Well, well, well! Bitcoin has been on a bit of a winning streak, racking up seven weeks of gains and strutting its stuff above the $100,000 mark. But hold your horses, folks! New signals are popping up that suggest this bullish party might be winding down. 🎉🚫

Now, pinpointing the exact moment when the price decides to do a somersault is about as easy as finding a needle in a haystack. But there are a few signs that might just scream, “Danger, Will Robinson!”—especially for those investors who haven’t quite gotten their feet wet yet.

Two Signs Indicate Profit-Taking May End the 7-Week Rally

The first eyebrow-raising sign is that those hefty wallets, the ones that could probably buy a small country, have stopped hoarding and are now flinging their coins around like confetti at a New Year’s Eve party.

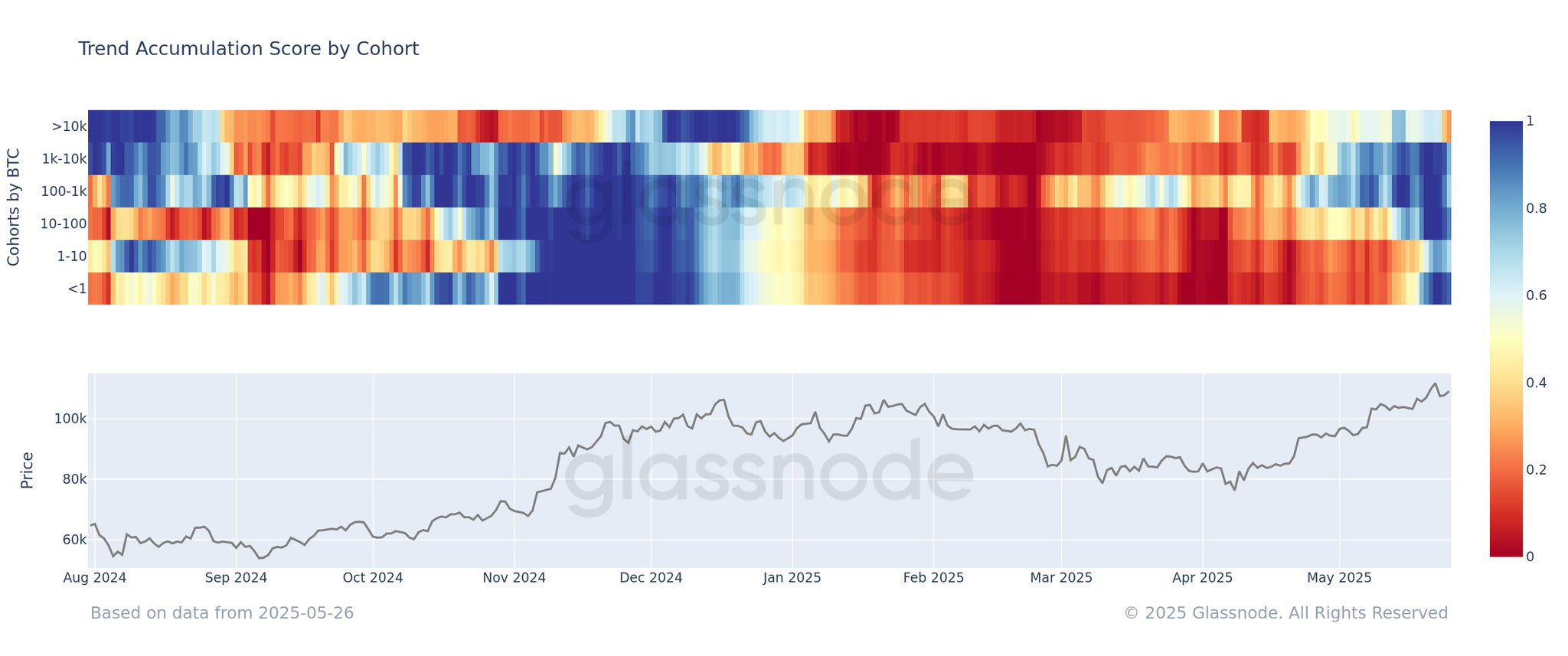

According to the ever-reliable Glassnode data, in May, the accumulation score for wallets holding over 10,000 BTC took a nosedive from about 0.8 to below 0.5. This dramatic shift is visually represented by a color change from a calm blue to a rather alarming orange. Talk about a mood swing!

“The group of wallets holding the most BTC has started distributing,” Thuan Capital stated. Well, that’s one way to ruin a party!

And it gets better! Wallets holding between 1 BTC and 10,000 BTC are showing signs of weakness too, with their blue tones fading faster than my enthusiasm for Monday mornings. Only those with less than 1 BTC seem to be in a frenzy, accumulating like it’s Black Friday and Bitcoin just went on sale.

These data points are like a flashing neon sign indicating that the big fish are cashing in their chips. Meanwhile, the little guppies are swimming around in a frenzy of FOMO (fear of missing out), chasing after short-term gains like it’s the last slice of pizza at a party.

