On a most agreeable Thursday, the illustrious Bitcoin found itself comfortably perched near the sum of $90,000, as the latest U.S. labor tidings lent credence to a rather quaint notion for the year 2026: fewer partings from employment and a reluctance to engage in the labor market’s often tumultuous affairs. Indeed, what a curious state of affairs it is when an economy prefers to dally rather than dance!

- Alas, Bitcoin’s value has experienced a slight retreat, declining by over 5%. One might say it is merely playing coy.

- The esteemed Stephen Miran, a notable figure among Federal Reserve officials, advocates most ardently for a reduction of 150 basis points in interest rates this very year. Such a delightful prospect may cast a favorable light upon Bitcoin and its whimsical companions in the cryptocurrency realm.

- The latest jobless claims provide evidence that employers, in their infinite wisdom, have settled into a tranquil state of “low-hire, low-fire” – a veritable ballet of indecision.

In the opening days of January, initial jobless claims saw a modest uptick, with 208,000 Americans seeking the benefits of unemployment in the week concluding on January 3rd, a rise from the preceding week’s 200,000. The figures, though slightly elevated, remain beneath the anticipations of the learned economists, thus highlighting the labor market’s surprising fortitude amidst the waning growth momentum. What a splendid display of resilience!

At the moment of this proclamation, Bitcoin (BTC) danced around the figure of $90,464, enjoying a modest increase of 1.2%, before it took a brief tumble to its lowest point since January 3rd – a drop exceeding 5% from its lofty heights earlier in the week. Oh, the drama!

This decline occurred concurrently with American investors partaking in the act of divesting from ETFs, with reports indicating a loss exceeding $486 million on Wednesday alone, following a prior loss of over $243 million the day before. One might observe that these ETFs, once brimming with promise, have seen their cumulative inflows shrink to a mere $57 billion, down from last year’s exuberant high of over $65 billion. They now hold assets totaling over $118 billion, which is hardly a trifling sum, yet represents only 6.5% of their market capitalization.

Jobless Claims

Continuing claims, which graciously track those souls receiving benefits beyond their first week, have risen to 1.91 million in the week through December 27th, up from 1.86 million – a sign, perhaps, of the increasing difficulty in finding new employment. Ah, the holiday season does tend to add a touch of unpredictability to such figures, but one must admit that claims remain near the lower fringes of their range over the past year.

However, other indicators paint a less serene picture. A report from the ever-reliable Challenger, Gray & Christmas declared that U.S. employers announced 1.206 million job cuts in 2025, a staggering 58% increase from the previous year, the highest total in five years – driven primarily by federal agencies and the ever-advancing technology firms restructuring around the marvels of AI. Hiring plans have plummeted by 34%, plunging to their lowest level since the year 2010. How time flies!

Job openings too have dwindled, sinking to a 14-month low in November, with a paltry 0.91 openings available per unemployed worker – the weakest ratio since March 2021. All eyes now turn to the forthcoming nonfarm payrolls report on Friday, where economists predict a job growth of merely 73,000 and an unemployment rate of 4.5%. A rather pivotal moment, indeed, that shall ascertain whether the labor market stabilizes or continues its descent into a leisurely slowdown.

Fed Officials Say…

Our dear Stephen Miran, a senior official of the Federal Reserve, continues to advocate for further reductions this year. He expresses a most earnest desire that his fellow officials might agree to a cut of 150 basis points to invigorate the labor market. He intones:

“I’m seeking about a point and a half of cuts. Much of this is influenced by my perspective on inflation. Underlying inflation appears to be hovering within acceptable bounds, which serves as a promising indication for overall inflation’s trajectory in the medium term.”

Mr. Miran, appointed by none other than President Donald Trump, has found himself among the more lenient figures within the central bank, advocating for 50-basis-point reductions at each of the three meetings. Yet, there remains a question as to whether his aspirations for additional cuts shall materialize, for many officials exhibit a certain reticence towards such measures. The dot plot from the latest meeting indicates that officials foresee but one more cut this year.

If Mr. Miran’s vision of 150 basis points cuts were to materialize, it would undoubtedly prove advantageous for Bitcoin, as it tends to flourish in climates of affable monetary policy. Moreover, such cuts would coincide with the U.S. government’s further stimulus efforts, particularly in the form of tax refunds. Oh, the sweet taste of fiscal delight!

The average tax refund is projected to be approximately $3,167, a modest rise from $3,138 in 2024. With additional refunds, tax cuts, and an expanding M2 money supply, one can only surmise that Bitcoin and its altcoin cousins shall bask in the glow of prosperity.

