What to know:

- Oh dear! Bitcoin has taken a tumble, slipping to its lowest in nine days, briefly flirting with the $106,000 mark, while ETH and XRP decided to put on their best performance as the rest of the crypto crowd sulked.

- Tariff uncertainty is back on the menu, darling! A U.S. appeals court has reinstated trade barriers, leaving investors feeling a tad peckish for clarity.

- Ethereum‘s ether is apparently preparing for a breakout above $3,000, according to the ever-optimistic B2 Ventures founder. Fingers crossed! 🤞

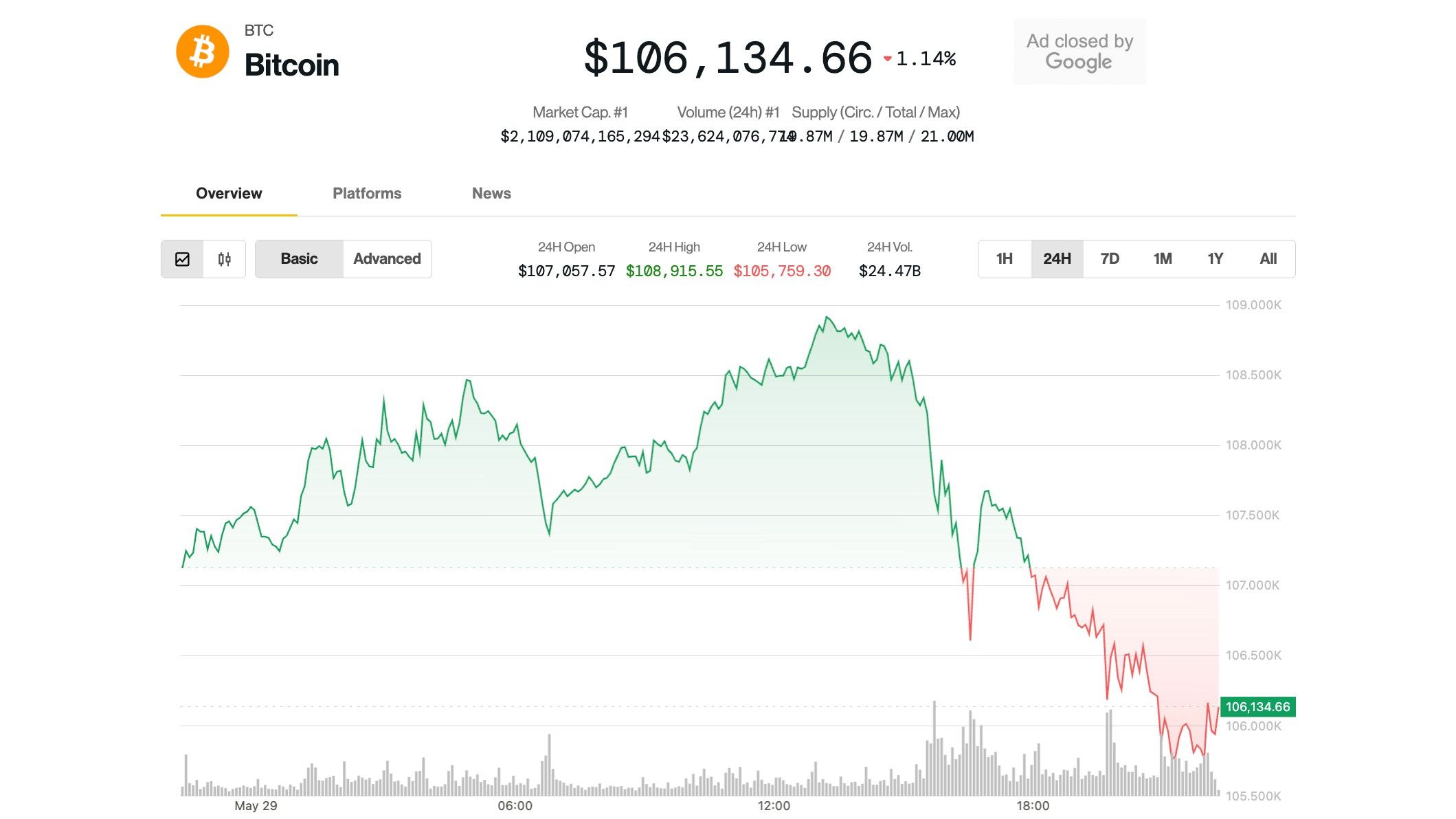

Bitcoin, that fickle friend, quietly slid to its weakest price in nine days on Thursday afternoon, as the crypto markets took a breather after a rather exuberant rally from the April lows.

The top cryptocurrency hit a session low of $105,750 before deciding it was time to rebound to just above $106,000. It was down 1.5% in the last 24 hours, but still only a mere 5% away from those record high levels. How thrilling! 🎢

The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding the usual suspects like exchange coins, memecoins, and stablecoins — has slumped 0.9% in the last 24 hours. Solana and Avalanche, bless their hearts, underperformed BTC with losses of 1.8% and 2%, respectively. Meanwhile, Ethereum’s ether and XRP decided to defy the downtrend with a cheeky 1%-2% gain. Bravo! 👏

Crypto stocks have had a rather muted session. Coinbase (COIN) is down 2.7%, but Strategy (MSTR) has risen 0.8%. Bitcoin mining firms Bitfarms (BITF), Bit Digital (BTBT), CleanSpark (CLSK), and Greenidge Generation Holding (GREE) have all booked roughly 4% losses. Oh, the drama!

A quick peek at traditional markets shows U.S. equities giving back most of the gains from yesterday’s court ruling that blocked the Trump administration’s global tariffs. But wait! A U.S. appeals court today reinstated the tariffs while the government appealed the earlier ruling, adding a sprinkle of uncertainty to the investor’s cocktail. 🍸

LMAX Group market strategist Joel Kruger expects a rather volatile ride with tariffs back in focus, as the self-imposed July 9 deadline for trade deals approaches. But fear not, he still sees further upside for digital assets. How positively optimistic! 🌈

“Bitcoin remains robust in the latter half of the week, consolidating just below its recent peak while steadfastly holding above $100,000 for 20 consecutive days, underscoring persistent bullish momentum,” he said. Quite the compliment, isn’t it?

Ether shows strength, analysts note

Kruger also noted that Ethereum’s ether is showing signs of snapping its multi-year downtrend against BTC, as the corporate crypto treasury bonanza has reached the second-largest digital asset with SharpLink Gaming’s (SBET) $425 million fundraising plan. Quite the financial soirée!

Arthur Aziz, founder and investor of B2 Ventures, said that ETH is coiling for a breakout but warned of downside risks. Oh, the suspense!

Sharing his technical analysis in a note, he mentioned that the $2,750 level has posed a significant barrier capping gains over the past weeks, while the $2,550-2,450 area has emerged as a key support level. He noted that ETH is forming a bullish ascending triangle pattern, which historically precedes rallies to higher prices. How very geometric! 📈

“The stage for a future $3,000 level breakout is being set right now,” he said. However, “abusing” leverage in futures markets could trigger a “sharp breakdown” below the $2,550-2,450 support zone in cascading selling. Oh, the perils of excess! 🎭

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-05-30 00:14