The sun beats down on the dusty streets of the cryptocurrency world, and Bitcoin‘s 🌟 star is shining brighter than ever. New all-time highs are the norm, and the mining difficulty has reached a record high, a testament to the network’s growth and development. It’s a regular ol’ gold rush out there, folks! 🏔️

But, as with all things in life, there’s a mix of good and bad. The combination of Bitcoin’s ATH, elevated mining difficulty, and Long-Term Holders’ (LTH) behavior paints a rosy picture, but risks still lurk in the shadows like a rattlesnake in the bushes. 🐍

ATH Price, ATH Mining Difficulty: A Match Made in Heaven?

According to the folks at Blockchain.com, Bitcoin mining difficulty has increased by a whopping 7.96%, reaching 126.27 T, with a seven-day average network hashrate of 908.82 EH/s. That’s a whole lotta computational power, partner! 🤠

But, as the saying goes, “pride comes before a fall.” If this trend keeps up, it could reduce miners’ efficiency, especially given the lackluster mining results in June. It’s like trying to find gold in a dry riverbed – it just ain’t gonna happen. 🌟

However, there’s a glimmer of hope on the horizon. The next Bitcoin mining difficulty change is projected to decrease by 6.69% on July 27, 2025. That’s like finding an oasis in the desert – it’s a welcome relief! 🌴

And then t 💃

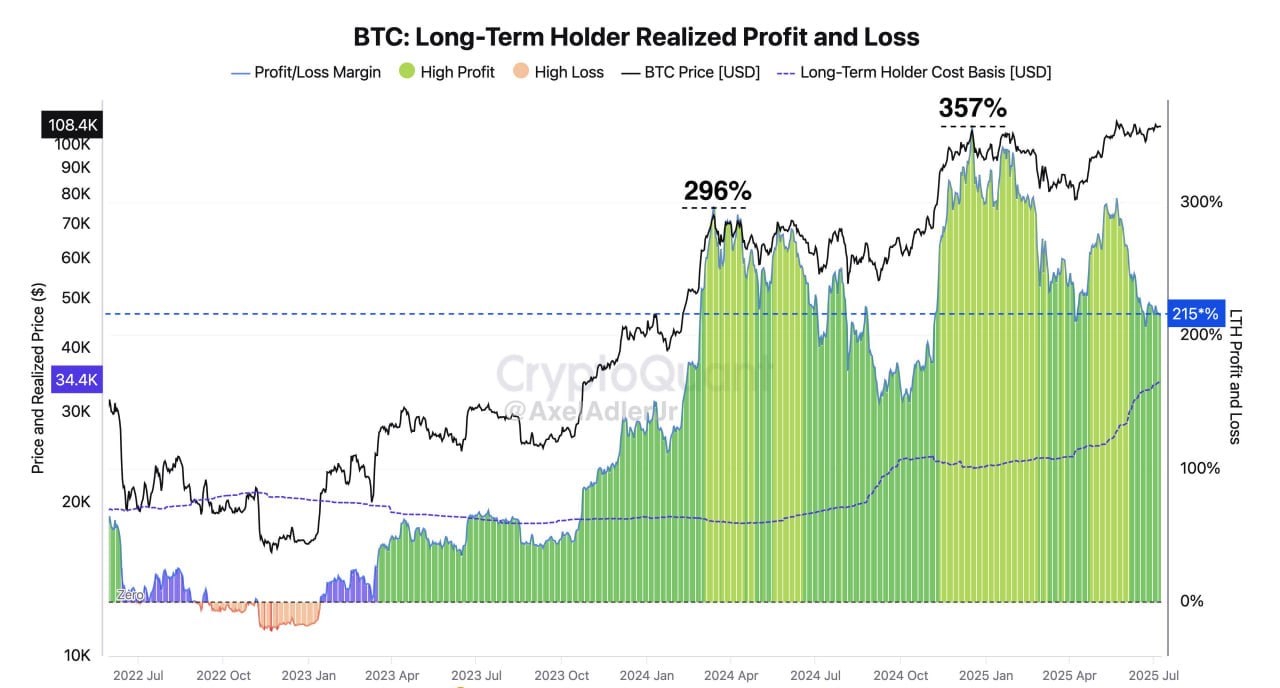

It seems that most LTHs are holding on for dear life, even as Bitcoin reaches new heights. From 2022 to now, the chart indicates that high-profit phases often accompany sustainable price rallies. It’s like a game of musical chairs – everyone’s waiting for the music to stop. 🎶

But, there’s a fly in the ointment. Google search interest in Bitcoin remains subdued, like a sleepy town on a Sunday afternoon. This could reflect investor maturity, shifting from Fear of Missing out (FOMO) to a long-term strategy rather than short-term speculation. It’s like the difference between a cowboy and a rancher – one’s looking for a quick buck, while the other’s in it for the long haul. 🤠

