At the unholy hour of 8 a.m. Eastern, Bitcoin dances flirtatiously between $104,881 and $105,266—ah, the sweet serenade of market cap at $2.08 trillion and a daily volume gently nudging $24.93 billion. The price wanders within a tight embrace, from $103,655 to $105,213, as if contemplating a breakout or just showing off its gymnastic flexibility in the grand circus of crypto.

Bitcoin

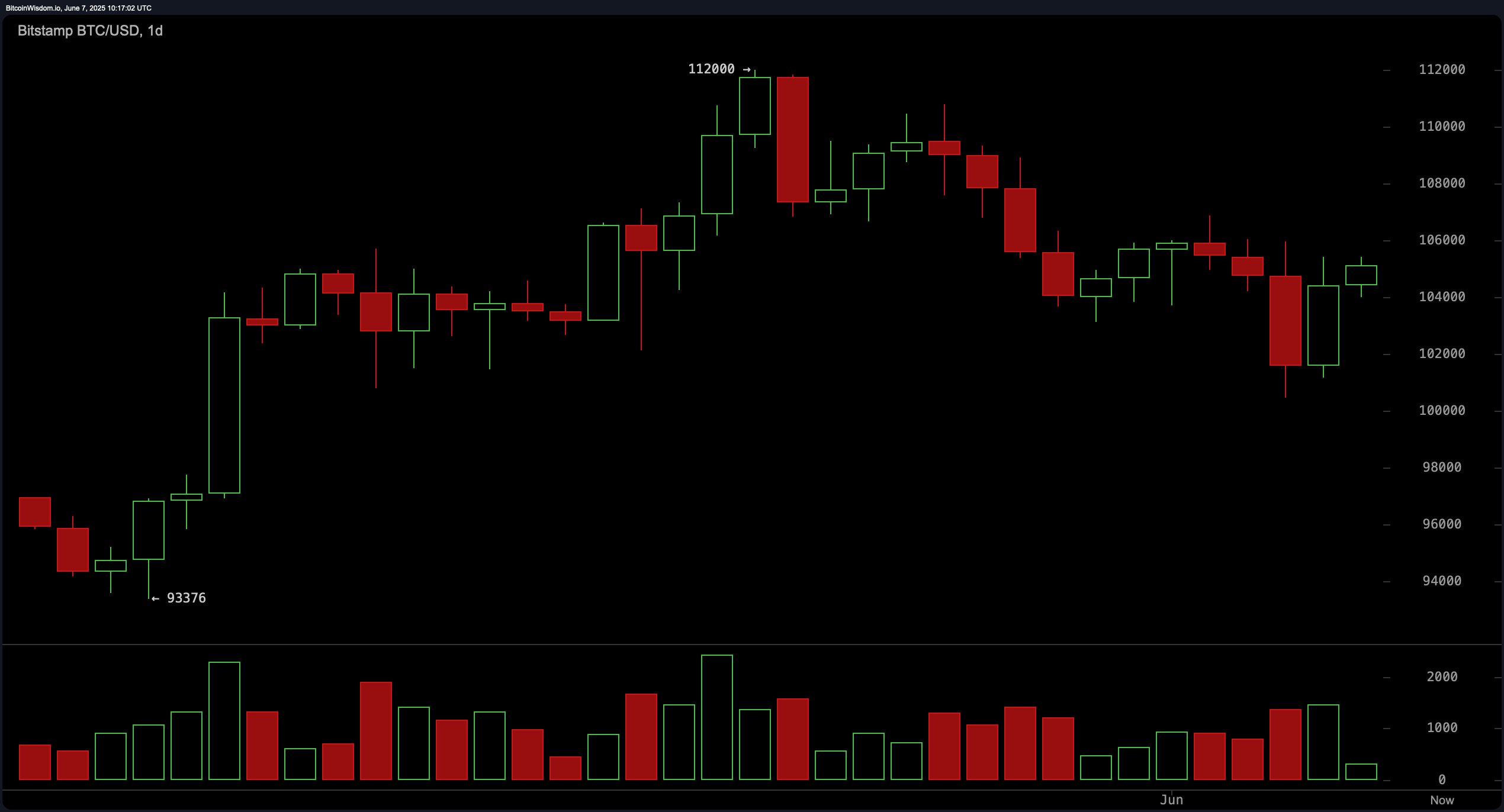

Ah, behold the daily tableau, where Bitcoin lingers after a heroic peak near $112,000—an apex so lofty one might need an eagle’s view to truly appreciate its grandeur. That double top was like a theatrical sneeze, causing a dramatic retreat toward the cozy support at $100,000. Yet, support remains resilient—closer to $102,000, the buyers pounce again, eager for a taste of the pie. Oscillators—like nervous teenagers—are giving mixed signals: RSI at a calm 52, CCI sulking at -59—both whispering “nothing huge happening.” But beware the bearish engulfing pattern—like a dragon lurking in the shadows—threatening sentiment, even as volume shrinks and sellers seem to hesitate, perhaps twirling their mustaches in indecision.

