As July sputters to a close like an old jalopy, traders and investors will don their monocles and peer intently into the foggy crystal ball of August. They shall scrutinize several US economic signals that could either make or break their portfolios—or at least give them something to talk about over artisanal coffee. ☕

This week’s US economic signals are particularly tantalizing, with Bitcoin (BTC) circling the $120,000 mark like a hawk eyeing its prey. Or perhaps more accurately, like a pigeon hoping no one notices it’s still there. 🦅

Consumer Confidence: The Mood Ring of Economics 💍

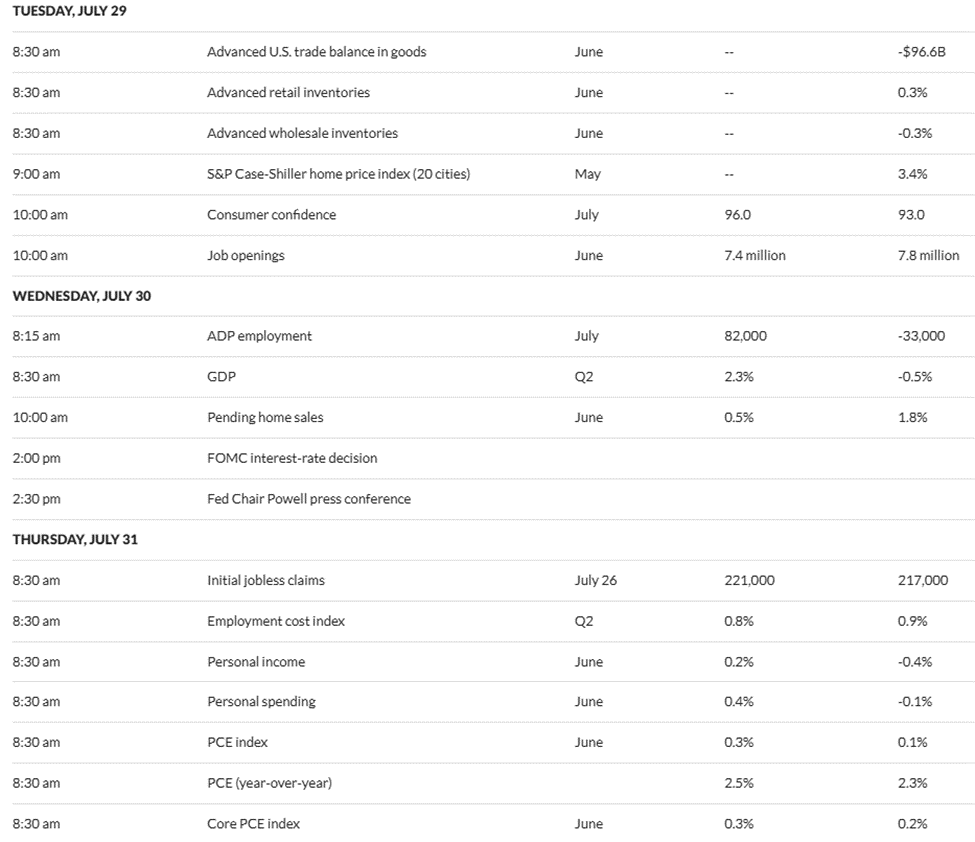

The consumer confidence report kicks off this week’s parade of US economic indicators, scheduled for Tuesday. The Conference Board’s Consumer Confidence Index took a nosedive in June 2025, plummeting to 93.0—a 5.0-point drop from May’s slightly cheerier 98.0. Economists, ever the optimists, predict a rebound to 96.0 for July. But let’s face it, consumers are currently more worried about tariffs than a cat stuck in a tree. 🐱

“Unless inflation behaves itself and trade policy stops playing musical chairs, consumers won’t feel confident enough to splurge on anything fancier than ramen noodles,” quipped Joanne Hsu, director of the Surveys of Consumers, via Reuters. 🍜

