“`html

Oh, darling, it appears that Bitcoin has decided to don its finest attire and strut ahead, leaving the likes of Ethereum and Solana to ponder their existence in the shadows of the crypto ballroom. 💃

Bitcoin Futures Volume: A Dashing Resurgence!

In a delightful little tête-à-tête on X, the ever-so-astute analytics firm Glassnode has regaled us with the latest gossip regarding the futures trading volume of our beloved Bitcoin and its rather lackluster companions.

Now, when we speak of “futures trading volume,” we’re referring to that charming little indicator that tracks the total amount of cryptocurrency frolicking in the futures trades on those oh-so-centralized derivatives exchanges. Quite the mouthful, isn’t it? 😏

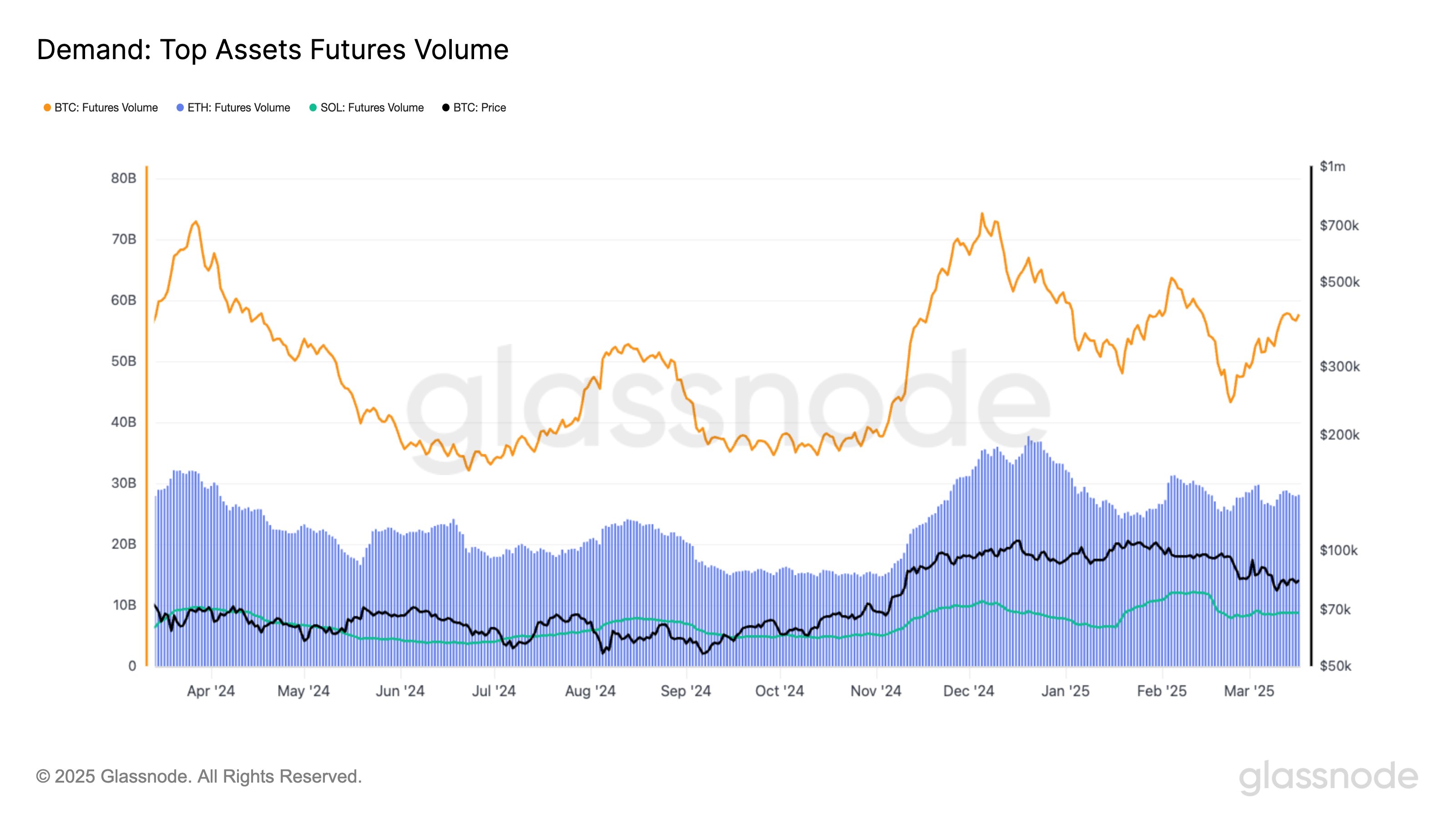

First, let us feast our eyes on a rather fetching chart that highlights Bitcoin’s futures trading volume:

As the graph so eloquently illustrates, our dear BTC had a bit of a hiccup last month, dipping down to a rather pedestrian $40 billion. But fear not! It has since bounced back to a more respectable $57 billion. Bravo! 🎉

“Bitcoin Futures volume started the year at $60B, peaked at $63B YTD, and now sits at $57B – 32% higher since Feb 23 but still below December’s $74B peak,” the analytics firm chirps. Quite the rollercoaster, wouldn’t you say?

While Bitcoin is basking in the limelight, Ethereum and Solana seem to be stuck in a rather dreary limbo. The chart reveals their futures trading volumes have been as flat as a pancake on a Sunday morning.

Ethereum, bless its heart, started the year with a modest $32 billion and now languishes at $28 billion. Solana, on the other hand, has crept up from $7 billion to a staggering $8.7 billion. Oh, the excitement! 🙄

The futures trading volume is a rather telling barometer of speculative interest, and it seems Bitcoin is the belle of the ball while the altcoins are left twiddling their thumbs.

In other scintillating news, the market intelligence platform IntoTheBlock has revealed that Bitcoin’s long-term holders are starting to increase their supply. How positively riveting! 🧐

These “long-term holders” are those charming investors who have clutched their coins tightly for over a year, refusing to part with them. Quite the commitment, wouldn’t you agree?

According to IntoTheBlock, these long-term holders typically accumulate during bear markets, which could suggest a shift in sentiment. But let’s not get too carried away; remember, darling, that this isn’t always a reliable signal. After all, in mid-2021, similar accumulation didn’t lead to a prolonged downturn. How delightfully unpredictable! 😅

BTC Price: A Bit of a Tumble

As we pen this little missive, Bitcoin is floating around the $81,800 mark, down more than 3% over the last 24 hours. Oh, the drama! 🎭

“`

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Top 8 UFC 5 Perks Every Fighter Should Use

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

2025-03-19 11:14