Bitcoin Price Technical Analysis Points to More Gains

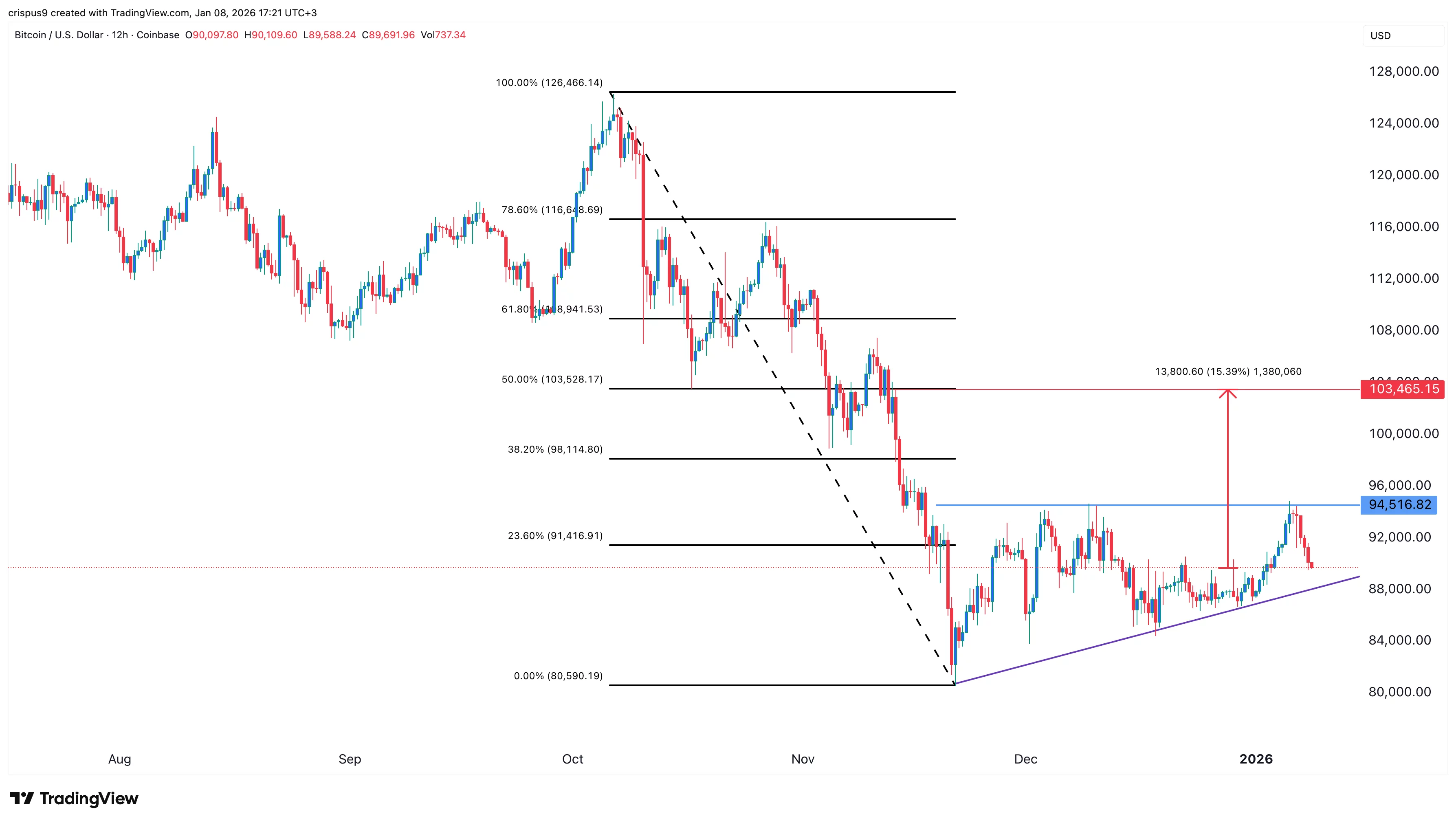

The 12-hour chart reveals that Bitcoin’s price has embarked upon a rising journey these past few months, ascending from a low of $80,590 in November to a height of $94,516. It appears to have formed an ascending triangle pattern, with its resistance level set at an impressive $94,516, whilst the diagonal trendline connects the lowest swings since November.

Thus, the most probable prediction for BTC prices leans toward optimism, with the next key target being a gallant $103,465, resting at the 50% Fibonacci Retracement level. This target, dear reader, is approximately 15% above our current station. One can only hope that Bitcoin continues to charm and beguile its audience! 🌟

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

2026-01-08 20:50