If consumer confidence rises above expectations, risk appetites might swell like a beach ball in summer heat, potentially giving crypto a much-needed boost. But if it doesn’t? Well, safe assets like bonds will bask in the spotlight while Bitcoin sulks in the corner. 😩

Jobs Reports: Employment Drama Unfolds 🎭

Ah, labor data—the pièce de résistance of macro factors influencing Bitcoin in 2025. This week promises not one but multiple jobs reports, each poised to send Bitcoin on yet another emotional rollercoaster ride. Hold onto your hats! 🎢

JOLTS: Job Openings and Labor Turnover Survey 🔍

The June JOLTS report, due Tuesday, is expected to dip below May’s 7.8 million job openings, possibly landing at 7.4 million. A respectable number, sure, but hardly cause for throwing confetti. 🎉 Still, it remains the star attraction among this week’s economic indicators.

ADP Employment: Private Sector Shenanigans 🤵

Private-sector employment fell by 33,000 jobs in June, leaving economists scratching their heads like confused owls. 🦉 For July, they’re expecting an increase of 82,000 jobs—better, but still lackluster compared to previous months. One wonders if employers have collectively decided to take extended vacations instead.

Initial Jobless Claims: Weekly Whiplash 📉

Initial jobless claims came in at 217,000 last week, but economists predict a slight uptick to 221,000 this Thursday. Should these numbers rise significantly, whispers of economic weakness may prompt the Federal Reserve to adopt a more “accommodative” stance—code for “let’s print money and hope nobody notices.” 💸

