Ah, Bitcoin! The digital darling that pirouetted past its previous all-time highs this week, reaching a dizzying $112,000 on Thursday, as if it were a ballerina on a sugar high. This euphoric leap, a veritable ballet of bullish momentum, catapulted BTC into a new price discovery phase, a moment that would make even the most stoic investor shed a tear of joy. But, alas, the applause was short-lived! 🎭

In a plot twist worthy of a soap opera, US President Donald Trump, in a fit of tariff-induced bravado, threatened a 50% tariff on European Union imports. Cue the dramatic music! The global markets, once buoyant, turned cautious, and Bitcoin’s price plummeted faster than a lead balloon. 🎈

The sell-off was swift, a veritable lightning bolt that pulled BTC back below local highs, as investors reacted to the rising geopolitical and economic uncertainty. This retracement, while not unusual after such a vigorous rally, highlights the crypto market’s sensitivity to macro headlines—like a cat to a cucumber! 🥒

Our top analyst, the illustrious Big Cheds, shared his technical wisdom, noting that Bitcoin has returned to the daily EMA 8. Holding this moving average could signal that the bulls are still in control, and this pullback is merely a healthy consolidation. Or is it just a prelude to a deeper correction? Only time will tell! ⏳

Bitcoin: The Resilient Gladiator in a Colosseum of Uncertainty

Despite the persistent macroeconomic uncertainty, Bitcoin continues to show resilience, like a gladiator in the Colosseum. As US Treasury yields remain elevated and volatility sweeps across global stock markets, BTC has managed to hold strong after recently pushing into new all-time highs. While many risk assets falter under these conditions, Bitcoin is proving its narrative as a macro hedge, attracting interest from both institutional and retail investors alike. 🏛️

However, despite its recent breakout to $112,000, the rally has not yet been confirmed as a sustainable bullish phase. Analysts widely agree that a clean break above $115,000 is essential to trigger the next leg of price discovery. Without that confirmation, the current move could be seen as an overextension, especially amid broader market instability. Talk about a cliffhanger! 📉

Cheds, ever the sage, shared a key technical insight this week, noting that Bitcoin is now back at the daily EMA 8 level—a moving average that has acted as reliable support since the $80K range. This suggests that the current pullback could be a healthy retest of trend support rather than the start of a deeper correction. Fingers crossed! 🤞

If BTC manages to bounce from this level, bullish momentum could resume quickly. But if the EMA 8 fails, downside risk may increase, especially if traditional markets continue to slide. For now, all eyes remain on how Bitcoin reacts at this technical crossroads. Will it rise like a phoenix or crash like a poorly made soufflé? 🍰

BTC: The Reluctant Hero Retests Key Levels

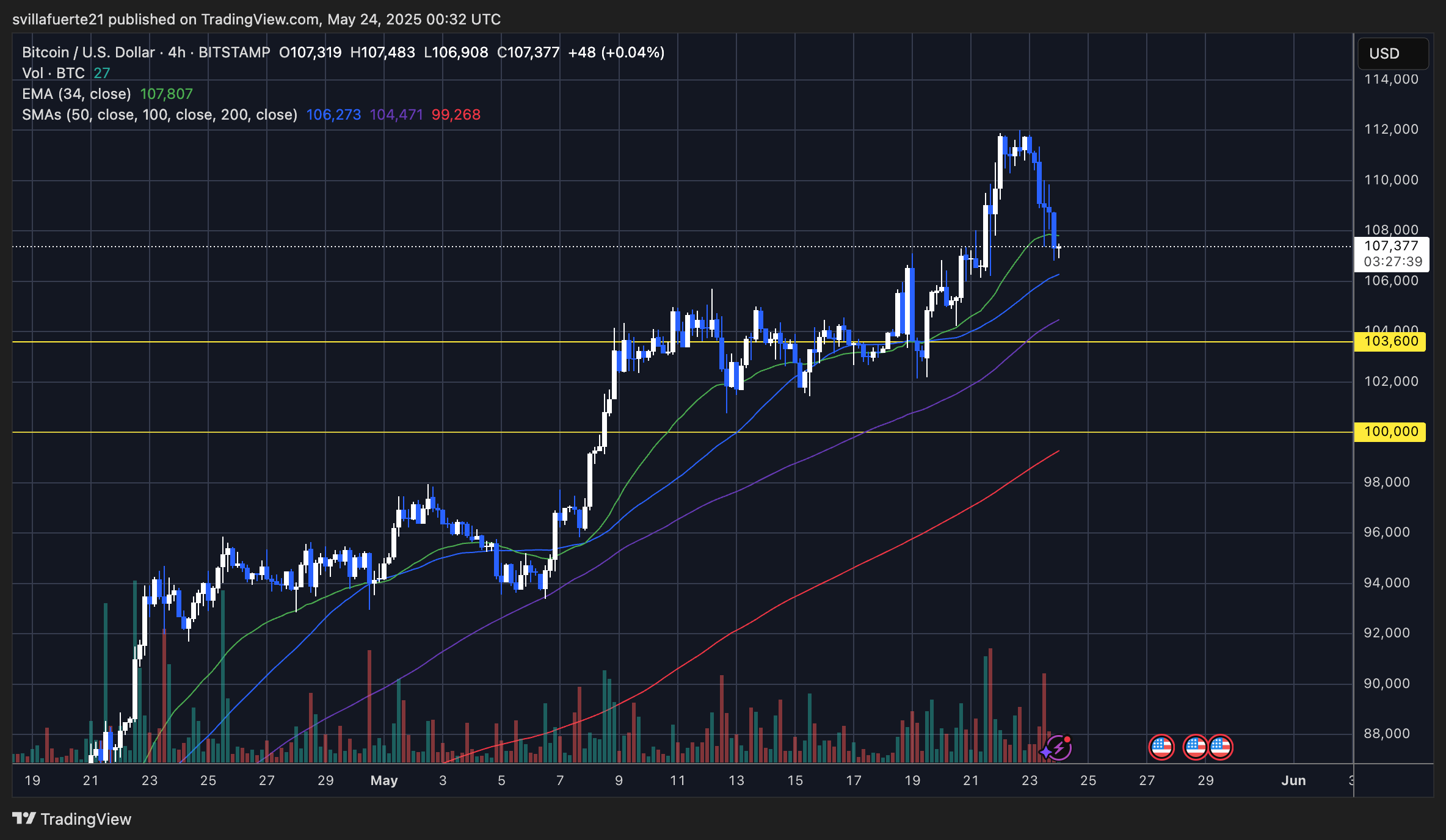

Bitcoin is currently retesting key technical levels following its sharp rally to a new all-time high near $112,000. As shown in the 4-hour chart, BTC has pulled back to the 34-period EMA (currently around $107,800), a level that has served as reliable dynamic support during this uptrend. The latest candle action shows buyers stepping in slightly above this area, suggesting it’s still holding. Will they hold the line? 🛡️

Price is also hovering just above the 50-SMA at $106,273, reinforcing this zone as a confluence of support. Volume has picked up slightly on the pullback, which could indicate healthy profit-taking rather than panic selling if this level holds. A continuation toward the previous high, and potentially a push above $112K, remains on the table. But if the support fails and BTC dips below $106K, eyes will shift toward the next major horizontal support at $103,600. A drop to this region would still be technically valid within the broader uptrend but could shake short-term bullish momentum. What a tangled web we weave! 🕸️

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- How to Unlock the Mines in Cookie Run: Kingdom

- Invincible’s Strongest Female Characters

- Nine Sols: 6 Best Jin Farming Methods

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-24 19:36