Once again, Bitcoin decided it was the perfect time to throw a little tantrum, crashing below $90,000 faster than a cat knocking over a vase. If you blinked, you missed a few grand, which is basically crypto’s version of a quick summer fling-short, intense, and leaving everyone a bit poorer.

And it wasn’t just Bitcoin-altcoins jumped in the chaos, probably trying to escape too, which helped push liquidations past the staggering $400 million mark. That’s a lot of financial heartbreak in just a single Friday afternoon, enough to make even the most hardened trader consider early retirement or a very long vacation on a beach somewhere that doesn’t accept crypto.

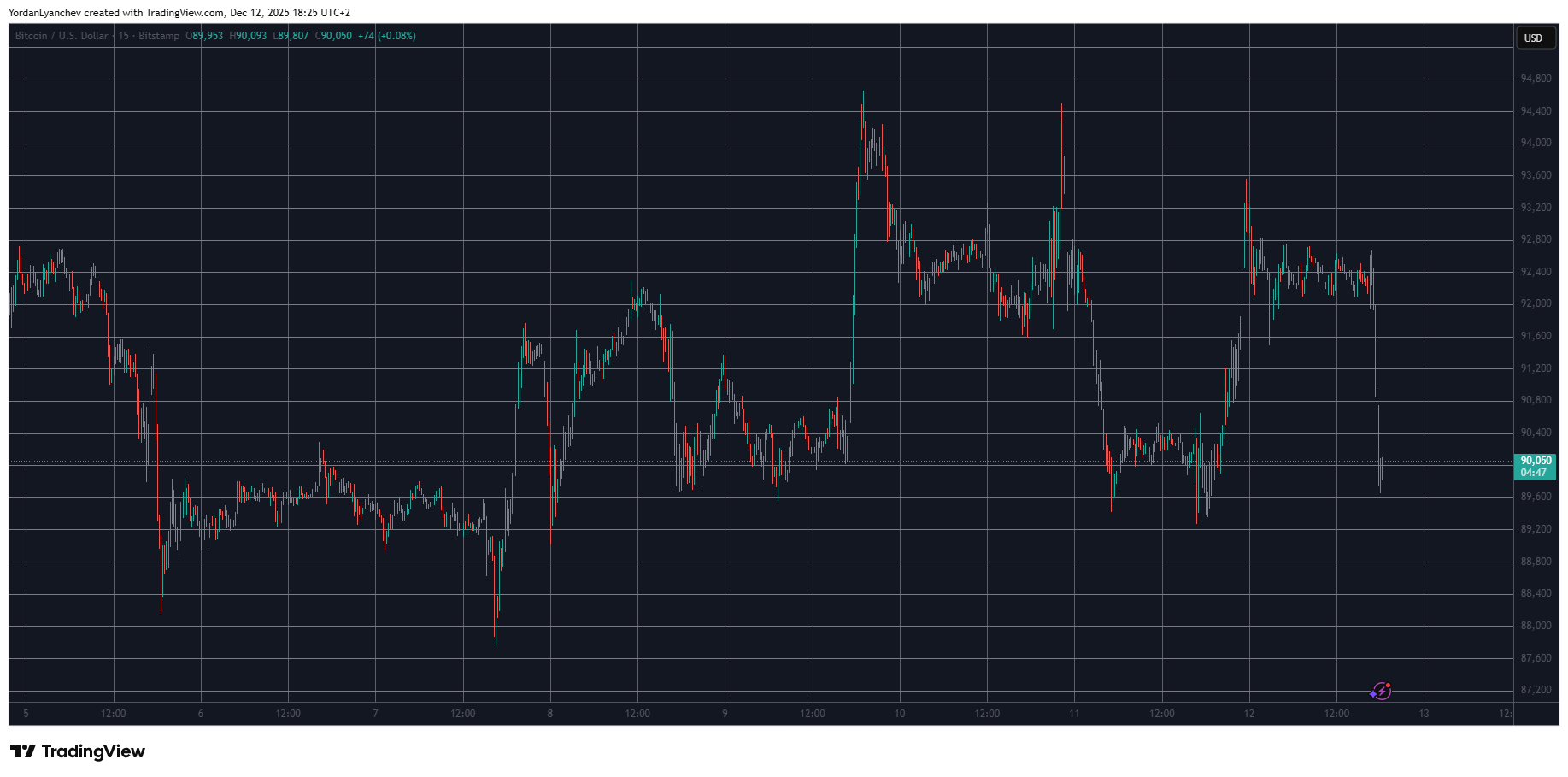

CryptoPotato had the audacity to report a little over an hour ago that BTC had managed to stabilize above $92,000 after its weekly binge of chaos. It had shot up from under $90,000 to over $94,000 midweek, thanks to the Fed’s interest rate “adjustments” (read: messing with everyone’s heads). But, like all good disasters, it couldn’t resist a final plunge, tumbling below $89,500 yesterday before the bulls tried (and failed) to lift it back up to a lofty $93,600.

Current status? Bitcoin’s back to testing the $90,000 line like a snooty cat eyeing a suspiciously noisy humans. Meanwhile, altcoins are following the script with even more dramatic declines. Ethereum, that once-proud horse, lost 4.5%, now flirting just above $3,000-just a day ago, it was strutting past $3,400, only to meet an epic rejection that would make even a soap opera jealous.

Other tokens like ARB, UNI, ENA, and AAVE have dumped by as much as 5.5% in the past hour alone, making the daily liquidations soar to $415 million, with a hefty $163 million wiped out just in the last sixty minutes. Looks like trader fortunes are crashing faster than a disgruntled clown at the end of his show.

Over 120,000 traders have bid farewell to their accounts today, and the grand prize for liquidation (a whopping $5.7 million) went to Hyperliquid, proving that sometimes, the market’s idea of fun is just a lot of money disappearing in minutes.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Xbox Game Pass September Wave 1 Revealed

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-12-12 19:46