Ah, behold! The story of Bitcoin, once soaring to dizzying heights, now confined within a meager range of $115,733 as of September 21, 2025. A market cap of $2.30 trillion, yes, but at what cost? The daily trading volume stands at $19.24 billion, and yet, we find ourselves locked within an almost poetic stasis. The price dances ever so lightly, between $115,426 and $116,154, as if unsure whether to ascend or fall. One might wonder-can such a market be truly alive?

Bitcoin

In the fleeting moments of today, let us observe the 1-hour Bitcoin chart, where the price languishes in a sideways drift-a faint, perhaps even tragic, descent. The candlesticks, they seem to tremble in uncertainty, with their small, frail bodies reflecting nothing more than the weak, fading will of the market. The range between $115,400 support and $116,200 resistance is a battleground of indecision, a desperate pause before the inevitable storm. Will it rise or crumble? Neither side seems to care enough to fight for victory.

The price moves forward with no conviction, no passion to propel it beyond the formidable resistance levels. A break above $116,200 might promise a new dawn-but unless it comes with the thunderous roar of sustained volume, traders would do well to hold their horses and wait for the inevitable fall below $115,400 for a more suitable short setup.

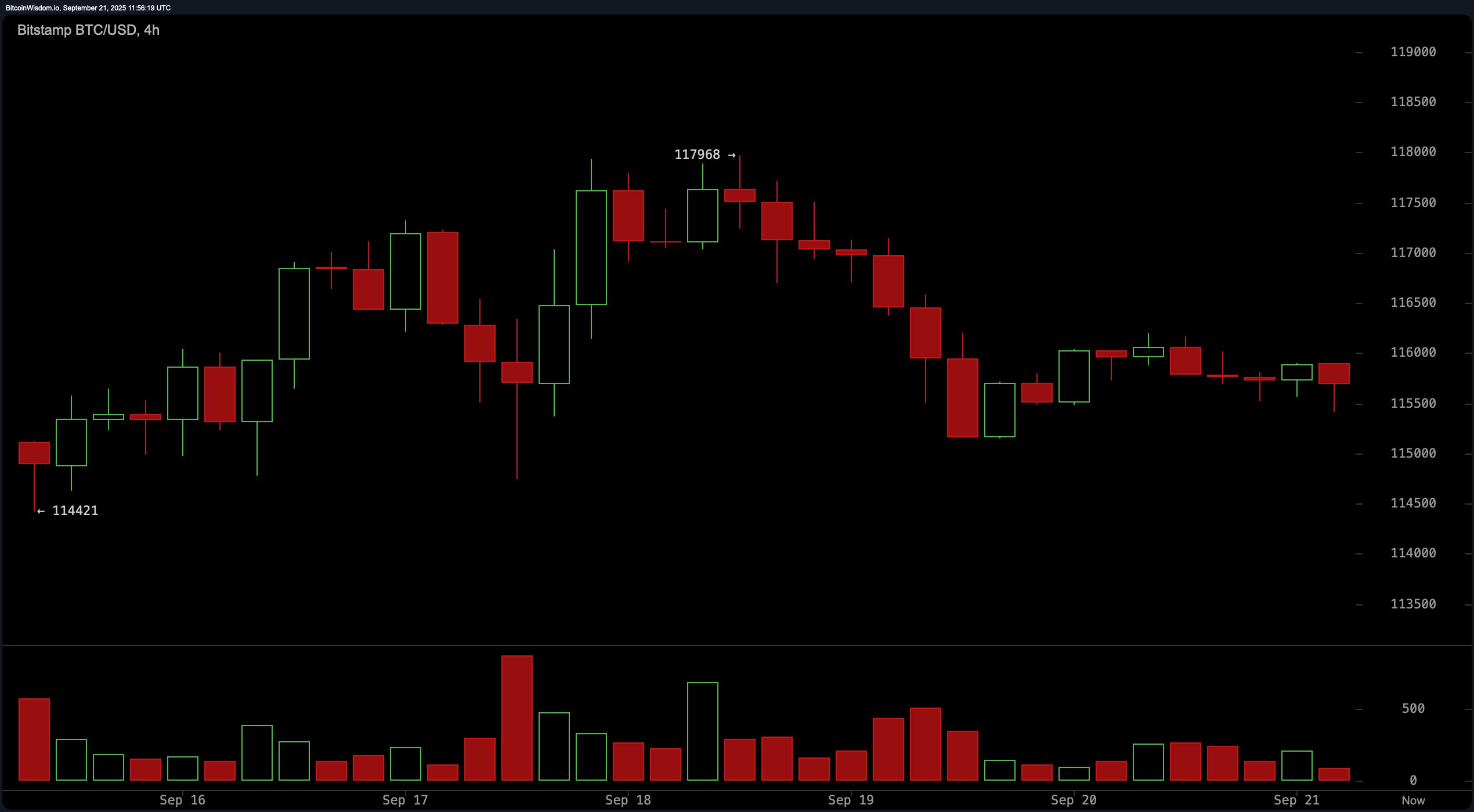

As we venture further into the void of technical analysis, the 4-hour chart speaks of a tale of retracement, of regret and missed opportunity. Bitcoin, once soaring to a glorious peak of $117,968, now seems to sag under its own weight. Lower highs, each one weaker than the last, as if the very market was haunted by the ghosts of past gains. The resistance at $116,000 is nothing but an unyielding wall-its refusal to be broken, a cruel reminder of the market’s fragility. If Bitcoin fails to break free from its cage, the next stop is a grim descent to $114,400, perhaps even lower. Only the faintest whisper of a bullish breakout above $117,000 could offer any hope of salvation.