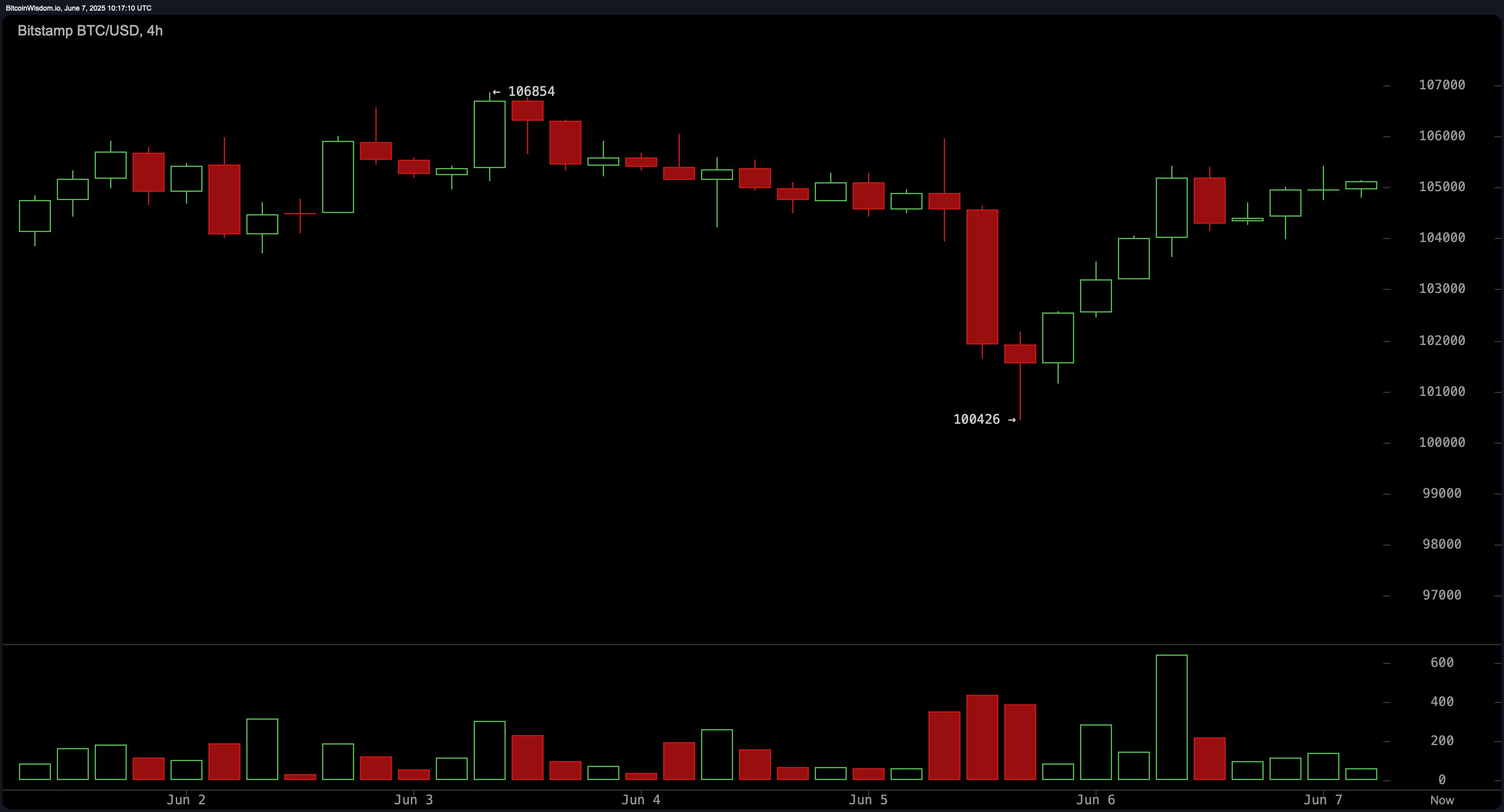

Zooming in to the intermediate scene, the 4-hour chart shows Bitcoin rebounding with the flair of a daring acrobat. After a swift plunge to $100,426—rejected near $106,854—the hero (or perhaps villain) recovered to flirt with $105,000. The green volume spike suggests brave dip-buyers, perhaps drunk on optimism. Now, it’s playing a game—forming a bullish flag or pennant—just beneath resistance. Should it boldly pierce $105,500 with volume enough to shame a peacock, it could strut all the way to $107,000. But if it falters below $102,000, expect a nosedive into the abyss of retracement.

