As a seasoned analyst with over two decades of experience in traditional and digital markets, I have learned to read between the lines of market metrics and trends. The recent crash in Bitcoin’s sell-side risk ratio is a cause for concern, but not panic.

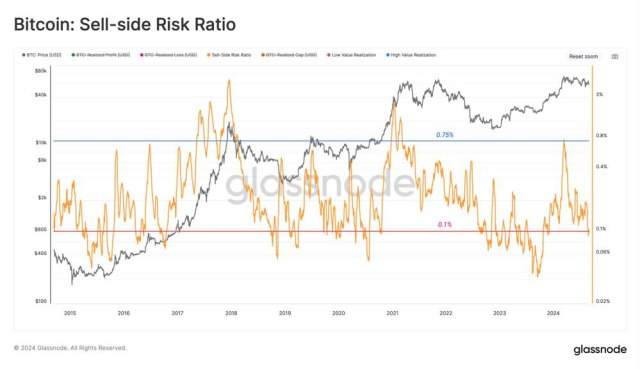

Lately, various measures associated with Bitcoin have been showing unfavorable results, as indicated by the substantial drop in its sell-side risk ratio due to ongoing price fluctuations. This decrease has sparked discussions among cryptocurrency enthusiasts regarding the future prospects of this digital currency.

Significance Of Bitcoin’s Sell-Side Risk Ratio Crash

In light of the current market turmoil marked by increased volatility, it’s worth noting that the ratio of Bitcoin sellers to buyers has significantly dropped over the past few days, according to recent data. On Tuesday, Kyle Doops, a well-known market analyst and host of the Crypto Banter program, highlighted this concerning trend on his social media platform (previously known as Twitter).

It is important to note that the ratio of realized profit and loss to market size is determined by the Bitcoin Sell-Side Risk Ratio. Furthermore, low numbers imply equilibrium, while high values show notable gains or losses, indicating volatility.

Based on insights from market experts, it seems that many cryptocurrencies are almost at their breakeven points. The recent dip down to the lower price range indicates that investors might be wrapping up their profits taking activities, hinting at potential increased market volatility similar to what was experienced in 2019.

Despite a decrease in Bitcoin’s sell-risk ratio suggesting possible future market turbulence, numerous cryptocurrency specialists within the community remain hopeful regarding its price surge. Some even forecast a fresh record high in the near future.

As a crypto investor, I’m excited about my recent prediction of new all-time highs for the largest digital asset. I’ve been closely watching Bitcoin (BTC), and I believe we’re on the verge of a bullish crossover from its current consolidation phase. This bullish sign could indicate a significant uptrend in the coming months, pointing towards increased value for my investments.

The expert pointed out that the current consolidation period has similarities with the prolonged phase BTC experienced last year. After an initial spike following the first positive MACD crossover, the price didn’t manage to exceed the range. Yet, after a second bullish crossover, there was indeed a breakout and a substantial increase in price.

Mags believes that if the current trend continues, Bitcoin could hit a record high again based on the pattern we’ve seen so far. He explained, ‘The initial signal was somewhat feeble, forming a temporary low, but the second one could potentially trigger a significant surge and new peak.’

BTC’s Price Performance Turns Bearish

At present, Bitcoin’s (BTC) price trend has shifted downward following some days of growth, reaching approximately $56,000. The primary reason for this decline seems to be the consistent negative performance of BTC throughout September, as observed in previous years.

Although September might show a downtrend for Bitcoin (BTC), there’s a strong possibility that the fourth quarter of this year could be favorable for the cryptocurrency based on historical patterns pointed out by renowned market analyst and trader, Rekt Capital.

Based on the analyst’s view, as long as they can last until the end of each month, investors could potentially witness favorable monthly gains in the value of their digital assets for the upcoming three months, if historical trends continue.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- BSW PREDICTION. BSW cryptocurrency

2024-09-11 15:41