Hold onto your wallets, folks! Bitcoin‘s doing the cha-cha into oversold territory, and guess what? ETF demand has ghosted us, leaving traders scratching their heads. The market’s so weak, even a snail could outpace it-if it moved at all! 🐌💸

Bitcoin is having a little identity crisis. Oversold signals flashing like a neon sign at a discount store, ETF inflows doing a disappearing act, and spot sales so frantic they look like a garage sale on steroids. Traders? They’re pulling back faster than a cat from a bath. Liquidity’s thinner than grandma’s old tights. The price? Slipping, sliding, barely holding on-it’s basically doing the limbo under $114,000, and it ain’t loving it. 🎢🕺

Bitcoin’s Sad Little Defensive Dance

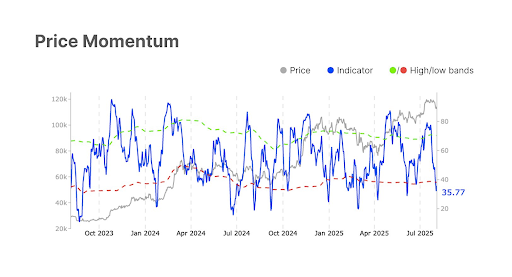

Data from Elvis… I mean, Glassnode, shows BTC’s RSI dropping from a rather hopeful 47.4 to a downright desperate 35.8. The spot CVD’s in the negatives-like your bank account after a weekend of online shopping-at -$220 million, doubling the previous week’s misery. Volume’s shrinking faster than your patience at a slow café-down from $8.4 billion to $7.5 billion. Participation? Practically non-existent. 🚶♂️💤

Sellers? They’re pushing harder than a dad at a barbecue, buyers? They’re just standing there, holding their noses. Bitcoin’s testing whether it can fall further without a parachute-around that $114K mark-trying to see how low it can go before the thrill of the chase ends or the demand reappears, whichever comes first. 🕳️⬇️

Futures? Soft as a marshmallow in a heatwave. Open interest down from $45.6 billion to $44.9 billion, as if traders found they’d rather watch paint dry. Funding for long positions? A little party gone quiet-down 33%, to a measly $3.1 million. And perpetual CVD? Negative $1.8 billion-forced selling is still the party crasher. 🎉🚫

Options market? Oh, it’s contracting faster than your cousin’s wedding guest list-dropped 8.4% to $39.8 billion. Traders are hedging like they’re on a rollercoaster that’s about to derail, pushing the Delta Skew to 5.51, which basically means they’re betting on bad news instead of good. 🤡🎢

Crypto ETF Flows Retreat Faster Than a Vacation Deal

CryptoRank reports: The first net ETF outflow in 15 weeks! Yep, it’s like a bad breakup-nearly 25% less love, with inflows dipping to $269.4 million. Trading volume? Up a smidge at 9.9% to $19.8 billion, but that’s just cash burning, not confidence. Institutions are poking around, but with all the enthusiasm of someone at a dentist’s office. 🦷🙄

First Crypto ETF Outflow in 15 Weeks

Last week, crypto ETFs took a nosedive, and this week’s continuing to drift, proving that “buy the rumor, sell the news” isn’t just for gossip-it’s the new reality now that crypto legislation is signed, sealed, and delivered… into disappointment.

– CryptoRank.io (@CryptoRank_io)

On-chain stuff? Less lively than a Sunday morning. Transfer volume drops 13.9%, fees down 14.4%. Bitcoin in the green? Only 93.6% are still smiling about profits, and NUPL’s plummeted to 8.6-less profit, more regret. Looks like the crypto party’s over until the next bounce-if it ever happens. 🥲🔧

The Market’s Between Oversold and Lost in the Woods

This is the reset we didn’t want-Bitcoin’s love affair is cooling, replaced by cautious glances and lighter wallets. Glassnode hints that there’s some room for a bounce, but don’t hold your breath-if ETF demand doesn’t come back, this fragile fairy tale could last longer than your aunt’s bad sweater.

Right now, traders are clutching their support levels like grandma’s pearls. Without some fresh inflows-or a miracle-the market might just sit around in this awkward limbo longer than a bad sequel. Buckle up-it’s a bumpy ride, folks! 🚀🛑

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Sony Shuts Down PlayStation Stars Loyalty Program

- EUR USD PREDICTION

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

2025-08-06 05:54