Well, folks, hold onto your hats—this cryptocurrency escapade is more like a roller coaster ride through a carnival haunted house. Cryptoquant’s got the scoop: Bitcoin’s in its third big profit-taking spree of 2023–2025, kind of like a Mardi Gras parade that ends with everyone flipping their hats for some gold. Usually, after such a spectacle, the market takes a breather—think of it as Bitcoin stretching its legs before sprinting again. 🚀

Bitcoin & Ethereum: Taking a Break Before the Next Leap?

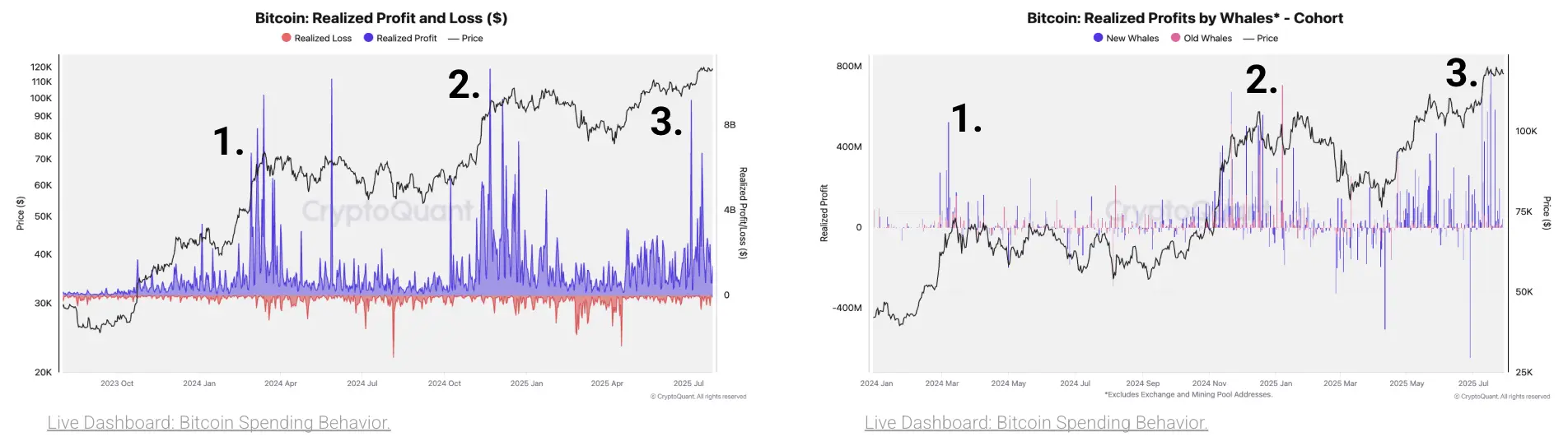

According to some fancy folks at Cryptoquant, this profit-taking dance started after Bitcoin ( BTC) sashayed past a staggering $120,000 late in July 2025. Kinda like hitting the jackpot and then saying, “I’ll take my winnings now, thank you very much.” Earlier episodes included Bitcoin hitting $70,000 in March 2024 (when U.S. ETFs came into town) and then soaring past $100,000 after the presidential elections—because nothing says ‘market fun’ like politics and profits combined! 💰

Cryptoquant’s sharp-eyed researchers spotted a cool $6–8 billion in realized Bitcoin profits—think of it as a giant lemonade stand where everyone’s walking away richer. The new whales—those fresh-faced Bitcoin holders who’ve typically been around less than 5 months—are the main culprits selling off their digital gold, driving the prices to dizzying heights.

And then there’s the SOPR—sounds like a fancy French cheese but actually means the profit ratio of recently bought coins. When it spikes over 1.05, it’s like everyone’s saying, “Hey, I bought ‘em cheap, and now I’m selling high!” This was especially true with that big whale dumping 80,000 BTC on July 25—because apparently, some folks just can’t get enough of playing Monopoly with digital currency. 🎲

Bitcoin’s profit-taking isn’t alone; Ether and its cousins—USDT, USDC, and WBTC—are also cashing out big, pulling in up to $40 million daily. It’s like a massive yard sale where everyone’s trying to clear out their digital closets before the market cools down, which, according to Cryptoquant, is happening now. U.S. investors ain’t throwing as much money into the pot, and the Coinbase premium turning negative is the market’s way of saying, “I’m not paying extra for this hot potato anymore.”

Historically, such profit-taking is a sign that the market is about to take a breather—think of it as Bitcoin taking a power nap for 2–4 months before springing back to all-time highs. So, sit back, grab some popcorn, and watch the show—because if history’s any guide, this roller coaster isn’t done yet. 🎢

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-08-01 18:59