Ah, dear reader, behold the spectacle of Bitcoin, which has gallantly maintained its position above the illustrious $100,000 mark for a staggering 23 days—an achievement that would make even the most stoic of investors weep with joy! Furthermore, the network’s computational prowess has reached dizzying heights this year, heralding 2025 as a year of remarkable milestones. Yet, amidst this grand bull cycle, where price and hashrate dance a merry jig, the metrics of on-chain and off-chain activities seem to have taken a rather unfortunate tumble, revealing unmistakable signs of decline. How delightfully tragic! 🎭

New Highs for Bitcoin, But Core Metrics Slip Back

Last year, Bitcoin shattered records like a clumsy waiter dropping fine china, and 2025 is no exception. On the fateful day of May 22, 2025, our beloved digital asset soared to a breathtaking peak of $112,000 on Bitstamp, while the aggregated data from Coingecko and Coin Market Cap places the weighted high between $111,814 and $111,970 across a delightful array of trading platforms. Glassnode’s data indicates that May 22 marks the third all-time high (ATH) within this current cycle. Bravo! 👏

One particularly noteworthy metric this year, shattering historical records like a piñata at a child’s birthday party, is Bitcoin’s hashrate. On May 8, 2025, the network’s total computational horsepower climbed to an unprecedented 929 exahash per second (EH/s). This peak is all the more impressive given the punishing mining difficulties and the sharp revenue compression that has lingered since the halving event of April 20, 2024. Currently, miners are earning approximately 22% less per petahash compared to the median payout prior to the fourth halving. Oh, the irony! 😅

Before the halving, median earnings hovered around $75 per petahash per second (PH/s), suggesting that Bitcoin ( BTC) would need to surpass $139,300 per BTC for the hashprice to return to its former glory. This estimate, of course, conveniently ignores transaction fees, which in 2025 have dwindled to a mere 1% of daily miner revenue. The fee volume has plummeted from 2024 levels, rendering Bitcoin’s spot price the primary variable in the calculations of miner profitability. How delightfully convenient! 🤑

On- and Off-Chain Engagement Shrinks

Alas, a further downturn is evident in on-chain engagement—specifically, block space utilization. The transaction throughput per day has collapsed this year, and the mempool, once a bustling marketplace of over 700,000 pending transfers, has been entirely cleared. The resulting fee drought has left miners navigating a rather lean environment. At certain intervals, such as blocks 899008 through 899056, numerous blocks appear only half or even one-quarter full. How quaint! 😏

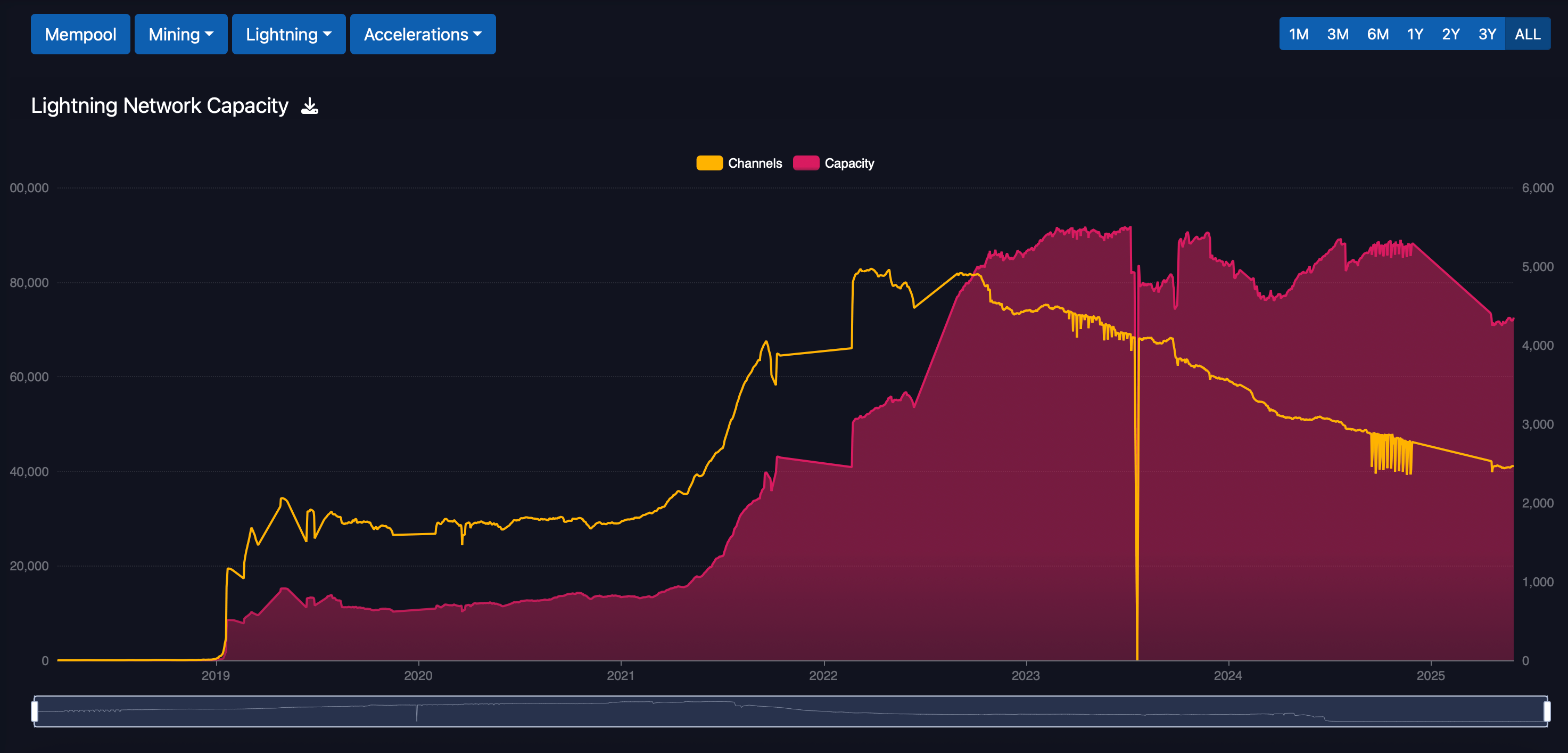

Daily transactions have fluctuated between 290,000 at the low end and 630,000 at the high, settling at a median of roughly 460,000 transfers per day in 2025. Off-chain metrics also signal contraction, particularly within the Lightning Network. Channel counts have halved, plummeting from over 80,000 in September 2022 to just above 40,000 today. Simultaneously, network capacity—the aggregate BTC locked in channels—has also declined. How utterly tragic! 😢

Since November 2024, Lightning Network capacity has slid from more than 5,000 BTC to just above 4,300 BTC, marking the lowest threshold since 2022. Additionally, the network has not managed to sustain any consistent growth beyond the 5,000 BTC level since October 2022. With structural adjustments underway both on- and off-chain, the market may be entering a period where operational efficiency outweighs raw scale. How delightfully ironic! 🤔

Whether this current recalibration sets the stage for a grand resurgence or signals a longer-term constraint remains an open question for the network’s evolving economics. One can only hope for a twist in this tale! 🎩

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Obsessed with Solo Leveling? Meet Super Cube, China’s Jaw-Dropping Answer to Anime

2025-05-30 22:00