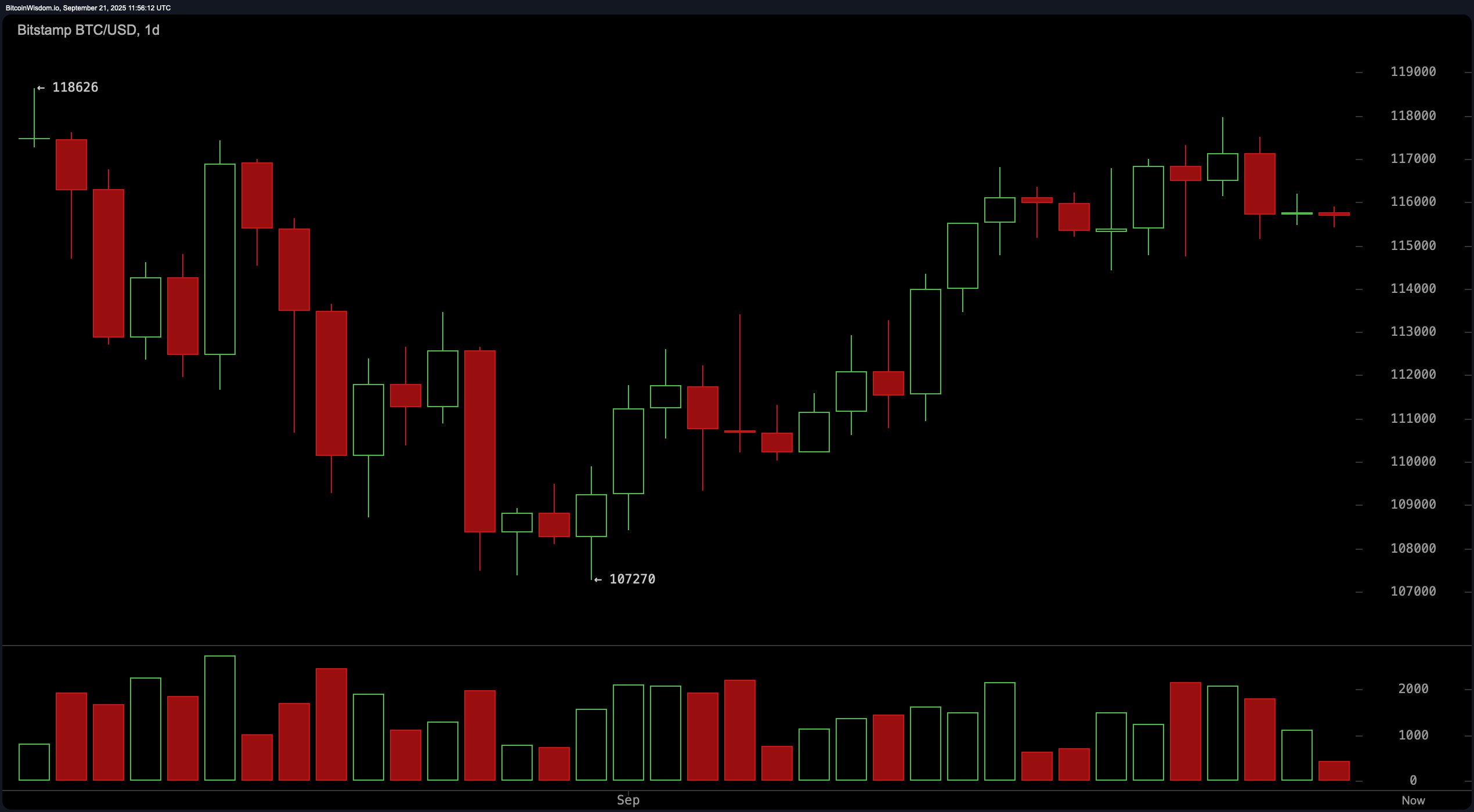

The daily chart, however, brings with it a sense of foreboding, a shadow cast over the market’s aspirations. Bitcoin, having briefly touched the lowly depths of $107,270, now dares to dream again, reaching for the heavens with a recent peak of $118,626. And yet-oh, the irony-this newfound hope may be its undoing. The whisper of a double top at $117,000 to $118,000 looms large, threatening to crush the delicate optimism that has sprung up in recent days. Volume is fading, as it often does when things are about to crumble. A failure to hold above $115,000 would herald a swift reversal, and perhaps a fall even further into the abyss.

The oscillators, those quiet, secretive indicators, speak only in neutral tones. RSI at 55, stochastic at 71, and the commodity channel index at 54-all signs of indecision, a market caught in the throes of a deep existential crisis. Even the awesome oscillator, a tool that has witnessed countless battles, now stands at a meager 3,157. Yet, in this sea of confusion, the MACD dares to offer a bullish signal. Is it a beacon of hope? Or a cruel mirage, a trick played by the market to keep us hanging on just a little longer?

The moving averages, however, seem to favor the bulls-at least over the long term. EMAs for 10, 20, 30, 50, 100, and 200 periods all sing songs of optimism, while only the 10-period SMA gives voice to the bear. But let us not be deceived: the short-term price action, caught in a narrow range, is a fragile thing, vulnerable to the whims of the market gods. Only a decisive move above $118,000 or below $115,000 will determine the fate of this cryptic tale.

Bullish Verdict:

If Bitcoin somehow manages to break through the $118,000 level, the heavens may open, and we could see the price rise to the lofty heights of $120,000 or even $122,500. Long-term moving averages and the MACD buy signal may carry the bulls forward-if only the key resistances are cleared with sufficient momentum. The market, like a tormented soul, may yet find its way to redemption.

Bearish Verdict:

But, alas, if Bitcoin slides below $115,000, with volume increasing as if it were the harbinger of doom, then all hope is lost. The failed breakout would open the path to even darker times, with support zones at $114,400 and perhaps even $112,000. The fading volume, the weakening momentum-it all points to one inevitable truth: the bears are poised for dominance.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- How to Unlock & Upgrade Hobbies in Heartopia

2025-09-21 16:03