In the dusty corners of the digital frontier, where fortunes are made and lost with the flick of a finger, Bitcoin has found itself wedged between the stubborn walls of $81,000 and $86,000. It’s a place where the bulls and bears dance a peculiar tango, each step filled with uncertainty and a hint of desperation. The on-chain indicators, those cryptic whispers of the blockchain, seem to paint a rather gloomy picture for our beloved cryptocurrency. Yet, a glimmer of hope flickers in the data, suggesting that perhaps, just perhaps, the bull run isn’t quite ready to take its final bow. 🐂💰

BTC Investors Not Yet In Full Panic Mode: Blockchain Firm

In a recent proclamation from the digital oracle known as Glassnode, it was revealed that a certain breed of Bitcoin holders, the “short-term holders” (STH), are feeling the heat of the market’s relentless pressure. This observation, as clear as mud, is based on the value of unrealized losses—those pesky little numbers that haunt investors like a bad dream. An unrealized loss, for those uninitiated in the ways of the market, is like holding onto a sinking ship, hoping it might miraculously float again. It only becomes “real” when one decides to jump ship at a loss. 🛳️💔

According to the wise folks at Glassnode, these unrealized losses have been creeping up like a cat on a hot tin roof, pushing our short-term holders toward a significant +2σ threshold. Now, this threshold, dear reader, has historically been a harbinger of increased selling pressure. But fear not! Glassnode assures us that the size of these losses still fits snugly within the cozy confines of a bull market. In fact, the magnitude of these losses is but a whisper compared to the thunderous sell-offs of 2021, hinting that the bull cycle might still have a few tricks up its sleeve. 🎩✨

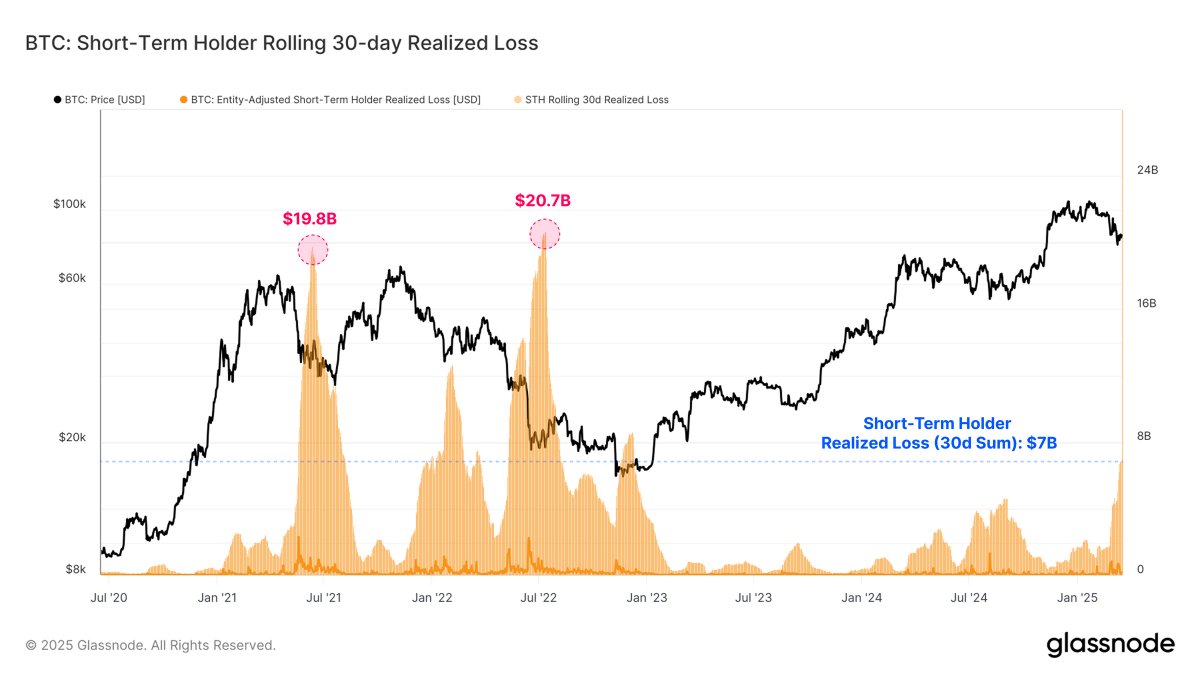

To paint a clearer picture, Glassnode has unveiled that the rolling 30-day realized loss for our short-term holders has now surpassed a staggering $7 billion. That’s right, folks, the largest sustained loss event in this cycle! Yet, before you start throwing your hands up in despair, remember that this figure is still a mere shadow of the capitulation events that marked the dawn of past bear markets. In May 2021 and 2022, losses soared to dizzying heights of $19.8 billion and $20.7 billion, respectively. So, while the losses are significant, they’re still not enough to send everyone into a full-blown panic. 🥴📉

Bitcoin Price At A Glance

As I pen these words, Bitcoin stands tall at around $84,300, reflecting a modest 0.3% increase in the past 24 hours. According to the ever-reliable CoinGecko, our flagship cryptocurrency is down a mere 0.6% over the past week, a testament to the choppy waters we’re navigating. So, hold onto your hats, folks; this ride is far from over! 🎢💸

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- USD ILS PREDICTION

- Master Conjuration Spells in Oblivion Remastered: Your Ultimate Guide

2025-03-23 02:13