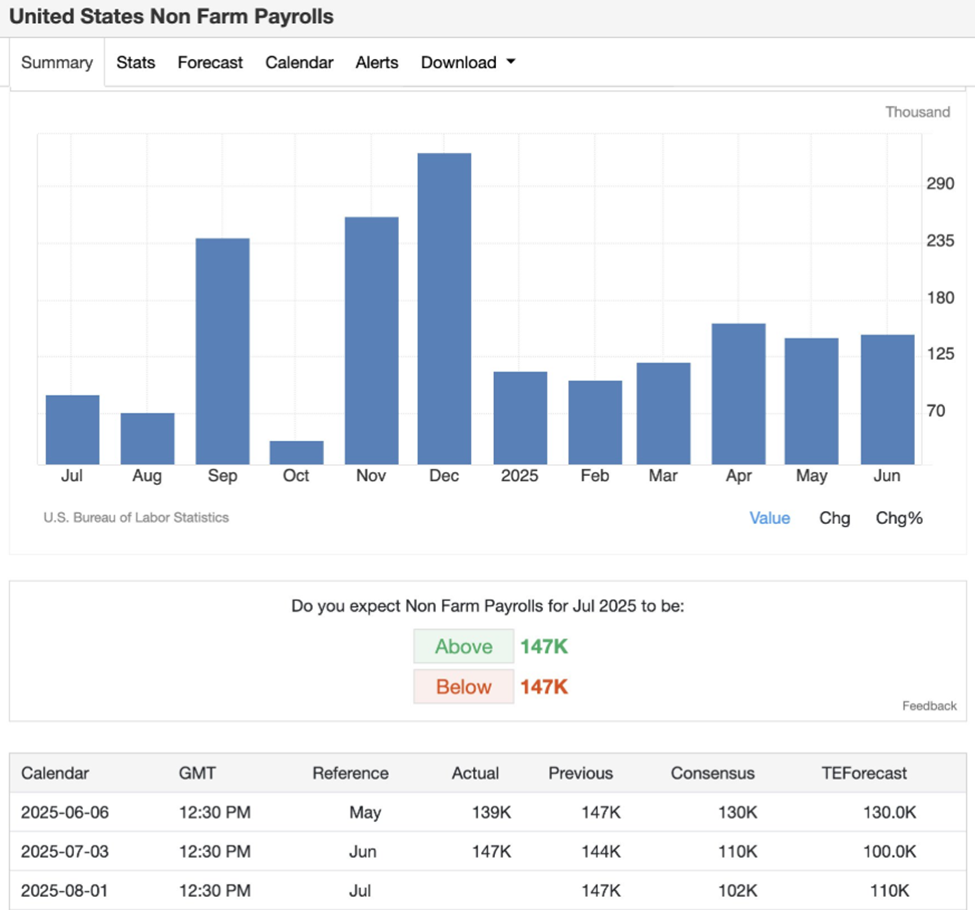

Non-Farm Payrolls: The Grand Finale 🎆

Finally, we arrive at the pièce de résistance: the Non-Farm Payrolls (NFP) report for July, set for release on Friday. Economists expect unemployment to tick up to 4.2%, while job growth slows to 102,000. Strong job numbers could keep the Fed’s monetary policy tighter than a drum, bolstering the dollar and potentially dampening Bitcoin’s spirits. 😔

FOMC Interest Rate Decision: The Main Event 🎤

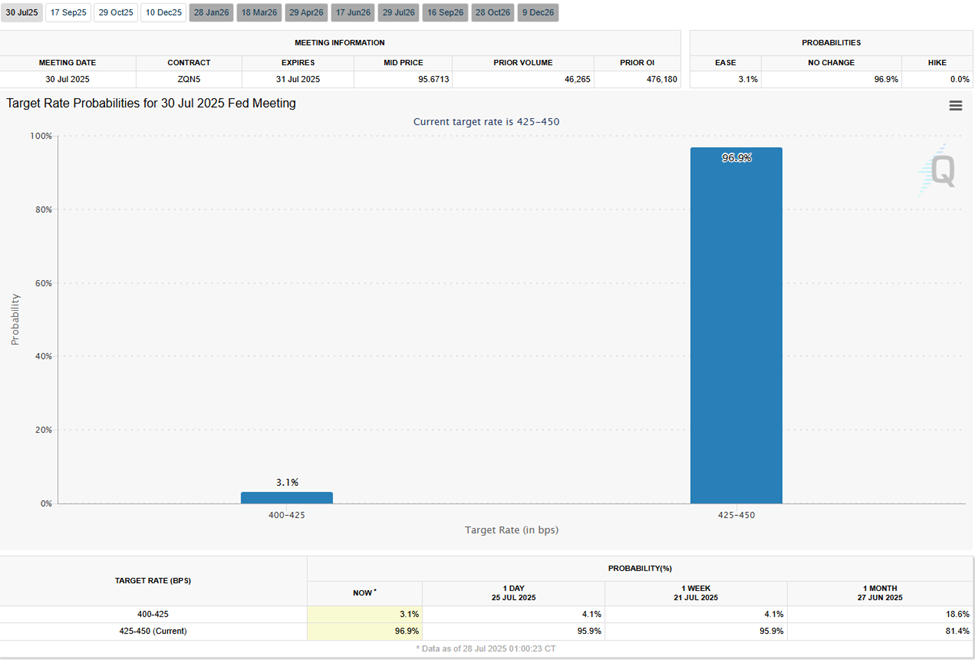

And now, ladies and gentlemen, the moment you’ve all been waiting for: the FOMC interest rate decision on Wednesday. After June’s CPI showed inflation creeping up to 2.7%, the Fed faces mounting pressure to cut rates. Yet, according to the CME FedWatch Tool, bettors give a 96.9% chance that rates will remain unchanged between 4.25% and 4.50%. Talk about suspense! 😲

“The real drama lies in Jerome Powell’s press conference,” noted one astute observer. “Will he hint at September rate cuts, or sound as indecisive as Hamlet?” 🎭

Indeed, beyond the FOMC decision itself, all eyes will be glued to Powell’s every word, searching for clues about the Fed’s future plans. If he hints at rate cuts, markets may erupt in joyous celebration. But if he repeats the same tired refrains, brace yourself for a crypto correction sharp enough to shave with. ✂️

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-07-28 11:37