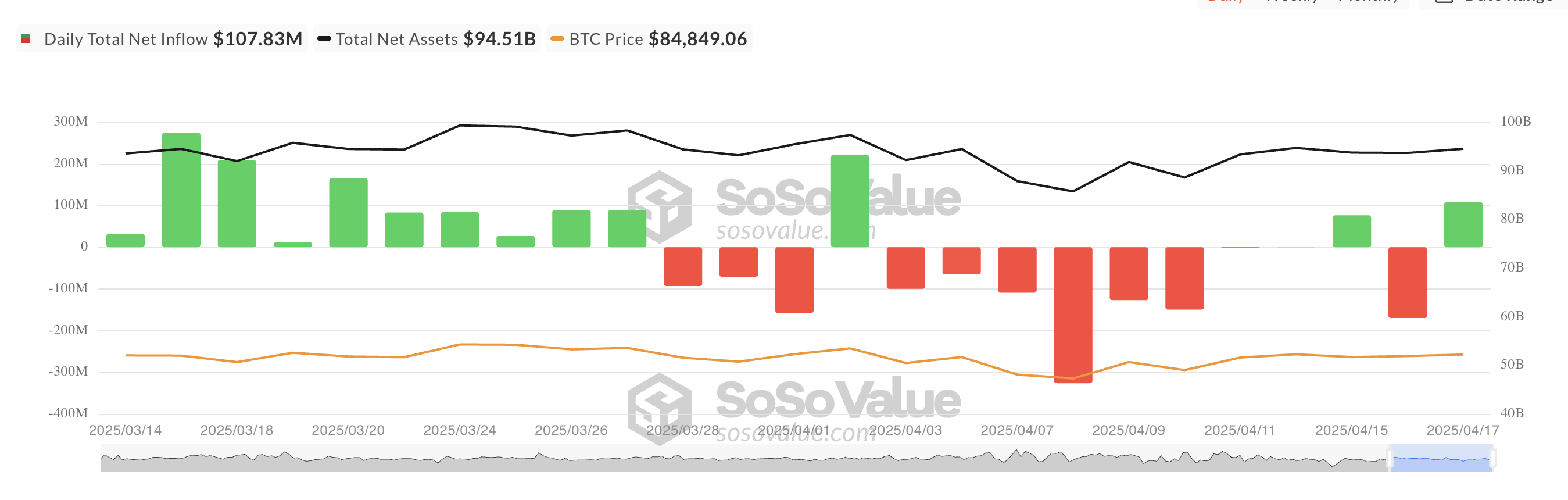

Ah, Bitcoin ETFs, that mixed bag of joy and despair that keeps investors either popping champagne or clutching their stress balls. Thursday brought a glimmer of hope—over $100 million in net inflows! Yay, right? Except, wait, just the day before, a wallet-wrenching $169.87 million streamed out faster than you can say “sell everything.” Welcome to this week’s episode of “Why Is My Portfolio Like This?”

If you’re counting, there’s been a modest net inflow of $15.85 million since Monday, which—if you’re feeling optimistic—means the week might end with more smiles than sighs.

Institutional Confidence or Just Playing Hard to Get?

After Wednesday’s dramatic exit, institutional investors showed us they have the emotional fortitude of a cat deciding whether the kitchen counter is safe. ETFs bounced back, suggesting this dip was less a market apocalypse and more a mild Monday hangover. Investors seemed to shrug and say, “Meh, let’s try this again.”

The renewed appetite happens as Bitcoin fans cling to the hope that this magic internet money will someday be worth more than their collection of NFTs their ex never wanted back. Even as short-term signals send mixed messages (like your therapist during a particularly awkward session), long-term believers hold steady.

BlackRock’s ETF IBIT led the inflow parade with a dazzling $80.96 million, pushing its cumulative net inflows north of $39.75 billion—which is almost as much as the national debt of a small country. Fidelity’s FBTC wasn’t far behind with $25.90 million, lounging around a comfy $11.28 billion in historical inflows.

Bitcoin: Gaining a Fraction and Maybe, Just Maybe, Your Attention

Bitcoin’s price scrunched its face and managed a modest 0.30% gain over 24 hours. Nothing to retire on, but hey, growth is growth. Futures open interest—a fancy term for the number of unresolved bets on Bitcoin’s price—shot up to $54.93 billion, climbing 5% like a hungry toddler scaling a kitchen counter.

This open interest basically counts how many gamblers haven’t folded yet. When it rises alongside price, it means the casino floor is crowded: more folks are placing bets, both “long” (buy low, sell high) and “short” (sell high, buy low), reflecting a market that loves to keep us guessing.

Call options, favored by traders betting on a price spike, are seeing strong demand. It’s like a crowd chanting, “Up, up, and away!” But before we all start buying yachts, let’s remember that not everyone is cheering in the Bitcoin stands.

Today’s plot twist: BTC’s funding rate flipped negative—an ominous sign that shorts are paying longs, or as investors put it, “Bearish vibes.” With the rate at -0.0006%, the futures market whispers, “Don’t get too comfy; some folks are betting on the price nosedive.”

So, in the grand theatre of Bitcoin ETFs: investors swoon, prices twiddle their thumbs, and somewhere in the mix, a few brave souls are shorting their way to glory. Until next week, where the rollercoaster starts again, fasten your seatbelts—or just keep your stress ball handy. 🎢🤷♂️

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-18 10:11