🚀🔥 Bitcoin‘s Hidden Strength: The Secret Signal for a $85K Breakout 🔥🚀

- Bitcoin’s Value Days Destroyed metric has dropped to its lowest level since mid-2024, signaling a shift to accumulation.

- Historical patterns showed that low VDD phases often precede bullish price movements, strengthening the long-term outlook.

Ah, the eternal question: will Bitcoin ever escape the prison of its own mediocrity? 🤔 Perhaps, my friends, the answer lies in the shadows, where the wise and ancient Value Days Destroyed metric resides.

It seems that this metric, a relic of a bygone era, has finally cracked under the weight of its own significance. The latest reading is the lowest since mid-2024, a Development of major importance. 📊

Long-term holders: the moral compass of the market

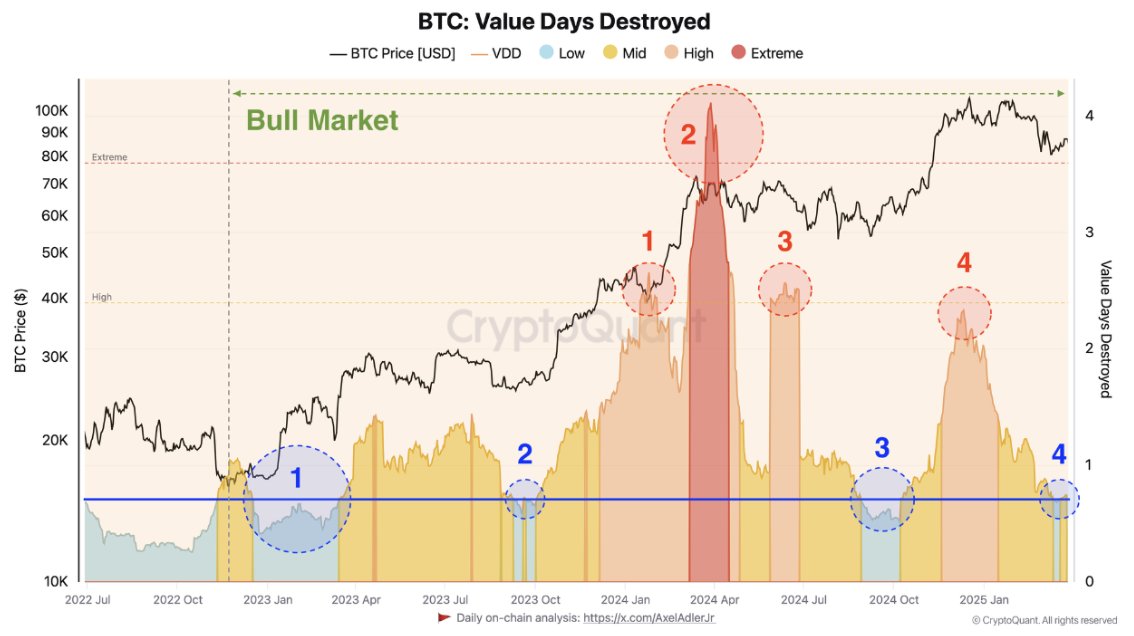

The Value Days Destroyed chart, a gaudy display of historical patterns, reveals four significant accumulation phases: January and October 2023, October 2024, and now March 2025. 📈

Each phase is marked by a sharp drop in VDD, signaling reduced coin movement and increased conviction among long-term holders. The current reading, highlighted by the fourth blue circle on the chart, is the lowest since mid-2024. 🚀

But what does this mean, you ask? Ah, it means that these seasoned participants, these stalwarts of the market, are buying low and exiting near local tops. Their behavior is like a dogmatic prayer, a testament to their unwavering conviction. 🙏

No signs of profit-taking from smart money

Red circles on the Bitcoin VDD chart point to four distinct selling spikes—January, April, July, and March 2025. 🚨

Each surge in value destruction corresponded to local tops, underscoring how strategic these entities are in capturing profits. But as of now, there’s no such spike. Ah, the sweet silence of accumulation. 😴

The absence of realized value destruction supports the theory that smart money is staying put. Their conviction adds credence to a price floor forming near the $82K level, discouraging aggressive short-selling in the current structure. 🚫