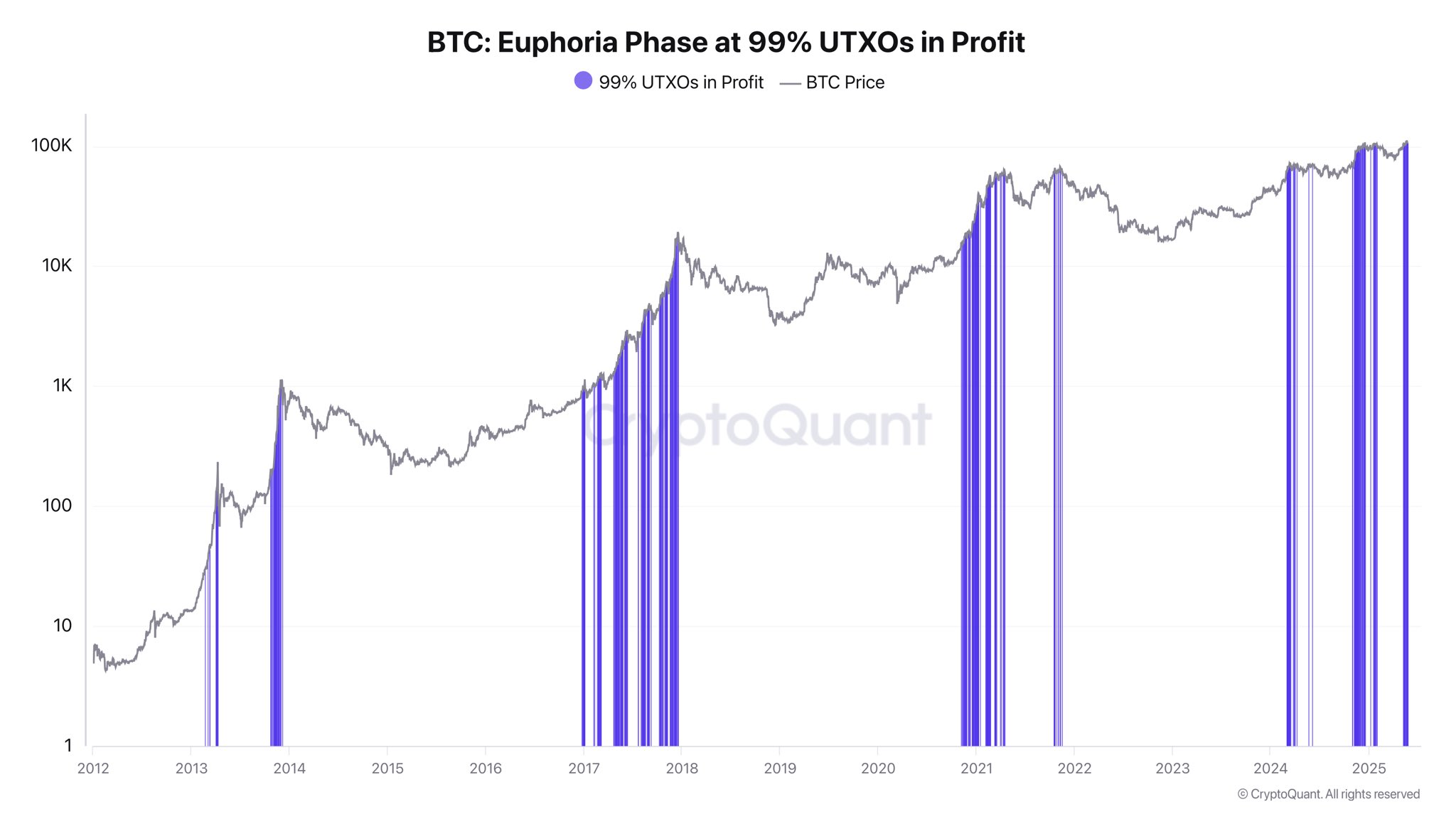

Another ominous cloud on the horizon comes from Unspent Transaction Outputs (UTXOs). These are the technical wizards that ensure each individual BTC can only be spent once on the blockchain. They also help us gauge the unrealized profits lurking in the shadows of unspent BTC.

CryptoQuant data reveals that when a whopping 99% of UTXOs are in profit, it usually signals that the market is about to overheat like a laptop left in the sun. Historically, these phases often precede price corrections. Whether it’s a quick dip or a long plunge, this signal is a big red flag for buyers.

“Right now, it’s hard to say we’re in a euphoric phase. The broader macroeconomic context and the uncertainty surrounding the Trump administration’s policy direction make it difficult for investors to flip fully risk-on. When this 99% signal drops, unrealized profits shrink and can trigger more profit-taking and push latecomers to capitulate and sell at a loss,” analyst Darkfost said. Sounds like a real party pooper!

As it stands, Bitcoin’s rally has hit the brakes around $108,000. No clear signs of a correction yet, but BeInCrypto reports a tidal wave of Bitcoin accumulation among corporations worldwide. Many experts are still holding onto their optimism like a kid with a new toy.

“A tidal wave of institutional demand is reshaping bitcoin’s market dynamics: Wealth‐management platforms poised to roll out access to bitcoin ETFs, corporate treasuries adding bitcoin to boost shareholder returns, and sovereigns diversifying reserves into bitcoin to hedge geopolitical risk. Together, these forces are creating a structural supply/demand imbalance—and over the next 18 months, bitcoin is set to cement its role as a global store of value,” Juan Leon, Senior Investment Strategist at Bitwise Asset Management, told BeInCrypto. Sounds like a lot of fancy talk for “We’re not done yet!”

So, while these short-term indicators might hint at a potential pullback from the current highs, they don’t seem to faze analysts’ broader expectations for this year and the next. Buckle up, folks! It’s going to be a bumpy ride! 🎢

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-05-27 11:11