What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Oh, the fickle heart of the market, ever shifting like the tides of human despair! 🌊 Just yesterday, we lamented the weak institutional demand for bitcoin, noting net outflows of over $500 million from spot bitcoin exchange-traded funds (ETFs) in the first two days of the week. 🤯 But lo! On Wednesday, they amassed over $457.3 million, the highest single-day tally in five weeks. A trend that needs to continue to power BTC higher. The bull phases earlier this year saw multiple days of above $500 million in net inflows almost every week. 📈

For the time being, the cryptocurrency remains locked in Wednesday’s indecisive trading range of $86,000-$90,000, with traders awaiting U.S. inflation data due at 8:30 a.m. 🕒 A print softer than the expected 3.1% year-on-year figure could prompt renewed risk-taking. Fed member Christopher Waller said on Wednesday that interest rates remain well above the neutral level, meaning there is scope for the central bank to cut. 🧠

After that report, focus will shift to the Bank of Japan’s interest-rate decision due late in the day U.S. time, Friday morning in Asia. The central bank is expected to hike rates by 25 basis points to 0.75%. Some observers say that could trigger a rally in the yen, causing risk aversion, although positioning in the FX market suggests low odds of a snap bullish reaction. 🇯🇵

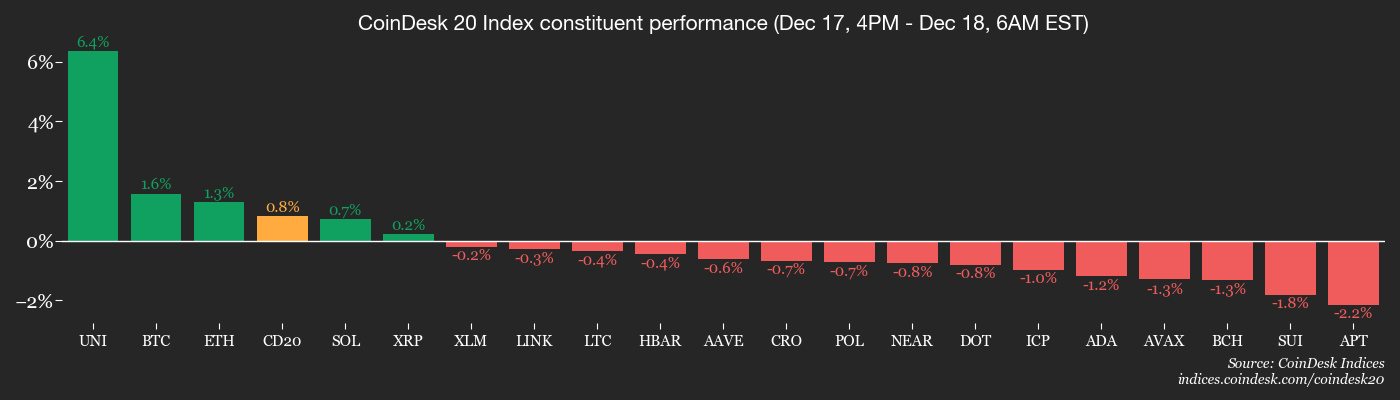

XRP is beginning to look increasingly bearish on charts. Veteran trader Peter Brandt called a double-top breakdown in the cryptocurrency, which could see prices fall to $1 or below. It recently changed hands at $1.87. 🐲 Ether, the second-largest cryptocurrency, is down over 2% on a 24-hour basis and BNB is trading 1.8% lower. Contrast that with privacy-focused tokens XMR and ZEC, both up 2%. The CoinDesk 20 index was down 1%, while the CoinDesk 80 index was down 3.2%, pointing to weakness in smaller tokens. 📉

In traditional markets, the dollar index rose for a second day, teasing a bull revival. The index hovered at 98.50, while gold dropped to $4,324 after testing the recent resistance zone of $4,340-$4,350. Stay alert! ⚠️