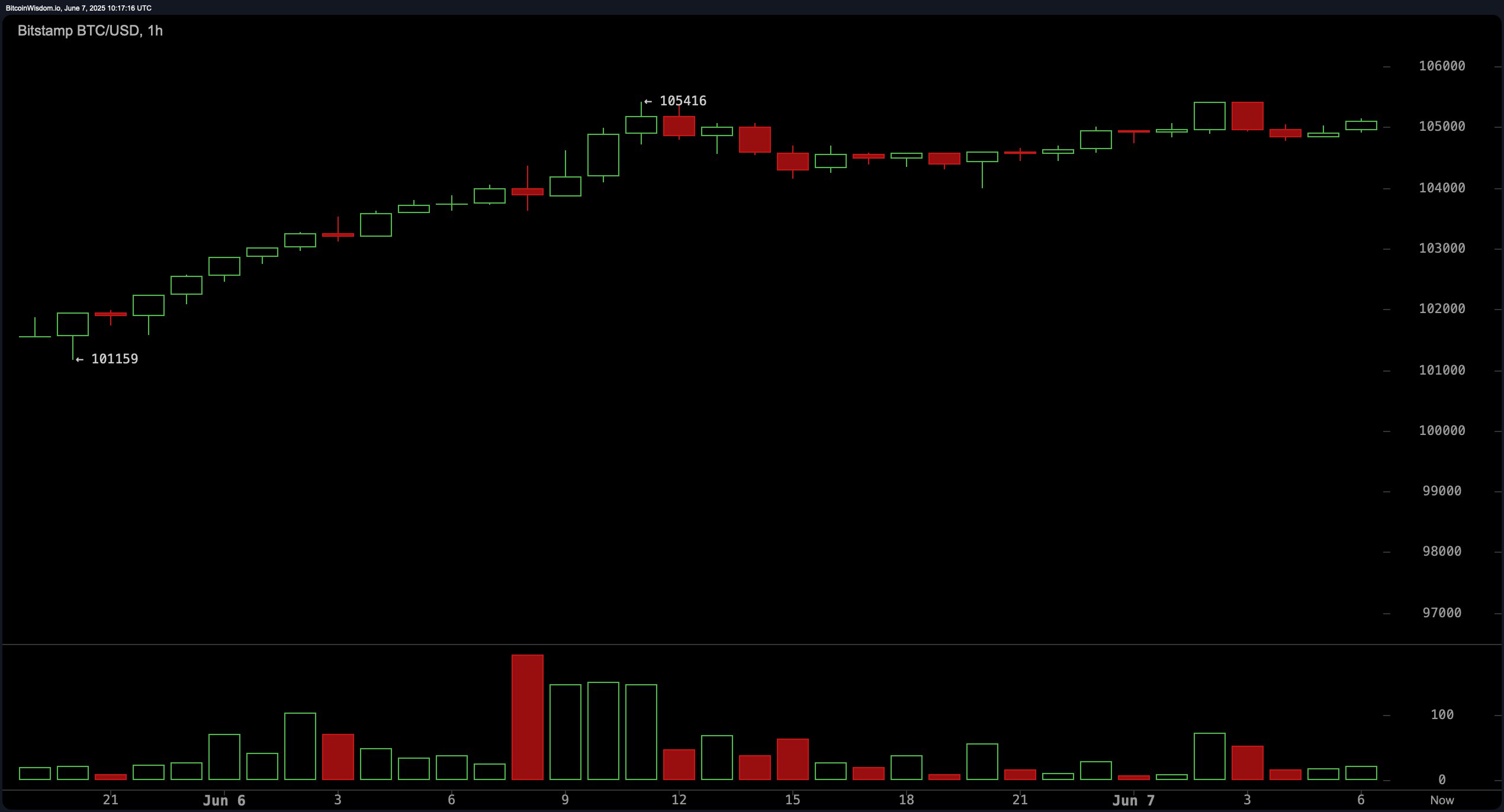

Short-term, the 1-hour chart reveals a staircase dance from $101,159 to $105,416, interrupted by a modest retreat—like a child stepping down from a staircase of hope. High buying volume fueled this ascent, now slightly cooled, hinting at a pause—a coffee break in the chaos. The pattern whispers “cup and handle,” urging a breakout above $105,500—an event that could catapult us straight to $106,500 or $107,000 faster than you can say “TO THE MOON 🚀.”

The oscillators, those fickle diviners, mostly whisper “meh”—except the awesome oscillator at -56 (a clear “sell”), and momentum at -2797 (a “buy”). MACD lingers at 728, but leans bearish—like a cat eyeing a mouse. The moving averages tell a story of their own: EMAs from 10 to 200 buzz bullishly, with the 10-EMA at $104,953 and 200-EMA cozy at $91,614. The 20- and 30-period SMAs, however, murmur a bearish tune, providing the middle-ground—an uncertain symphony of pressure.

Bullish Rumor Has It:

Bitcoin maintains its resilience above the sacred $100,000—like a stubborn mule with a penchant for bullish bounce-backs. The technicals are squeaky clean in parts, hinting at a spirited rally if it pierces $105,500 with volume enough to make markets gasp. The foundation—built on sturdy EMAs and momentum—says “go, go, go!” towards $107,000 and maybe even a nostalgic revisit to $112,000, the lofty dream of every hodler and chart-reader alike.

Or Is It Just Playing Hard to Get?

Still, shadows loom: bearish signals like the awesome oscillator and MACD confirm that caution is king. Resistance near $106,000–$107,000 may act as an insurmountable wall. A descent below $102,000—especially if volume roars like a beast—could push us sliding further south to $96,000–$98,000, shattering hopes of a continuous bullish romp. Ah, the sweet agony of crypto: where every day is a cliffhanger! 😅💸

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-07 15:57