoms or accumulation phases—moments when investors, like discreet socialites awaiting the opportune moment, bide their time before setting the stage for a grand resurgence.

For further titillating token insights: Do you yearn for more delicious digital gossip? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

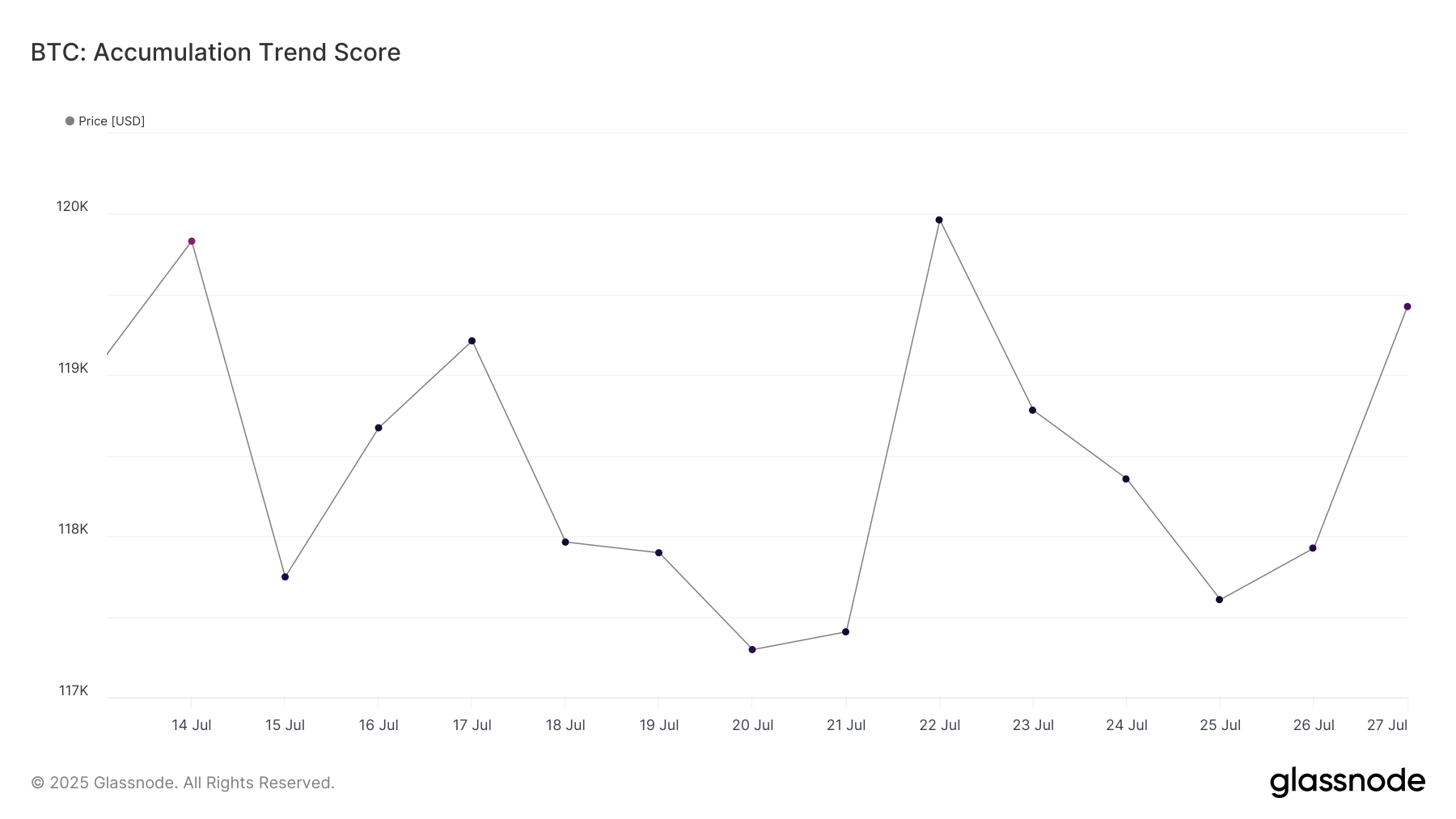

Bitcoin’s accumulation trend score, currently flirting dangerously close to 1.0 over the past two weeks, suggests that the market’s whales are not merely nibbling at Bitcoin—they are devouring it with the gusto of a gourmet at a lavish banquet. Their voracious appetite, as influential as a Wildean quip, hints at a seismic shift on the horizon.

An accumulation score near 1 is the secret handshake among the elite—a signal that institutional and high-net-worth investors are ready to lead Bitcoin by the hand, setting the stage for a bold ascent over its erstwhile resistance.

The steady accumulation by these august entities implies a growing confidence in Bitcoin’s long-term allure—a confidence so infectious it might soon coax the cryptocurrency from its cautious repose into a jubilant ascent.

Will BTC Ascend to Its ATH?

At present, Bitcoin sits at $118,938, nestled within the familiar embrace of $117,261 to $120,000. Yet, should investor sentiment remain buoyant as champagne, this range might soon be shattered, propelling Bitcoin gallantly past the $120,000 mark.

August, traditionally a month of gloom for Bitcoin—with a median monthly return languishing at -8.3%—now teeters on the brink of a historic reversal. Should Bitcoin secure $120,000 as its bulwark, one might expect it to vault past $122,000 and, with a flourish worthy of Wilde himself, stride confidently toward its all-time high.

Yet, as with every grand drama, the specter of reversal looms ominously. Should the winds of investor sentiment shift unexpectedly, Bitcoin might descend from its lofty perch, slipping back to a more modest $115,000—a twist as inevitable as the moral in a Wildean tale. After all, in the world of crypto, every rise has its fall, and every fall is merely the prelude to another rise. 😉

Read More

- EUR USD PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-07-28 11:39