Ah, Bitcoin, the eternal slumberer, holds its ground at $68,703 on this fine February morning of 2026. Like a weary proletariat after a night shift, it shuffles between $68,427 and $71,032, its market cap of $1.37 trillion and $49.82 billion trading volume whispering, “Just five more minutes.”

Bitcoin Chart Outlook: A Tale of Indecision and Tea Breaks

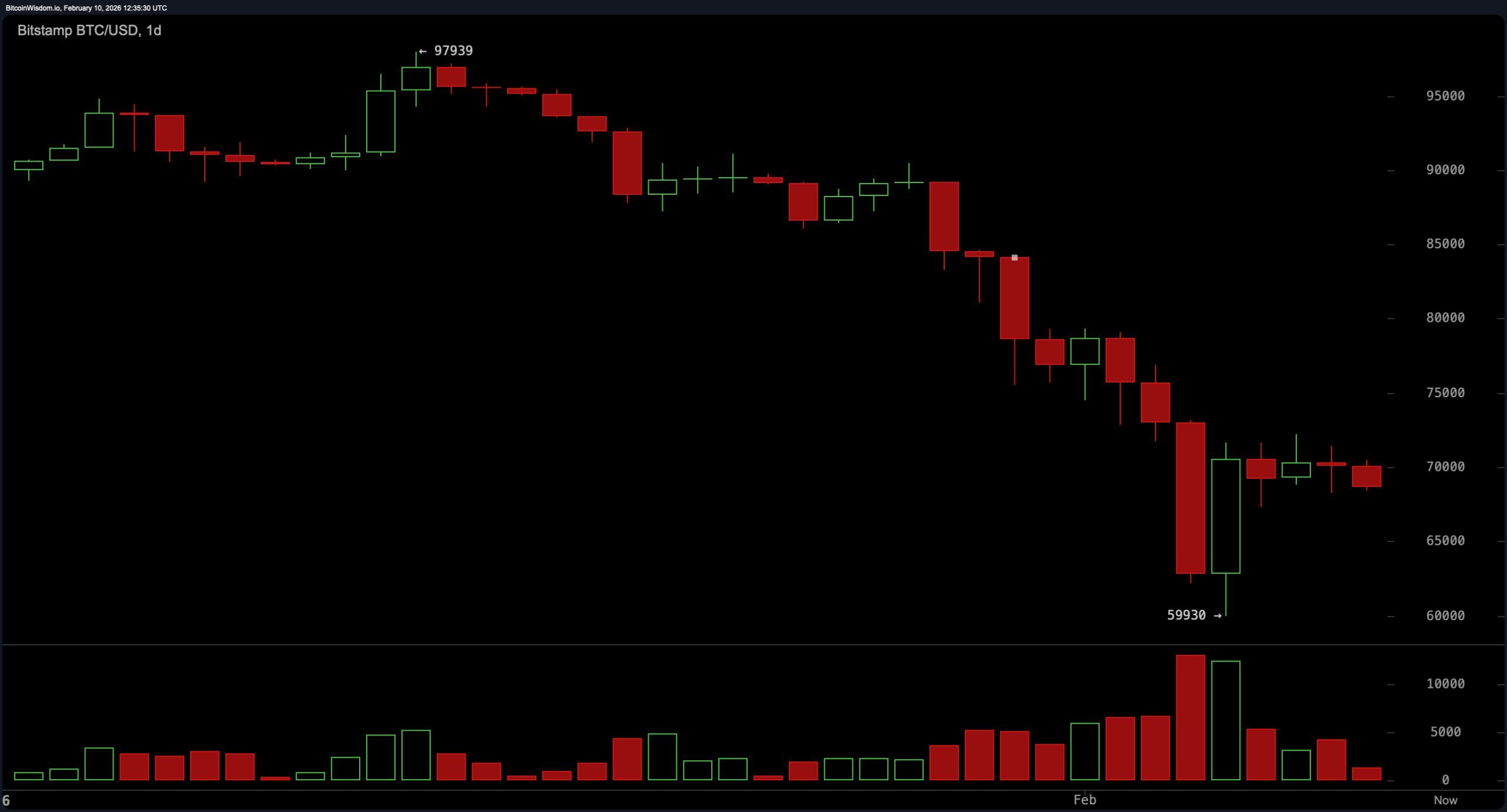

Let us not deceive ourselves with illusions of grandeur. Bitcoin’s daily chart is less a symphony of progress and more a dirge of stagnation. It lingers below key resistance, nursing bruises from its fall beneath $97,900. The $68,000-$70,000 zone? A sanatorium for battered bulls, not a launchpad for heroes. The true pulse beats at $60,000-$62,000, where the last remnants of hope cling like factory workers to their wages. Until $75,000 is breached with conviction, optimism remains a distant, mocking specter.