Bitcoin price action aligns with on-chain calm

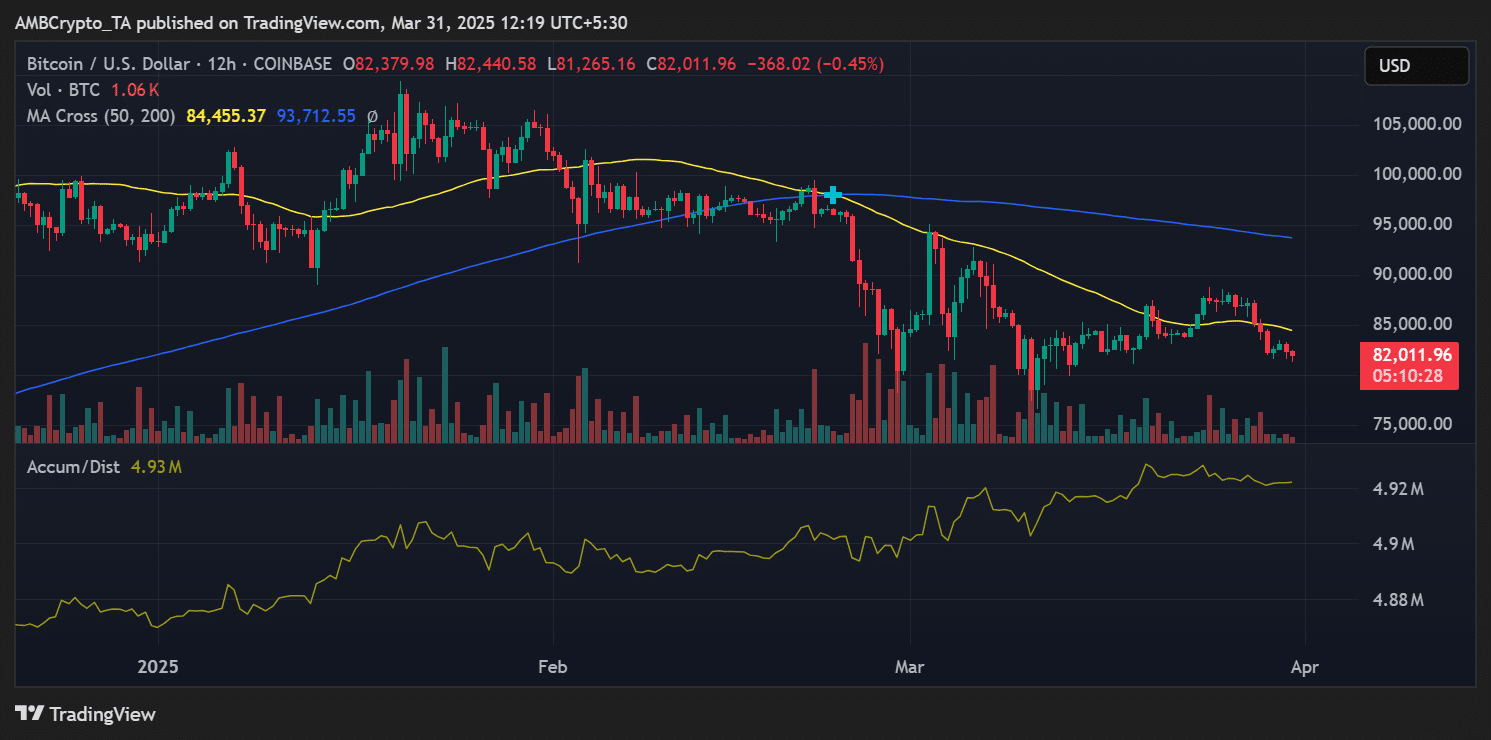

Bitcoin traded at $82,011 at press time, below both the 50-day and 200-day Moving Averages at $84,455 and $93,712, respectively. 📊

Despite the bearish short-term structure, the Accumulation/Distribution Line is stable at 4.93M, indicating that distribution pressure hasn’t intensified. Ah, the quiet confidence of the market. 😊

This divergence, price weakness vs. steady A/D levels, could point to a hidden bullish divergence forming. It could confirm this thesis if the price stabilizes and breaks above the $ 84K-$ 85K resistance zone. 🔓

What next?

Bitcoin’s low VDD environment, combined with the accumulation behavior of long-term holders and muted distribution metrics, signals a potential bottoming phase. 📈

If historical patterns repeat, BTC may be setting up for its next bullish impulse. Ah, the tantalizing prospect of a $85K breakout! 🚀🔥

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Tainted Grail: How To Find Robbie’s Grave

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- LUNC PREDICTION. LUNC cryptocurrency

- Nintendo Switch 2 Confirms Important Child Safety Feature

2025-03-31 14:20