It appears that Bitcoin, much like a well-dressed gentleman at a ball, has stumbled under the weight of its own ambition, falling below the $90,000 mark this week, a threshold it had so gallantly avoided for seven months. Traders, no doubt clutching their pearls, watched as the cryptocurrency waltzed around a modest $90,700, leaving it a good 25% below its recent all-time high of $126,000, reached just a mere month ago. It is said that a rather dramatic liquidation event on October 10th continues to reverberate through the trading floors, creating a delightful sense of unease. How quaint. 🧐

Analysts Predict A ‘Bottom’ (Is That a Good Thing?)

According to the ever-so-dignified BitMine chairman, Mr. Tom Lee, the October 10th liquidations, coupled with the lingering question of whether the US Federal Reserve will decide to cut rates in December, have kept the poor crypto market in quite a tizzy. He has ventured to suggest that there are signs of ‘exhaustion’ among the sellers, though whether these sellers are merely fatigued or simply out of ideas remains to be seen. His technical analysis, which I am sure involves a great deal of staring at graphs, suggests that a bottom may soon be upon us. How thrilling! 🎢

Matt Hougan, chief investment officer at Bitwise Asset Management, has most kindly echoed this sentiment, referring to the current prices as a “generational opportunity” and advising long-term investors to, perhaps, get their act together and notice. Clearly, all those jittery traders, fretting over high AI valuations and tariffs courtesy of President Trump, have unwittingly created the perfect buying opportunity for those with a longer-term view. Lucky them! 🤨

The Short-Term Holders: The Unsung Villains of the Decline

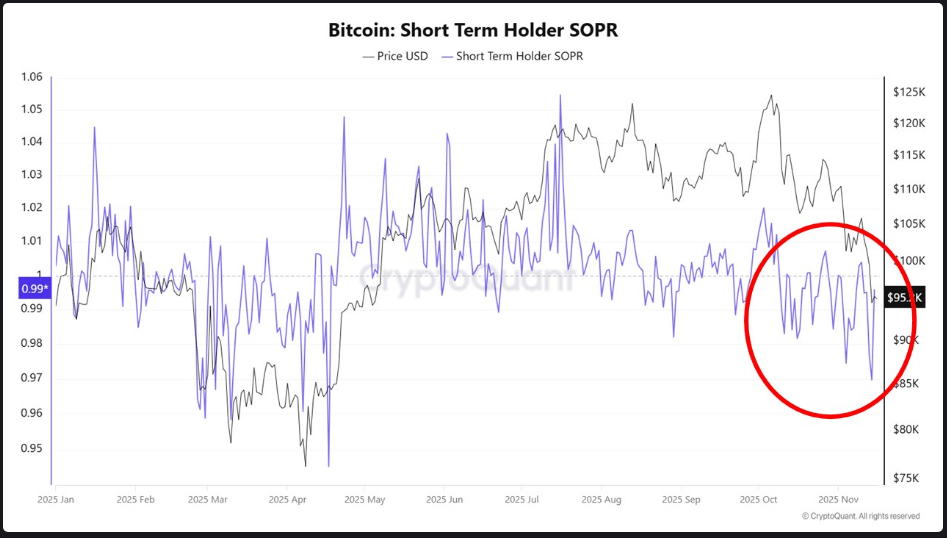

According to XWIN Research, those responsible for most of the recent decline were the short-term holders, who appear to have hastily made their exits, perhaps driven by panic, fear, or the alluring scent of a quick profit. It seems that the Short-Term Holder Spent Output Profit Ratio dipped below 1 on more than one occasion, signaling that many of these recent buyers sold at a loss. A most tragic display of financial folly! 😬

What is truly noteworthy is that coins younger than three months made up the majority of the spent volume during the worst of the decline. This, my dear friends, points to a rather distressing pattern of panic-driven exits, rather than a calculated move by seasoned investors to offload their holdings. Could it be that these newer buyers are a bit too hasty? Perhaps they should have read their financial literature a bit more carefully. 📚

Yet, we mustn’t overlook the long-term holders, who, according to the metrics, have been quietly distributing their coins since September. However, XWIN argues that this is merely routine profit-taking during a bull run, and not a sign of a catastrophic financial collapse. A most intriguing observation, don’t you think? 😏

It seems that the weak market was further exacerbated by exchange-traded fund outflows and the rather unsubtle sales by large crypto “whales,” those mythical creatures of the market who can move prices with a mere flick of their tail. Rising geopolitical tensions, naturally, added an extra layer of risk to this already precarious situation. How very dramatic. 🌍

Market participants have observed that Bitcoin, ever the early bird, began to weaken before other risk assets did, leading some investors to interpret this as a warning sign for broader markets. A bit of a ‘canary in the coal mine’ situation, if you will. 🐦

Mr. Lee is hopeful, forecasting a rebound should equities rise later this year. He believes that a strong stock market could lift Bitcoin to new heights by year’s end, much to the delight of investors everywhere. A bit of optimism to warm the heart! ❤️

Mr. Hougan, too, agrees that a recovery might come swiftly, and advises that the current moment offers an alluring opportunity for those with a 12-month investment horizon. Perhaps it’s time to gather your courage, dear investors. 🤔

However, the trading community remains divided: some view the recent data as clear evidence of exhaustion, while others fear that macroeconomic events and policy decisions could push prices lower still, until confidence returns. Such drama, I daresay. 😏

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- EUR USD PREDICTION

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- God Of War: Sons Of Sparta – Interactive Map

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

2025-11-18 13:52