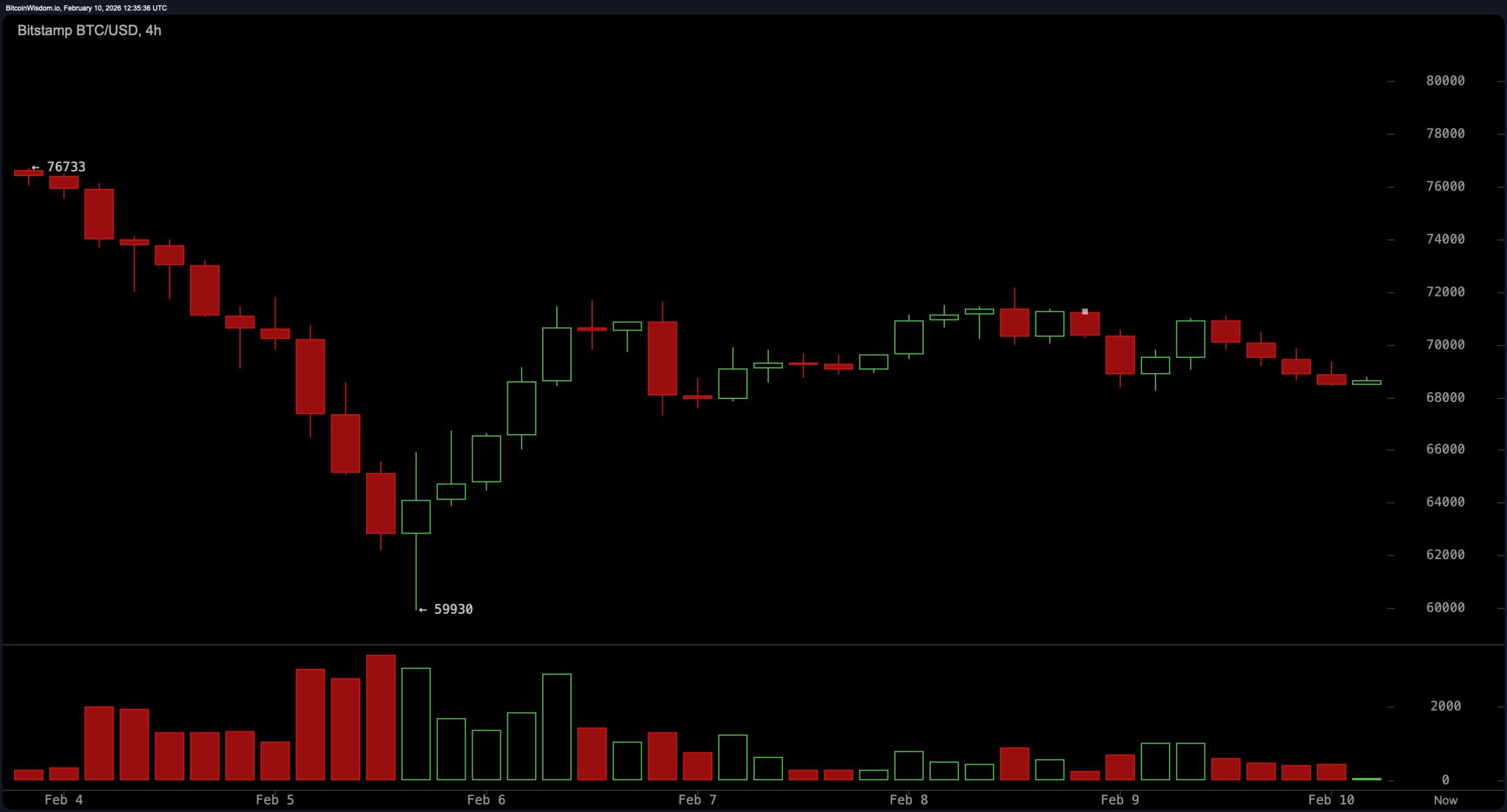

On the 4-hour chart, the drama unfolds like a poorly scripted play. Lower highs scribble themselves into a sideways mess, while volume slinks away like a disgraced bureaucrat. “You first,” the traders seem to say, as Bitcoin refuses to commit to anything but indecision. The $66,500-$72,000 range? A playground for mean-reversion trades, where dreams of breakout are drowned in the tepid tea of reality.

Zoom into the 1-hour chart, and Bitcoin’s momentum resembles a man who forgot not just his alarm, but his entire purpose. Sellers dictate the pace, gently nudging the asset into a series of half-hearted dips and feeble bounces. The $68,000-$68,500 zone offers not salvation, but a brief respite from the monotony. Upward pushes toward $70,000? Mere corrections, not declarations of intent. Sellers lurk like vultures, eyeing $66,800 with predatory glee.

The oscillators? They shrug in unison. RSI, Stochastic, CCI, ADX, Awesome Oscillator-all sit in neutral, like spectators at a dull parade. Momentum, the overconfident intern, pretends to be in the green, but its conviction is as thin as a capitalist’s conscience. MACD, ever the dissident, reads -5,704, a bearish whisper in a room of apathy. Moving averages point downward, a chorus of “Nice try” echoing through the charts.

In sum, Bitcoin is neither crashing nor climbing. It is trapped in a waiting room, a purgatory of consolidation. The smart money plays the edges, for the center is a void. Until the market breaks its habit of compression, adrenaline is reserved for the breakout-not this warm-up act.

Bull Verdict: A Glimmer of Hope, or Wishful Thinking?

A 4-hour close above $72,500 with rising volume could awaken the bulls from their slumber. If they muster the strength, $75,000 might be retested. But until then, enthusiasm is as speculative as a utopian dream-momentum needs more than hope and hopium to lead this rally.

Bear Verdict: The Silent Circle Tightens

A break below $66,000 would be the final straw, exposing the $62,000-$60,000 support zone. With momentum lacking and moving averages pointing down, the bears circle like shadows in a factory yard. If the range fails, the next leg lower awaits, unresisted and inevitable.

FAQ ⏱️

- What is Bitcoin’s price today?

Bitcoin trades at $68,703 as of Feb. 10, 2026. A price as unremarkable as a gray sky. - Is Bitcoin going up or down right now?

Bitcoin consolidates sideways, its momentum as weak as a factory worker’s tea. - What are the key support and resistance levels?

Support near $66,500, resistance between $72,000 and $75,000. A range as narrow as a capitalist’s heart. - What do technical indicators show?

Oscillators are neutral, moving averages bearish. A chart of indifference and despair.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2026-02-10 16:37