- Bitcoin’s unrealized losses are the gossip at this soirée, as BTC lingers in a rather unbecoming holding pattern.

- Despite these mounting misfortunes, investors sip their optimism cocktails with nary a hint of surrender.

This past week, dear reader, Bitcoin [BTC] has been performing a delicate little two-step—oscillating daintily between $82,000 and $86,000, without quite deciding where to place its next foot.

Alas, those who invested at these dizzying heights are now nursing some rather bruising losses, much like a party guest who overindulged on the champagne and now regrets every sip.

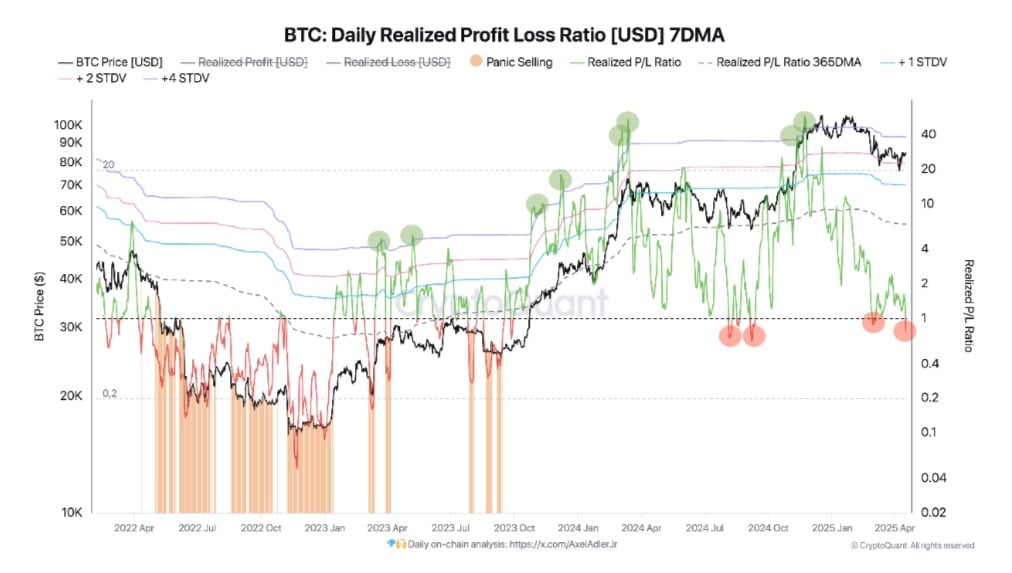

According to the ever-watchful CryptoQuant, Bitcoin’s Realized Losses are currently the talk of the market ball. The Profit/Loss Ratio (7DMA) has pirouetted below 1, signaling that most dancers—er, investors—are stepping on their own toes, realizing losses.

These blunders are particularly painful for the short-term holders, whose SOPR has taken a nosedive to a dismal 0.9—a clear admission that they’re selling at a loss, bless their hearts.

Moreover, Bitbo data reveals that short-term holders suffer unrealized losses akin to losing an expensive hat at the racetrack—their realized price languishing at $92,174, whilst the current dance floor price languishes nearer $84,000.

Yet, before you pen the obituary for Bitcoin’s rally, consider this: the stumble does not necessarily herald a full collapse, but perhaps a moment of hesitation—or dare I say, gathering of the skeptics for a potential encore of buying.

Historically, when this rather eccentric Profit/Loss Ratio swings to an extravagant +4 standard deviations from the 365-day average, the market tends to host a brief intermission—a local peak followed by a modest correction during the bull’s waltz.

With uncertainty sashaying through the market halls, one might expect a climactic capitulation event, propelling losses further into the spotlight.

Is the curtain about to fall on Bitcoin’s bravado?

Despite the mounting losses, investors stubbornly refuse to exit stage left. Instead, they wear their optimism like a diamond necklace, certain that Bitcoin’s price shall ascend once more, perhaps in a grand finale.

Indeed, the Fund Flow Ratio has pirouetted down from 0.13 to 0.06 over four days, suggesting retail investors are decidedly less eager to rush exchanges; while the whale contingent—those grand sea creatures of finance—have trimmed their exchange visits from 0.51 to 0.37, perhaps biding their time or stacking chips with a knowing smile.

What does the next act hold?

In sum, while unrealized losses continue to mount like last year’s unpaid tab, the hopeful remain steadfast, expecting Bitcoin to reclaim loftier heights.

If sentiment does not abandon the stage, we might just see Bitcoin pirouette back to $86,078. However, should the short-term holders decide to cut their losses and exit prematurely, expect a rather ungraceful fall back to the lower limit of the range—hovering around $82,800.

Oh, what a show it is! Shall we stay tuned? 🍸💃

Read More

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Nine Sols: 6 Best Jin Farming Methods

- USD ILS PREDICTION

- AI16Z PREDICTION. AI16Z cryptocurrency

- Slormancer Huntress: God-Tier Builds REVEALED!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail: How To Find Robbie’s Grave

2025-04-21 06:19