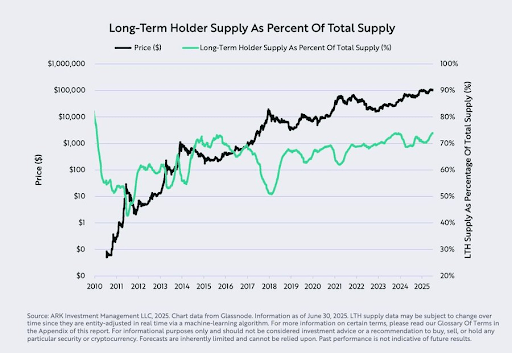

Oh, look who’s back with another “bullish” Bitcoin story – because apparently, we all needed more reasons to stare at our screens in anticipation. Ark Invest is basically shouting from the rooftops that the long-term holders’ supply has hit a whopping 74%, a 15-year high. I mean, who knew that holding onto digital gold for dear life could be so trendy? 😎 These “diamond-hands” folks are like the cool kids who never sell, even when the market’s throwing a tantrum. And let’s not forget the institutional investors piling in via ETFs – because nothing says commitment like a bunch of suits deciding Bitcoin is the new black. Prices are smashing ATHs left and right, hitting $123,000 last week. Price discovery? More like a wild guess at this point. 📈

Bitcoin Long-Term Holders Supply Hit 74%

According to Ark Invest, this 74% mark means Bitcoin’s supply is mostly in the grips of holders who’ve stuck around for at least 155 days. It’s like they’re auditioning for a role in “The Never-Sell Story.” They call it a sign of market conviction, positioning BTC as digital gold – or as I like to think, a shiny distraction from actual gold. 😏 Institutional buyers are flexing their muscles, outlasting those flaky retail investors. With demand from ETFs and treasury wonks, this metric might just keep climbing, giving long-term holders even more control. Because why share the wealth when you can hoard it all? 💰

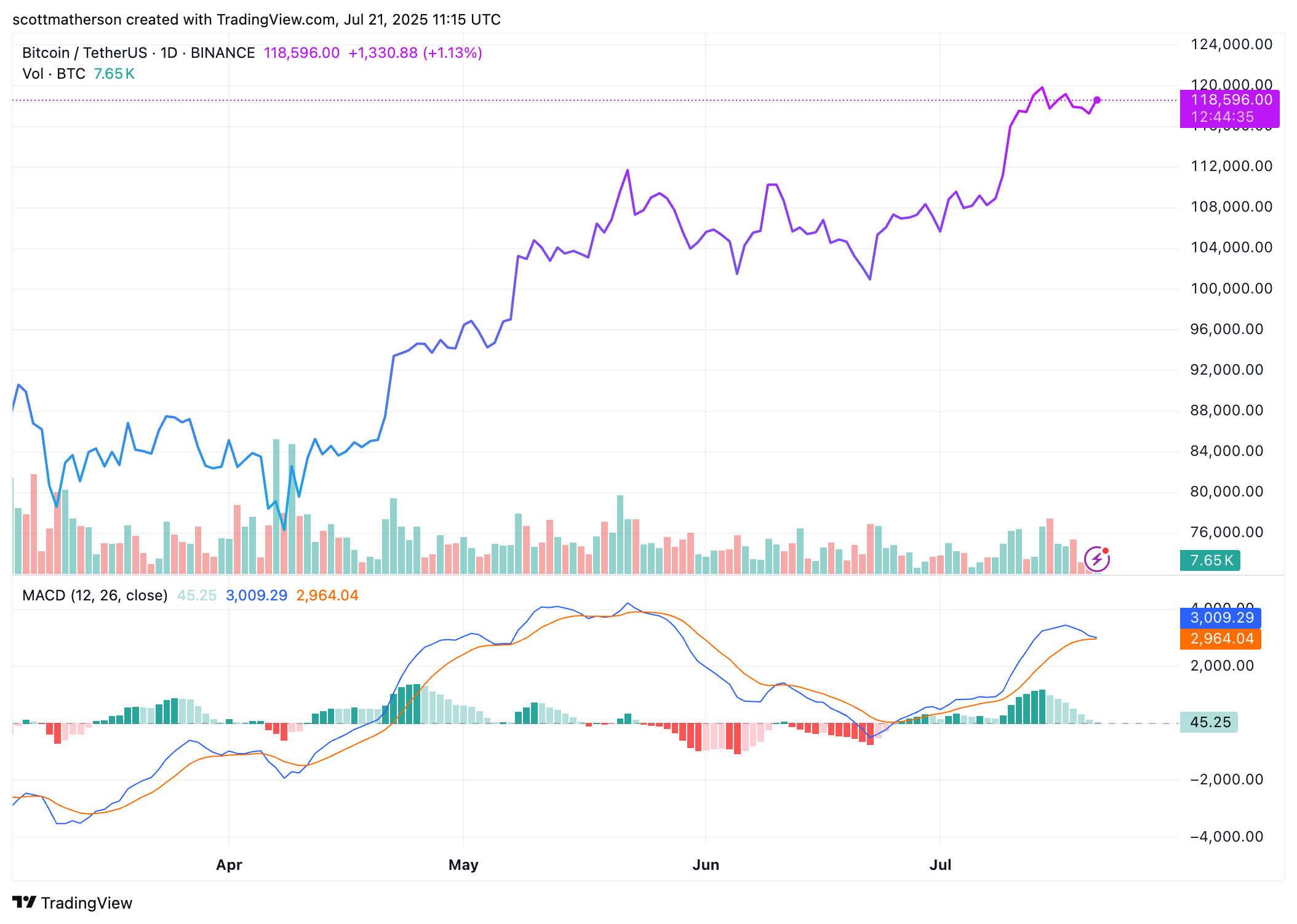

This buying frenzy has Bitcoin’s price doing loop-de-loops, reaching those ATHs we mentioned. BlackRock and Michael Saylor’s crew are accumulating like it’s going out of style, and BTC is still playing hard to get in price discovery mode. If you’re not exhausted from the rollercoaster, you’re probably not paying attention. 🎢

Cathie Wood from Ark Invest is all in on the hype, predicting Bitcoin could hit $1.5 million by 2030. She thinks it’s snatching market share from gold or just expanding the whole store-of-value party. In a CNBC chat, she doubled down, saying institutions are still dipping their toes in despite the buying spree. And get this: only about 1 million Bitcoins left to mine. Talk about a scarcity panic – it’s like the last slice of pizza at a party. 🍕

She also mentioned that with institutions just testing the waters, adoption could skyrocket. Because nothing says “I’m serious about this” like throwing money at a volatile asset. Meanwhile, the world keeps spinning. 🌍

Other Bullish Metrics For BTC

Ark Invest dropped another gem: global liquidity per Bitcoin hit a 12-year high at $5.7 million in M2 supply per BTC. They say this could keep rising thanks to Bitcoin’s slowing supply growth and all that juicy global liquidity. It’s like Bitcoin’s saying, “Hey, I’m rare and the money’s flowing – what could go wrong?” 🤷♀️

Back in June, Bitcoin held strong above that $96,000 to $99,000 support zone and is now cruising higher. Metrics like the short-term holder cost basis, 200-day moving average, and on-chain mean are all lining up for a bullish vibe. Why? Because numbers don’t lie, or do they? 😜 At the time of writing, Bitcoin’s chilling around $19,100, up a bit in the last day. Who knows what’s next – maybe it’ll buy us all coffee. ☕

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-07-21 16:17