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

- Dec. 18, 11 a.m.: Bitcoin Treasuries Digital Conference (Virtual) 🗣️

Market Movements

- BTC is up 1.55% from 4 p.m. ET Wednesday at $87,291.26 (24hrs: +0.39%) 🚀

- ETH is up 1.26% at $2,853.16 (24hrs: -2.41%) 📉

- CoinDesk 20 is up 0.96% at 2,671.22 (24hrs: -1.5%) 🧨

- Ether CESR Composite Staking Rate is up 2 bps at 2.87% 💸

- BTC funding rate is at -0.0007% (-0.8026% annualized) on Binance ⚖️

- DXY is up 0.14% at 98.51 💰

- Gold futures are down 0.39% at $4,356.80 🌟

- Silver futures are down 1% at $66.24 🐞

- Nikkei 225 closed down 1.03% at 49,001.50 📈

- Hang Seng closed up 0.12% at 25,498.13 🧠

- FTSE is up 0.25% at 9,798.54 📊

- Euro Stoxx 50 is up 0.37% at 5,702.83 🧩

- DJIA closed on Wednesday down 0.47% at 47,885.97 🧨

- S&P 500 closed down 1.16% at 6,721.43 📉

- Nasdaq Composite closed down 1.81% at 22,693.32 📉

- S&P/TSX Composite closed down 0.04% at 31,250.02 📉

- S&P 40 Latin America closed down 1.36% at 3,058.30 📉

- U.S. 10-Year Treasury rate is down 2 bps at 4.131% 📈

- E-mini S&P 500 futures are up 0.39% at 6,804.75 🚀

- E-mini Nasdaq-100 futures are up 0.72% at 25,078.25 🚀

- E-mini Dow Jones Industrial Average Index futures are up 0.12% at 48,298.00 🚀

Bitcoin Stats

- BTC Dominance: 59.97% (+0.38%) 📈

- Ether-bitcoin ratio: 0.03273 (-0.39%) 📉

- Hashrate (seven-day moving average): 1,049 EH/s 🔥

- Hashprice (spot): $37.29 💸

- Total fees: 2.81 BTC / $244,324 💸

- CME Futures Open Interest: 121,680 BTC 📈

- BTC priced in gold: 20.1 oz. 🧠

- BTC vs gold market cap: 5.83% 📈

Technical Analysis

- The chart shows DOGE‘s weekly price swings on a log-scale. The log-scale is used when tracking asset prices with extreme price ranges, like DOGE. 🧠

- The joke token has breached the upward sloping trendline drawn off 2023 and 2024 lows. 🤡

- The breakdown indicates that the bull market is likely over and deeper losses could be seen in coming weeks. 📉

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $244.19 (-3.33%), +2.63% at $250.60 in pre-market 📈

- Circle (CRCL): closed at $79.20 (-4.58%), +1.57% at $80.44 📈

- Galaxy Digital (GLXY): closed at $22.81 (-6.17%), +1.05% at $23.05 📈

- Bullish (BLSH): closed at $42.15 (-1.89%), +0.52% at $42.37 📈

- MARA Holdings (MARA): closed at $9.93 (-7.11%), +1.31% at $10.06 📈

- Riot Platforms (RIOT): closed at $12.96 (-3.79%), +1.31% at $13.13 📈

- Core Scientific (CORZ): closed at $11.48 (-7.88%), +3.02% at $13.98 📈

- CleanSpark (CLSK): closed at $14.03 (-3.20%), +1.13% at $11.61 📈

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $36.51 (-4.82%) 📉

- Exodus Movement (EXOD): closed at $14.54 (+0.76%) 📈

Crypto Treasury Companies

- Strategy (MSTR): closed at $160.38 (-4.25%), +1.87% at $163.38 📈

- Semler Scientific (SMLR): closed at $16.93 (-2.7%) 📉

- SharpLink Gaming (SBET): closed at $9.27 (-4.53%), +1.94% at $9.45 📈

- Upexi (UPXI): closed at $1.87 (-8.78%), +2.14% at $1.91 📈

- Lite Strategy (LITS): closed at $1.37 (-9.87%) 📉

ETF Flows

Spot BTC ETFs

- Daily net flows: $457.3 million 💸

- Cumulative net flows: $57.71 billion 💸

- Total BTC holdings ~1.3 million 🧠

Spot ETH ETFs

- Daily net flows: -$22.4 million 💸

- Cumulative net flows: $12.64 billion 💸

- Total ETH holdings ~6.16 million 🧠

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

2025-12-18 16:37