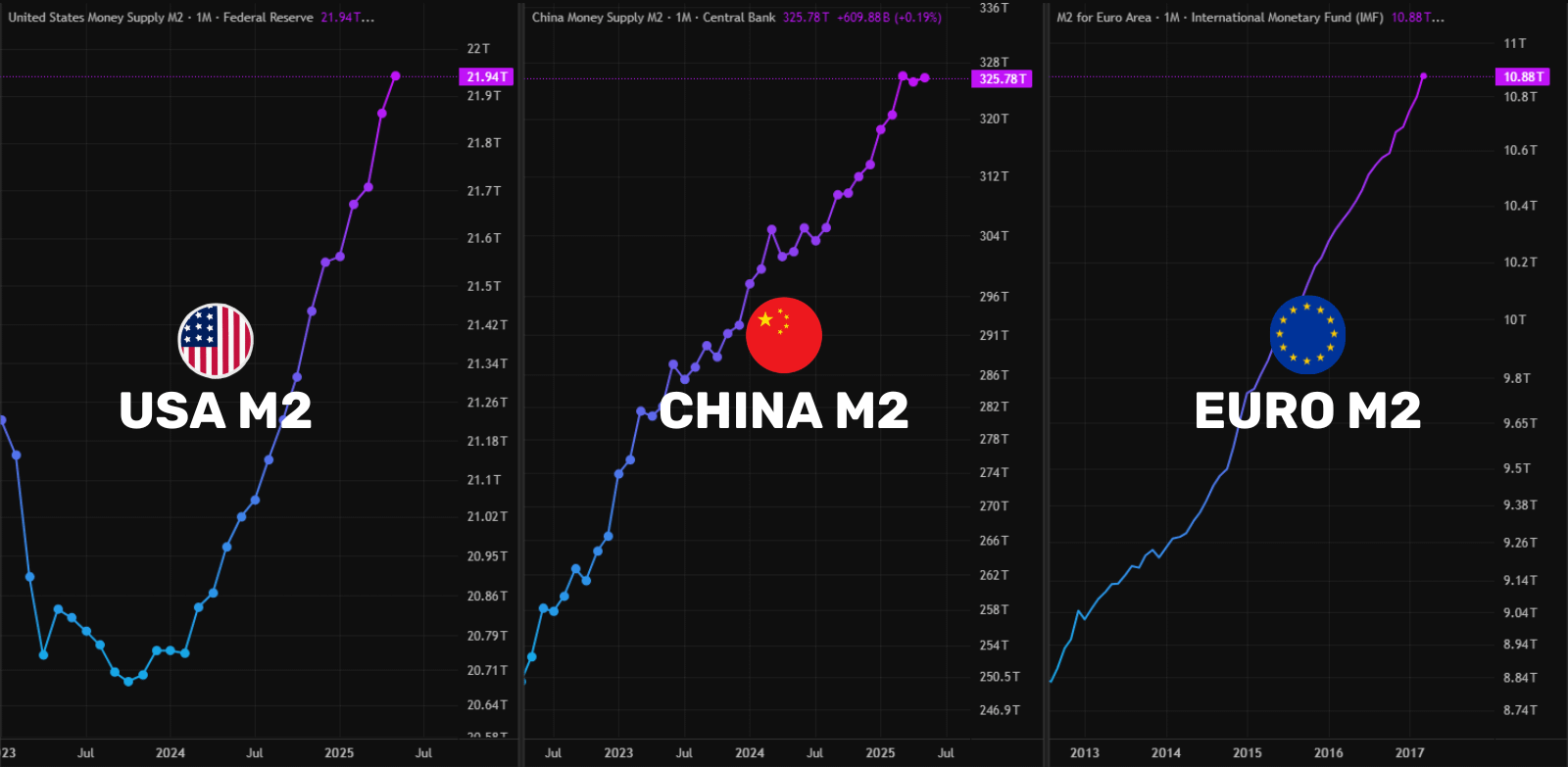

Overall, the synergy of Bitcoin’s ATH, high mining difficulty, and LTH holding behavior creates an encouraging yet risky outlook. With global liquidity rising like a flood, Bitcoin holds significant short-term potential. It’s like a siren song, luring investors in with promises of riches and glory. 🌟

But, investors should keep their wits about them and closely monitor key indicators like hashrate, mining difficulty adjustments, and market sentiment to mitigate risks from potential price corrections. It’s like navigating a minefield – one wrong step, and it’s game over. 💥

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- Best Ship Quest Order in Dragon Quest 2 Remake

- INR RUB PREDICTION

2025-07-15 06:41