Ah, Bitcoin-once the digital darling, now the distressed debutante at the ball, crashing through the grand door of $100,000 and landing in the mud of mediocrity. It seems the crypto cosmos has indulged in a bit of poetic irony, just to keep us on our toes. The entire crypto court, inspired by a government shutdown and a dash of macroeconomic melodrama, decided to join in the chaos. 🎭💸

- Bitcoin, in a flair for theatrics, slipped below the sacred and much-mocked $100k boundary.

- This was the lowest whisper of BTC since June, whispering secrets to the bears.

- Shares of Strategy, perhaps in a brave attempt at matching Bitcoin’s existential crisis, nosedived by 6% – because watch the master and the apprentice tumble together, it’s adorable.

Why, you ask? Well, fear, darling, is once again the coquettish mistress of the crypto bazaar. As the government declares a timeout, traders are hurriedly retreating from riskier pleasures, clutching their pearls and purses.

This anti-climax saw Bitcoin, in its least regal moment since July, tumble below the illustrious $100,000, unleashing a pandemonium that swept through the broader crypto realm like a bad Tinder date. Macro gloom, liquidations, and ETF outflows-oh my-each played their part in the descending drama. 🔥📉

On that fateful Tuesday, November 4th, Bitcoin plummeted to $99,954-a price so modest it might have been a typo, except it isn’t-its lowest dip in months. Since then, it’s bounced back to the exalted $100,269, barely escaping the abyss, but not without leaving a trail of over $300 billion evaporated into the ether. The entire crypto market cap, in a rather dramatic fashion, shrank by 6.4%, or as some prefer, the price of a small island in the Caribbean. 🏝️📉

Ah, the psychological barrier! That elusive $100,000-once a fortress of hope, now a mere number. The last time BTC flirted below this zenith was on June 23, when it also teased us at $99,705. How fickle fortune can be!

Why did our beloved Bitcoin hit the skids?

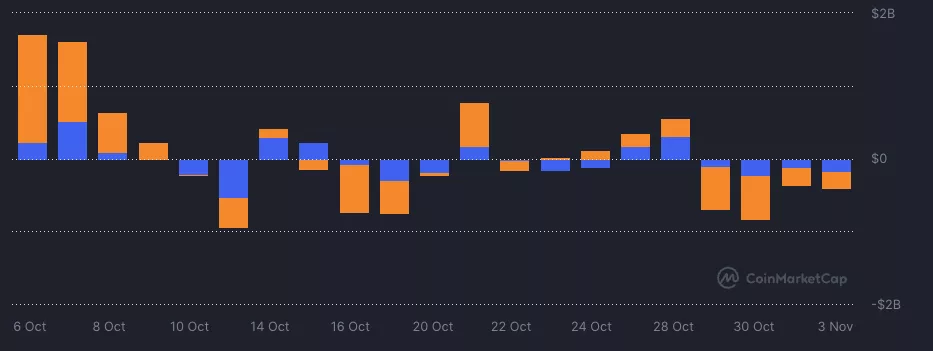

Macro woes, my friend. Threats of tariffs, the Fed playing hard to get with rate cuts-these were the uninvited guests at the glamorous crypto soirée. The audience, acting as if the cocktail of economic uncertainty was too bitter, chose to leave early. The cascade of ETF withdrawals and liquidations turned what was an elegant dance into a chaos-filled mosh pit.

For the record, Bitcoin (BTC) and Ethereum (ETH) ETFs are about to blow out their fifth consecutive day of negative flows. Because nothing says “I love danger” quite like $1.4 billion being liquidated in 24 hours, with longs leading the parade. 🎉💀

Now that our hero has fallen below the sacred dollar mark, whisperings of a further descent to $98,000 are echoing through the traders’ halls. Support levels are as fragile as a soufflé-both the safety zone and the battleground. Meanwhile, the US dollar-ever the loyal sidekick-has rebounded slightly, proving once again that in the game of markets, nothing is permanent, not even the illusions of stability. 💵✨

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- How to Unlock the Mines in Cookie Run: Kingdom

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Starsand Island: Treasure Chest Map

2025-11-05 01:22