Behold, the mighty Bitcoin, now trading at a modest $111,000, having surrendered its throne of $124,500 to the whims of the market. The bulls, valiant yet weary, cling to the $110,000 support like a drunkard to a lamppost, while momentum slinks away, whispering, “Not today, my dear.” Ah, the eternal dance of hope and despair! Analysts, those modern-day prophets, warn of a deeper correction-though one suspects their crystal balls are more polished than their logic.

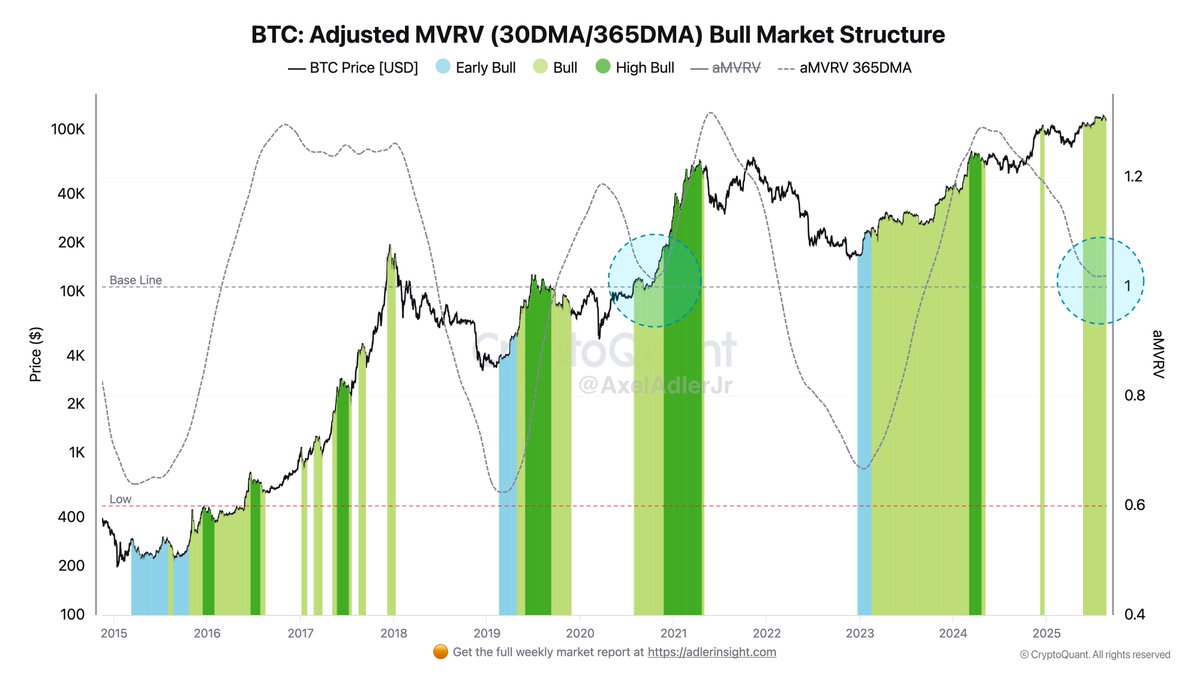

Enter Axel Adler, the sage of the MVRV, who proclaims that Bitcoin’s Adjusted Metric is teetering at the 1.0 zone, a precarious tightrope between short-term folly and long-term wisdom. “A balancing act!” he cries, as if the market were a circus performer juggling flaming torches. In truth, it is a muddle of profit-taking and volatility, with the 30-day metric yawningly matching the 365-day. A stalemate, or as I call it, “the market’s midlife crisis.”

Historically, this 1.0 zone is but a pause in the grand opera of bullish cycles, not the final act. The market, that fickle lover, is digesting its gains, passing coins from the impatient to the patient. Will it ascend to new heights or plunge into the abyss? Only time, that most unreliable narrator, shall say. But mark my words: the next few weeks will be a tale of two futures, one of triumph, one of tragedy-though likely, both are just the same story with different endings.

Bitcoin’s MVRV: A Pause, Not a Reversal 🧠

Adler, ever the dramatist, insists that the 1.0 zone is no harbinger of doom but a mere intermission. The annual basis, though flat, remains positive, as if the market were a tired dancer taking a bow. The 30-day metric, having cooled its jets after the all-time high, now coexists with the 365-day, which clings to past glories. A duel of titans, or as the market prefers, “a stalemate with a side of existential dread.”

This equilibrium, though stable, is as fragile as a snowflake in a hurricane. The market, in its infinite wisdom, is digesting the rally, not crumbling. Yet Adler warns against mistaking this for the end of an era. No, it is but a pause, a breath before the next crescendo. Until the annual basis turns downward, the market remains a game of musical chairs, with coins shuffled from the hasty to the steadfast.

In the coming weeks, the 1.0 zone will be the stage for a drama of epic proportions. Will Bitcoin rise, or will it fall? The answer lies not in the stars, but in the hands of traders, who are as fickle as the market itself. For now, it is a matter of time, balance, and the occasional sip of whiskey to steady the nerves.

BTC: Testing the Pivotal Level with the Grace of a Sinking Ship ⚓

Bitcoin, that wayward child, continues its tango with the $110,000 support, now flirting with $110,823. The daily chart, a canvas of struggle, shows BTC clinging to life, as if the market were a desperate lover begging for another chance. The 50-day SMA, a beacon of hope, hovers near $116,600, while the 100-day SMA, a stubborn relic, sits at $111,600. A battle of resistances, where bulls and bears duel with the intensity of Shakespearean tragedies.

The 200-day SMA, that ancient guardian, lies lower at $101,000, a fortress of support. A breach of $110K, they say, would unleash a storm of selling, sending Bitcoin to test the 100K-107K range-a zone of significance, if only because it’s the same place where the STH Realized Price once whispered secrets. On the flip side, reclaiming $115K-$117K would be a victory, though one suspects the market would merely shrug and ask, “What’s next?”

Read More

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- God Of War: Sons Of Sparta – Interactive Map

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

2025-08-27 17:22